On Sunday, October 10, ten European Union countries signed a declaration supporting nuclear energy and its role in the fight against global warming. The debate has been raging for many years on the use of this energy and some countries such as Germany and Austria are opposed to it, as well as many NGOs that consider it a risky technology. This initiative comes at a time of rising energy prices, but also ahead of the European Commission’s classification of energies, which will open up access to green finance and give a competitive advantage to sectors recognized as virtuous for the climate and the environment.

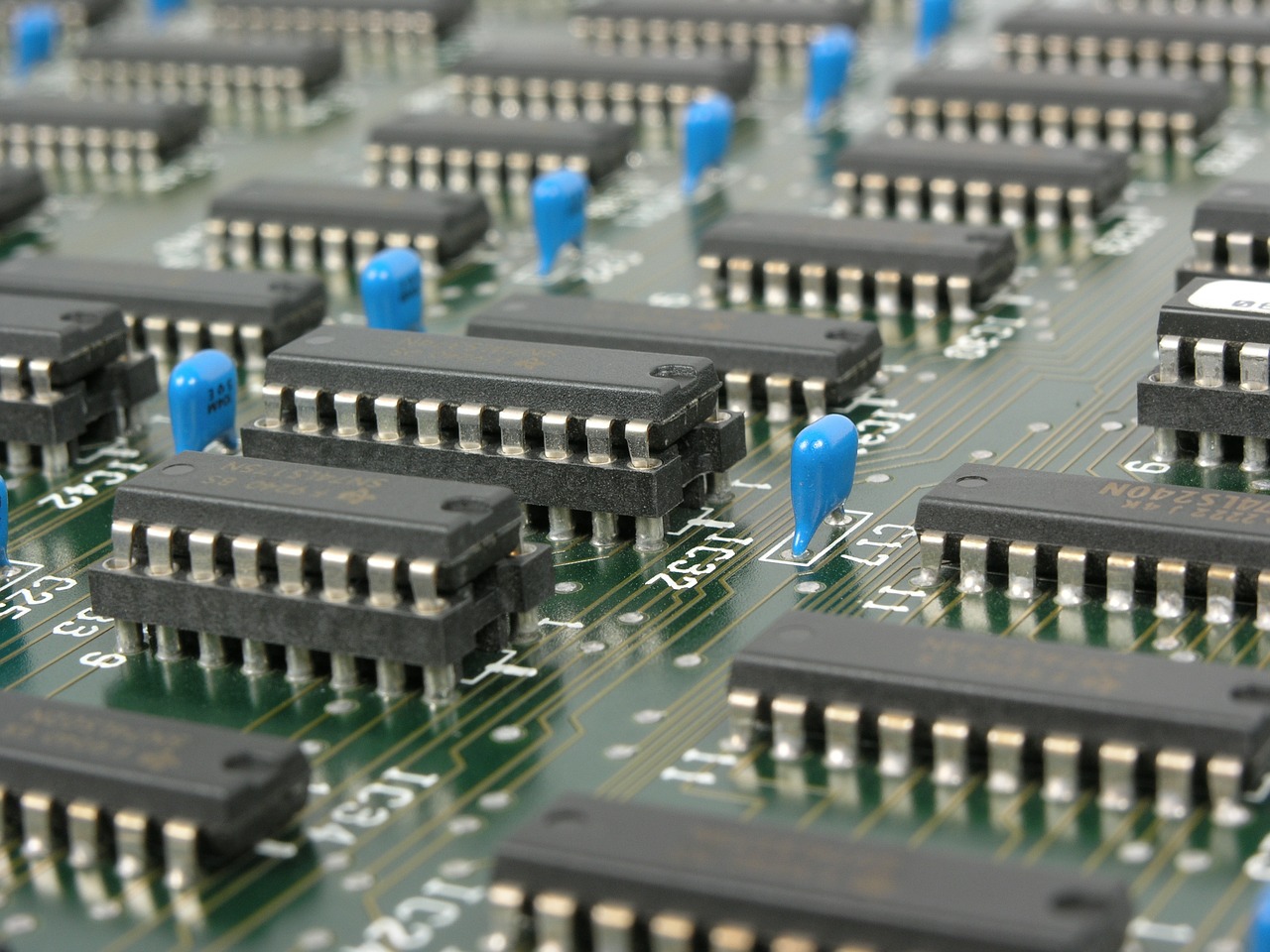

Nuclear energy production involves three main stages: uranium mining, production in nuclear power plants and the treatment of radioactive waste.

Uranium ore is found in uranium mines, mainly in the following countries: Kazakhstan, Canada, Australia, Namibia and Niger. After purification, the uranium is enclosed in a nuclear reactor, which uses the principle of nuclear fission to produce electricity. In this way, uranium nuclei replace the fossil fuels (coal, oil) used in thermal power plants. When a neutron strikes a uranium nucleus, it breaks up, releasing other neutrons and energy in the form of heat. The neutrons released will collide with other uranium nuclei, and so on: the reaction is self-perpetuating, and we speak of a chain reaction. The heat released during the chain reaction is used to produce water vapor. In the same way as in thermal power plants, this steam drives a turbine and its alternator to produce electricity. Once the uranium has been used, there remains a material that can no longer be used to fuel reactors, but which remains radioactive. This is nuclear waste, which is sent to a processing plant, where it is sorted according to its degree of radioactivity. Then, nuclear waste is stored or buried deep underground.

The great advantage of nuclear power is its ability to produce large quantities of energy at a moderate cost. Moreover, this energy is available all year round and the life span of the power plants is quite long (40 years). In terms of CO2 emissions, nuclear power only emits water vapor. Consequently being classified as a low-carbon energy source together with renewables.

However, nuclear power also comes with very complex issues. Among the most frequently cited drawbacks is the management of nuclear waste in the long run, which is still radioactive and harmful to health. Similarly, in case of an accident, the consequences on health can be serious, as shown by the example of the Chernobyl or Fukushima nuclear accidents. Moreover, uranium resources are not unlimited, as can be seen in France, where the mines have been almost exhausted, which leads to energy dependence on other states. In a much shorter term, the construction of nuclear plants is facing drastic challenges as cost and planning are hardly met by the commissioners, hence a trend to also look at smaller reactor technologies.

An increasing number of startups and organizations have entered the nuclear energy business to address these issues. One such case is Transmutex, a Swiss startup, which is developing cutting-edge technologies to transform nuclear waste into clean energy. Its first plant is planned for 2030. Recently, the firm also announced the development of a thorium reactor. Another notable initiative is that of Oklo, a Silicon Valley-based startup, that wants to build tiny nuclear reactors that can run off spent fuel from much bigger, conventional nuclear reactors. Large groups such as EDF in France, with the Nuward project, are also turning to the construction of mini-reactors, with much shorter production times and greater modularity.

The recent litany of announcements in the field of nuclear fusion has highlighted the effervescence of the sector, driven by public research institutes and start-ups. According to the think-tank Zenon Project, about 30 start-ups worldwide are seriously working on this subject. Nuclear fusion consists of transforming two light atoms into a heavier atom to release energy. To do this, a medium must be heated to over 150 million degrees, which requires a lot of energy. This process does not produce any carbon dioxide and uses a very small amount of fuel readily available in nature, unlike nuclear fission of uranium. The fuels necessary for its operation are present in large quantities on earth. Moreover, it generates little radioactive waste with a short life span, and the risks of explosion or runaway are zero. With the ITER project, 35 countries are engaged in the construction of the largest tokamak ever conceived, a machine that is intended to demonstrate that fusion can be used on a large scale to produce electricity.

Although nuclear power has been strongly criticized, it seems necessary, particularly in large consumer countries, to support the energy transition and reduce CO2 emissions. This is why a new wave of countries is now investing in nuclear power, such as England and Finland. Coupled with the development of renewable and low-carbon energies, it has every chance of being a major player in future decarbonization.