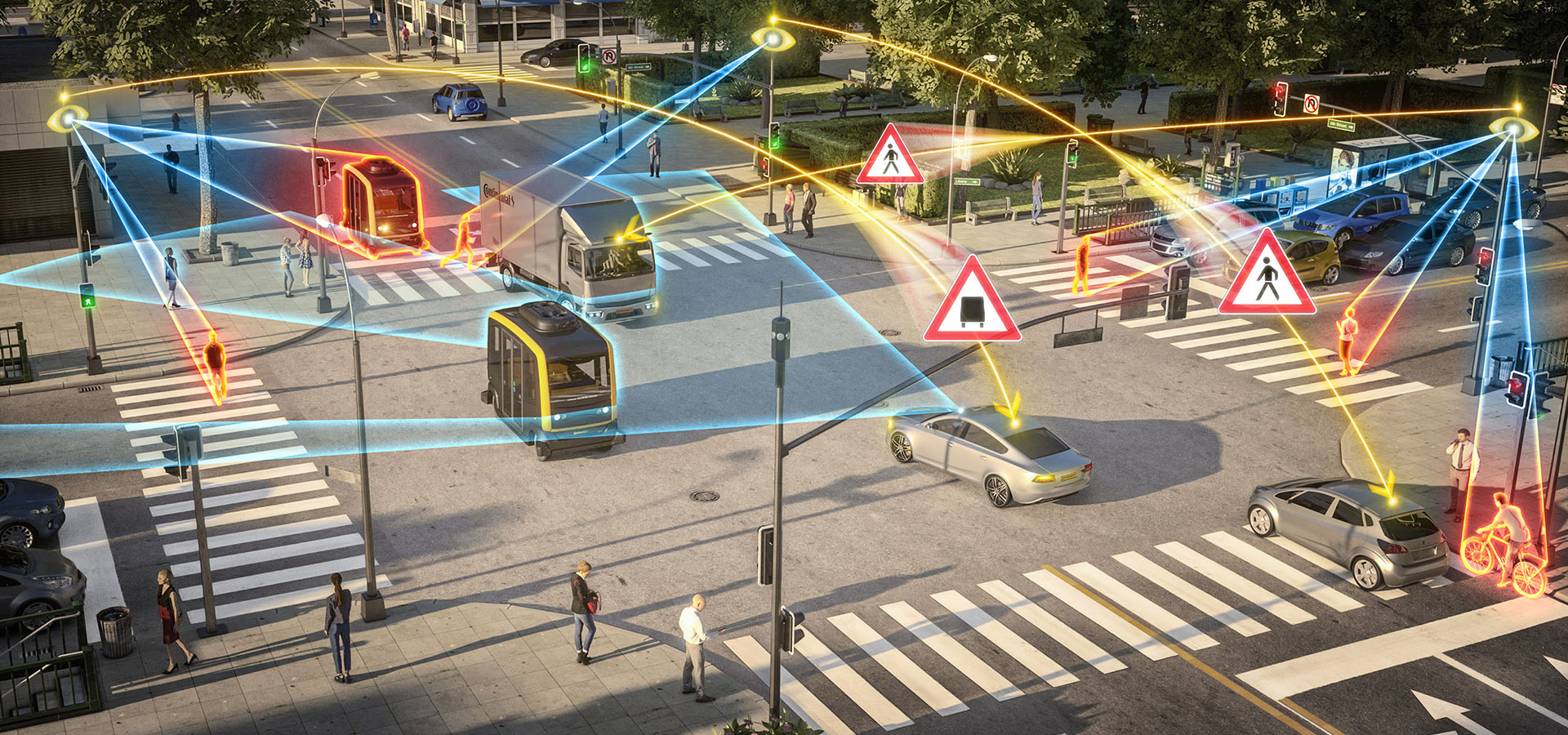

The city of Las Vegas has recently been granted permission to install and test 25 cellular-vehicle-to-everything (C-V2X) roadside units, to transition from Dedicated Short-Range Communications (DSRC) for connected vehicles, to cellular. The objective is to demonstrate the benefits of C-V2X technology, which is said to be as reliable and performant but with twice the range of DSRC. This highlights the growing presence and adoption of Vehicle-to-Everything (V2X) installations within cities. V2X refers to the transmission of information from a vehicle to any entity that may affect the vehicle and vice versa. It includes Vehicle-to-Infrastructure (V2I: data exchange between a car and equipment installed alongside roads, generally a roadside unit), Vehicle-to-Vehicle (V2V: data transfer between vehicles), Vehicle-to-Network (V2N: when a vehicle accesses the network for cloud-based services), Vehicle-to-Pedestrian (V2P), Vehicle-to-Device (V2D) and Vehicle-to-Grid (V2G: information exchange with the power grid). In this newsletter, we will focus on two key components of V2X which are V2V and V2I. The main motivations for V2X are road safety, traffic efficiency, and energy savings. Indeed, according to GSMA forecasts, by 2025, V2X could prevent 260,000 accidents (by detecting road hazards or vulnerable pedestrians and cyclists for example), save 11,000 lives, save 280 million hours of driving each year, and avoid 400,000 tonnes of CO2 emissions (for instance, with platooning, cars or trucks follow each other with short inter-vehicle distance, resulting in reduced fuel consumption and CO2 emissions).

With the advancement of V2X technologies, such as its non-line-of-sight sensing capability that allows vehicles to detect potential hazards, traffic, and road conditions, vehicles are becoming increasingly connected and are being progressively equipped to become fully autonomous. Some legacy V2I technologies are currently in operational use worldwide for relatively simple applications (e.g. for Electronic Toll Collection), while advanced V2X systems are beginning to gain widespread commercial acceptance. They rely on two underlying technologies:

- IEEE 802.11p or DSRC (Dedicated Short Range Communications): this original V2X standard is now mature and mainly used for safety use cases (such as starting to brake before a pedestrian or a hazard is visible to the driver), due to its reliability and low latency (2 ms). However, its range is rather short (less than 1 km). This technology is prevalent in North America, Japan, and Europe.

- Cellular V2X (C-V2X): this relatively new technology offers several operating modes that users can choose from, such as direct communication between vehicles or with the infrastructure and further road users (pedestrians, cyclists). For now, it is mostly used in non-safety-related use cases (vehicle operation management, traffic efficiency, etc.). While this technology has a range of 10km, it requires network support (4G/LTE/5G) and has a higher latency (1s). This technology is very present in China.

Hybrid solutions could be developed by 2030 to achieve interoperability. Startups like AutoTalks are working on such hybrid modules (capable of supporting both DSRC and C-V2X). Indeed, AutoTalks is an Israeli leader that develops fabless semiconductors for the V2X market. They address a variety of issues related to V2X communication, including communication reliability, security, positioning accuracy, and vehicle installation. AutoTalks has developed a chipset capable of supporting dedicated short-range communications (DSRC) and cellular’s C-V2X.

Many OEMs and automotive players are including V2X services into their car models. For instance, Volkswagen has premiered its all-new Golf with V2X capabilities. Car2X-signals from traffic infrastructure and information from other vehicles up to 800 meters away are notified to the driver via a display. The Golf also shares these warnings with other Car2X models. Initially focused on road safety and traffic efficiency applications, Toyota and General Motors were early adopters of IEEE 802.11p-based V2X technologies in Japan and North America. However, the momentum has lately swung in favor of C-V2X and they have expressed their willingness to invest in C-V2X technologies. This is also the path taken by Audi and Qualcomm Technologies, which are deploying a C-V2X technology pilot in Virginia. Workers wear special vests with built-in V2P technology that can alert drivers to their presence.

Besides the challenge of choosing the optimum communication bearer (DSRC, C-V2X, or hybrid), which keeps the industry and the mobile community very active, the security of V2X communication is also a key issue. The regulatory environment is the most important factor influencing the adoption of V2X technology. In China, the government has taken a stand and showcased C-V2X regulations, which should encourage automakers to position themselves quickly. In contrast, in North America and Europe, the governments and transportation ministries are struggling to bring clarity to the industry in terms of V2X, its scope and limitations.

To conclude, there is strong potential for V2X applications, the technologies exist, and it seems that the automotive industry will not wait for regulation to adopt V2X services. However, large-scale adoption will take time, due to the need to equip all infrastructures with adapted devices and the time needed for the automotive players to align on a single (or hybrid) communication technology.

2 Key Figures

433 V2X startups

registered byTracxn

Automotive V2X market expected to reach $12.9 Bn by 2028

The automotive V2X market was estimated at $689 M in 2020 and is expected to reach $12.9 Bn by 2028, at a CAGR of 44.2%.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Valerann, Commsignia, and Connected Signals

Valerann

Valerann is an Israeli start-up that develops sensor systems for installation on roads, and an associated data platform. Their smart studs, installed along the roads, can sense traffic movement, specific weather conditions, road issues and send this data to the central data centre. Combined with intended integrations with Waze, Google Maps, etc., Valerann intends to create a connected real-time traffic notifications and analytics platform.

Commsignia

Commsignia is a Hungarian start-up that develops cooperative intelligent transportation systems designed to increase traffic safety and efficiency on the road. It includes V2V and V2I communication systems that provide actionable insights pertaining to the logistics pipeline through their in-app information services, thus enabling businesses, corporate clients and logistics industry players to connect with other drivers for various road-safety programs.

Connected signals

Connected Signals (originally, Green Driver) is an American high-tech startup, focused on providing traffic signal state and predictions to drivers, automakers, and others. Knowing the current state of traffic lights and how they will change creates opportunities to increase driving safety, increase fuel efficiency, and improve the driving experience. Applications range from EnLighten, which tells drivers when the light they are stopped at will turn green, to vehicle powertrain optimisation based on the state of upcoming lights.

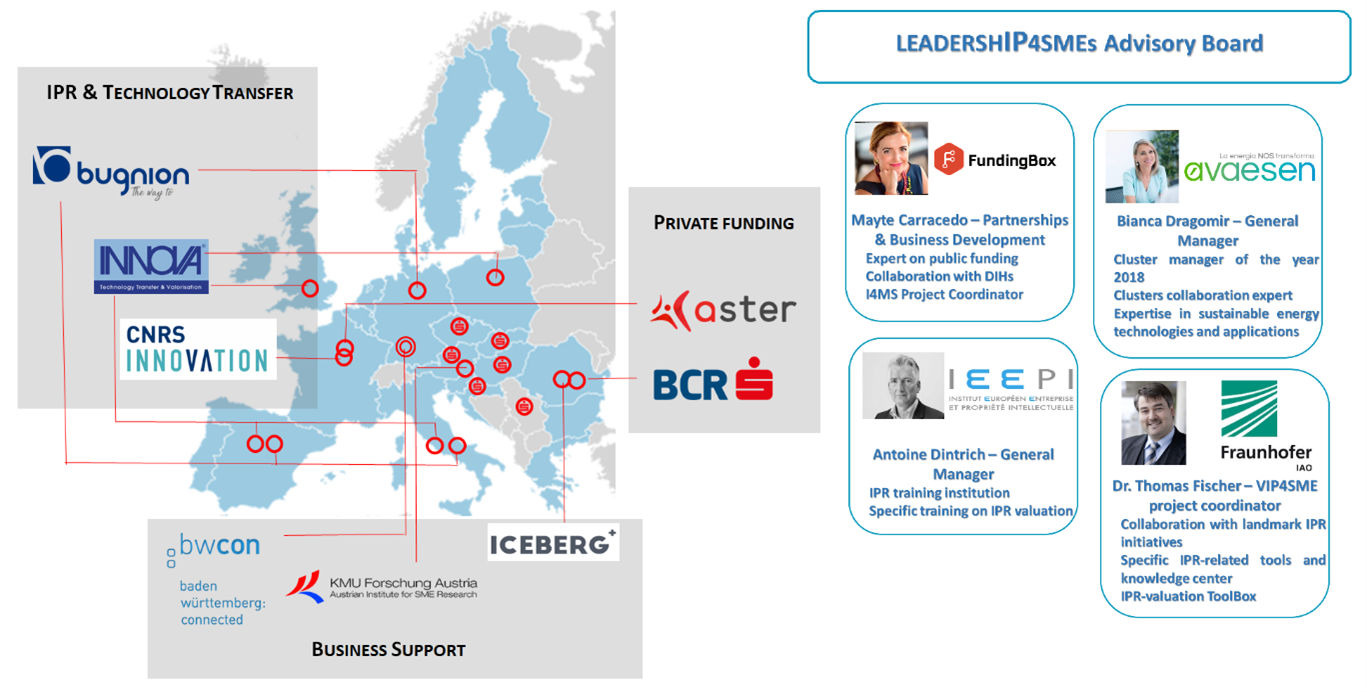

We are delighted to be part of LeadershIP4SMEs, an EU research project under H2020, which aims to help IP-centric startups & SMEs better leverage their IP assets to access adequate funding.

Intellectual property rights (IPR) can be an ignored value due to intangibility and missing ways / methods to consider it for the funding and investment of SMEs and start-ups. The EU-funded LEADERSHIP4SMEs project will support innovative SMEs and start-ups to improve and strengthen, and thus valorize their IPR, facilitating their access to adequate funding that is vital to their growth. The project will set a platform of specific tools to:

- Strategically manage and place IPR in the business model and plan to attract

funding; - To define the most value-creating business strategy;

- To better value and protect their intangible assets;

- To generate business and encourage collaborations;

- As well as to help identifying financial guarantees, at regional, national and

European level.

The platform relies on a compilation of the best practices in the domains of IPR management, business acceleration and funding that allows a better valuation of IPR and acts as an online hub of support from IPR, innovation and business support, and private and public funding and cooperation.

In addition to the implementation of this platform, a support program for startups and SMEs is being deployed, with the aim of operationally helping beneficiaries to effectively leverage their IP assets to stimulate their growth.

The LEADERSHIP4SMEs consortium is made up of 8 European partners with complementary expertise about intellectual property protection and the financing of companies with high growth potential: Aster, BCR, bwcon, Bugnion, CNRS Innovation, Iceberg, INNOVA, KMU Forschung Austria.

123Fab #42

1 topic, 2 key figures, 3 startups to draw inspiration from

Since the Paris agreement five years ago, most of the 196 signatories have taken steps to limit global warming below 2°C above pre-industrial levels. The EU has set a carbon neutrality goal by 2050 and a 55% decrease in greenhouse gas emissions by 2030 compared to 1990. Corporations across all industries are also taking action to reduce their carbon impact: from Danone’s commitment to be carbon neutral by 2050, to Carrefour’s 40% decrease in CO2 emissions by 2025 and 70% reduction by 2050 compared to 2010, to Microsoft’s goal to be carbon negative by 2030. Climate consciousness and decarbonization have gained tremendous momentum over the past decade, and customers are increasingly engaged: for a $100 product, they are willing to pay an average of $19.50 more to offset carbon emissions. Demonstrating environmental commitment is now a sine qua non condition for a leading businesses and the most impactful indicator is the quantity of CO2 equivalent released.

To assess the carbon footprint of a company, a wide variety of data is required. Emissions are segmented into 3 scopes:

- Scope 1 represents direct GHG emissions such as emissions from combustion and processes.

- Scope 2 refers to indirect emissions associated with energy consumption, the amount of GHG released to produce the electricity, heat, cold, or vapour consumed.

- Scope 3 gathers all other indirect emissions including those from the upstream and downstream value chain, transportation of persons and goods, waste, purchases of products and services, use of the sold products etc.

For each category, the emission factor (kWh used, litres of fuel consumed, kilometres travelled…) must then be translated into equivalent tons of CO2 emitted. This adds to the complexity of the process as the available data is not always in a good format or directly usable (companies can have different energy contracts in different countries, relying on a complex energy mix and an uneven contribution to energy sources depending for instance on the country’s energy policy).

This study must be carried out for each type of product at each company site, so the difficulty of gathering and translating all the data into CO2 emissions grows exponentially with the size of the company, even if all the data is available. Sometimes the necessary data is not available. For instance, a company’s carbon footprint also includes emissions from employee commuting, which requires assumptions to estimate.

The complexity and cumbersomeness of this process have led to the emergence of new tools to automate the analysis and tracking required for carbon emission accounting.

- Emission tracking: Startups such as Emitwise, Worldfavor, and Position Green have designed software and platforms that gather information from all of a company’s locations to automate sustainability reporting and track emissions. These tools give corporates a better understanding of their carbon emissions and allow them to take the most impactful actions for the environment. Other startups target specific sectors. For instance, Sustainabill focuses on tracking the environmental impact of supply chains and allows businesses to compare the sustainability ratings of their suppliers. CarbonCloud develops automated carbon footprint scoring for the food and beverage industry.

- Emission tracking and reduction: Another way to help corporates reduce their carbon footprint is to provide them with insight. Cozero has developed a platform that automates emission accounting, as well as a digital marketplace that offers low-carbon alternatives to reduce carbon emissions. Klimametrix sends its users individual action plans based on their footprint calculations to help them reduce their CO2 emissions. Planetly has built software to analyze companies’ emissions and suggest actions to reduce them, whether it’s improving production processes, switching to renewable energy or adopting greener transportation for business trips.

- Emission tracking and offsetting: Some startups help reduce carbon emissions by offsetting them, guiding corporates in financing carbon reduction projects to compensate their own emissions. Startups like ClimateSeed and Cloverly help measure your carbon footprint and select relevant carbon reduction projects. You invest in one or more projects and receive carbon credits in line with your emissions. This system allows corporates to invest in reliable and verified projects, and to receive reports on the progress of these projects.

It is more difficult for large corporates to track their emissions accurately due to their large number of inputs, locations and suppliers. In fact, most call on consulting firms to get a tailor-made solution and assessment of their emissions. Last year, Amazon invested in Pachama, a startup that offers offsetting solutions through reforestation and quantifies the carbon absorbed by planted trees. This year, Samsung partnered with Carbon Footprint Ltd to offset the carbon footprint of their washing machines and dryers over their lifetime. ERP companies have a head start on this subject, as their software already handles much of the data needed for carbon accounting. In 2019, Salesforce launched its sustainability cloud and last year SAP launched its carbon footprint analytics to meet the demand for automated carbon accounting.

In conclusion, automated emissions tracking is still an emerging topic, which makes it difficult for companies to choose a tool given the lack of differentiation between them. However, in the coming years, we expect to see an increase in investment in this area, as well as a proliferation of startups. The ones that will stand out from the rest will be those that manage to position themselves in specific and highly regulated sectors; across the entire value chain; with smooth integration within the existing IT infrastructure.

2 Key Figures

95 carbon footprint software startups

registered by Crunchbase

Carbon footprint management market expected to reach $12.2 Bn by 2025

The global carbon footprint management market was estimated at $9 Bn in 2020 and is expected to reach $12.2 Bn by 2025, at a CAGR of 6.2%.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Sustainabill, Cozero, and Cloverly.

Sustainabill

Sustainabill is a Cologne based startup,developer of supply chain management platform designed to achieve multi-tier-visibility and trace supply chains to the source. The platform analyses the entire supply chain network and source of the raw material to collects data from suppliers and sub-suppliers as well as to identify sustainability-related risks.

Cozero

Cozero developped a digital carbon action platform focused on helping companies take control of their corporate emission data. The companies platform offers tools for end-to-end carbon management, planning, emission accounting and carbon portfolio management to maintain carbon log and forecast carbon output using data analytics, thereby enabling companies to achieve carbon neutralization.

Cloverly

Cloverly’s sustainability as a service platform calculates the carbon impact of common internet activities like e-commerce shipments, rideshare and on-demand deliveries and then purchases carbon offsets to make those activities carbon-neutral, enabling buyers to view in real-time the source of the offset and through its algorithm matches customers with the closest source of renewable energy for localized impact.

123Fab #24

1 topic, 2 key figures, 3 startups to draw inspiration from

Over the years, the French government has boosted the financial incentives offered to the biomethane industry to reduce the costs associated with the production and operation of units. Whereas the exemption from the domestic consumption tax on natural gas (TICGN) previously applied to biomethane, the French government has just announced that it will no longer apply from January 2021. France Biométhane, a green gas think-tank, deplores this decision which, according to them, discredits biomethane and favors fossil fuels.

Biomethane, defined as a renewable natural gas with properties close to those of natural gas, may well play a major role in building a sustainable energy future according to the International Energy Agency (IEA). Indeed, there is no need to change the transmission and distribution infrastructures or end-user equipment. Consequently, it can be injected into the natural gas distribution network very easily or used as fuel for vehicles (bio-CNG, bio-LNG). It is also comparable to renewable energy since it emits 10 times less carbon than natural gas, can be stored and offers a solution to the intermittent use of solar and wind energy. Finally, it reduces the pressure on landfills and fits into the circular economy. Therefore, there are reasons to believe that biomethane could become more firmly established in the future. How about its economic viability and technical feasibility?

To date biomethane can be produced in 3 ways:

- The biogas road – which uses wet biowaste. It uses the means of anaerobic digestion to convert the biowaste into biogas. The biogas is then purified to remove the CO2 and other contaminants to produce biomethane.

- The syngas road – which uses dry or semi-dry biowaste. It uses the means of pyro-gasification to convert the biowaste into syngas. The syngas is then cleaned and methanised to convert the hydrogen, carbon monoxide and dioxide into methane.

- The hydrogen road – which uses electricity. It uses the means of electrolysis (or power-to-gas) to convert electricity into hydrogen. The hydrogen is then cleaned and methanised to convert it into methane.

In short, there are three main methods for producing biomethane: anaerobic digestion, pyro-gasification and electrolysis. To date, approximately 90% of the biomethane produced comes from anaerobic digestion and the upgrading of biogas. Among the purifying and upgrading technologies, we can find water scrubbing, adsorption, cryogenic separation, membrane technology, etc.

Waga Energy, a landfill gas-to-energy technology firm, is one of the large players in this segment. In 2018 they notably joined forces with environmental services giant Veolia. Since then, Veolia has been using Waga Energy’s Wagabox® technology to produce biomethane using biogas, which is injected directly into the natural gas grid operated by GRDF. In early October, the two players signed a contract to install a purification unit at the waste storage center in Claye-Souilly. This facility, which should be commissioned by February 2022, will produce biomethane from waste and supply 20,000 households in the Paris region with renewable gas.

Last year, France set an objective of injecting 10% of biomethane (21 TWH) into the country’s gas network by 2030, like Denmark is already doing. Numerous biomethane injection sites have seen the light of the day. To date, 133 biomethane injection sites are producing 2.3 TWH per year. With an average annual growth rate of more than 60% over the last 3-4 years, the French goal seems feasible.

However, production costs remain high when taking into account the cost of input supply, the cost of transformation (into biogas/syngas and then into biomethane), and the cost of injection (connection to the energy grid). The price to produce biomethane reaches €95 compared to €20 for natural gas. This is why the development of biomethane will ultimately depend on the policy framework and if the market conditions remain attractive for the project leaders (green gas feed-in tariffs, stability, or reduction of construction and gas connection costs).

Overall, the optimal uses of biomethane are in the end-sectors where there are fewer low-carbon alternatives (high-temperature heating, petrochemical feedstocks, heavy-duty transport, shipping, etc.). There are also other motivations such as rural development (household digesters), energy security (complementing wind and solar PV or substituting imported natural gas) and urban air quality.

2 Key Figures

330 Biomethane startups

registered by Crunchbase

Market size expected to reach $3.4bn by 2027

The global biomethane market accounted for $1.8 billion in 2019 and is expected to reach $3.4 billion by 2027 growing at a CAGR of 8.3% during the forecast period.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: CPD-Swiss, Nexus Fuels, and Pyrowave.

Waga Energy

Waga Energy develops, designs, invests and operates WAGABOX® units that recover biogas from landfill sites to transform it into biomethane. Waga Energy uses two upgrading processes: membrane filtration and cryogenic distillation.

Enosis

Enosis develops a biomethanation reactor that converts biogas, syngas and CO2 into methane and provides flexibility services to the electrical grid.

Electrochaea

Electrochaea’s proprietary power-to-gas (P2G) process converts renewable energy and carbon dioxide into grid-quality renewable methane for storage and distribution.

EIT Health and Biogen are joining forces to launch ‘neurotechprize’ to advance promising technology solutions addressing Alzheimer’s Disease (AD) from around the globe.

Through the neurotechprize, they aim to accelerate the most promising solutions and technologies addressing the challenge of AD in Germany.

Aster Fab is thrilled to have supported Biogen and the neurotechlab in the design and organization of the prize.

**

4 AREAS OF FOCUS

EIT Health and Biogen have identified four areas of focus that could make a difference in the life of people diagnosed with AD:

1. Accelerating the diagnostic pathway

2. Improving disease monitoring

3. Easing burden on patients

4. Maintaining quality of life

**

THE PROGRAM

The program is aimed at health entrepreneurs in the neurotech space seeking support in the validation of their ideas and developing business goals in a supportive and enriching environment.

The program offers participants:

- A tailored three-month journey focused on your team’s objectives, established individually at the beginning of the program

- Intensive mentoring from top experts in business and science

- Access to industry stakeholders

- 10,000€ funding to support participation of founders and/or key team members in the journey

**

ADMISSION PROCESS

Shortlisted teams will be invited for an online interview directly by EIT Health staff and Biogen experts. The interviews will take place between 20-26 January 2022. Shortlisted teams will be able to book the time for the interview via link provided in the invitation.

The application score and the result of the online interview will be combined to draw up a list of teams selected to pitch live in front of the Jury.

Up to 15 shortlisted teams (Semi-Finalists) will be invited to pitch their solution in front of the Jury on February 1st, 2022 to secure their spot in the program. The Jury will select up-to 10 teams (Finalists) who will be invited to enter the program (Finalists).

**

THE PRIZE

The Jury will be able to award up-to two prizes:

- 1st Prize of 100,000€ for the winning solution

- 2nd Prize of 50,000€ for the runner-up

123Fab #41

1 topic, 2 key figures, 3 startups to draw inspiration from

In 2020, in addition to $650 million in private investment in Africa’s mini-grid sector, the African Development Bank announced a $7 million grant to help this African industry. Mini-grids can be defined as sets of electricity generators (10 kW to 10MW) – and possibly energy storage systems – interconnected to a distribution network that supplies electricity to a localized group of customers.

Different technologies can power mini-grids. The most common types are solar mini-grids, hydro mini-grids, and hybrid mini-grids that couple renewable energy with non-renewable sources, such as solar-diesel or solar-biomass systems. Mini-grids can be connected to the national electricity network, but they can also operate autonomously without being connected to a centralized grid. In the first case, the mini-grid is designed to interconnect with the central grid, which means that it operates under normal conditions, disconnecting only in case of a central grid failure or demand peak. In the other case, the mini-grid is designed to operate autonomously in a remote location with the option to connect to a central grid when grid extension occurs. Thus, mini-grids address a wide range of uses, from access to energy in remote and off-grid areas in emerging countries to electricity generation in eco-districts in more developed regions. The three main use cases are the following:

- Remote areas where households lack access to electricity (40%): The State of the global mini-grid market Report of 2020 estimated that 238 million households could be connected to mini-grids in Sub-Saharan Africa, Asia and island nations by 2030. As a result, large corporations and startups are addressing this surging market. In Africa, ENGIE inaugurated its first PowerCorner mini-grid in Zambia in April 2019 and aims to develop 2,000 mini-grids by 2025. In Asia, India’s Tata Power has a similar project in its home country. Startups are also addressing this market. A great example is Nuru, a mini-grid owner and operator using solar-hybrid systems in DRC, in a country where the national electrification rate is only 7%.

- Remote commercial and industrial sites (16%): For off-grid and hybrid power plants, where connection to the national grid is more expensive, hybrid mini-grids can be installed. This is what eLUM does, providing solar-diesel solutions to factories and power plants, such as for a food processing factory in Ghana.

- Eco-district and city for better energy efficiency (10%): The city of Feldheim, Germany, owns and operates a local renewable mini-grid system consisting of solar, wind, and biomass power generation sources, as well as a battery storage system. It has managed to reduce the cost of electricity for residents by 30%.

Mini-grids are a strong trend, that should be embraced rather than questioned. Indeed, up to one-third of the losses associated with distributed energy resources could be recovered if utilities tapped into the mini-grid opportunity. The integration and development of mini-grids are made possible by several technology innovations:

- Plug-and-play energy management systems using artificial intelligence: Thanks to the developments in optimization model software, connection to the main grid can be efficiently done and AI can be used to forecast demand and energy generation from renewable sources, to accurately match supply with demand. For instance, research institutes CSIRO (Australia) and NREL (USA) are working together to simplify the integration of renewable mini-grid systems by creating a plug-and-play controller that can maximize the use of solar energy.

- Low-cost battery storage technology: Battery storage systems are crucial in balancing the variability of PV and wind and in shifting the electricity generated at times when supply exceeds demand, to times when demand exceeds supply. While historically renewable mini-grid systems have used lead-acid batteries due to their lower cost, technological advances and large-scale manufacturing of lithium-ion batteries now make them a competitive solution.

- Advanced metering infrastructure: Smart meters can enable remote monitoring of consumption and support the implementation of various pricing schemes, such as time-of-use tariffs. In the case of off-grid systems, renewable mini-grid operators can implement prepaid or pay-as-you-go models using mobile payment systems and smart meters – to remotely switch on and off customers’ electricity supply.

All of these innovations have not only enabled mini-grids to become a relevant source of electricity supply, but they have also helped generate undeniable economic, ecological, and social impacts. First, mini-grids are often the only economically viable option for electrifying rural communities. Hybrid mini-grids also increase the reliability of the electricity supply. When it comes to their carbon emissions, they are limited as they often incorporate 75%-99% renewable supply. Finally, the implementation of mini-grids has proven to have a positive social impact by fostering and improving the local governance structure through community involvement.

Despite these benefits and market attractiveness, mini-grid penetration remains low in most developing countries due to technical difficulties and economic challenges. The main technical issue is lack of maintenance or use of poor-quality technology, which could be due to a lack of sufficient funding or a shortage of local skills for maintenance. Then, the major economic challenges are the need for regulations to protect mini-grid asset cash flows (e.g., protecting isolated mini-grids if the main grid arrives), and the need to solve customers’ ability to pay, as their irregular income streams pose significant risks to revenue collection.

To conclude, mini-grids have a strong future with short-term uncertainties. While the mini-grid market is estimated to grow at least at a double-digit rate over the next six years, the growth is limited by technical and financial issues. New component technologies (e.g., batteries) and new integration models appear to be the main drivers to solve these issues today (e.g., AI, smart meters).

2 Key Figures

389 mini-grid startups

registered by Tracxn

The mini-grid market expected to reach $30 Bn by 2025

The global mini-grid market was estimated at $11.4 Bn in 2019 and is expected to reach $30 Bn by 2025, at a CAGR of 14.75%.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: SolarKiosk, Kemiwatt, and SOLshare.

SolarKiosk

SolarKiosk is a German start-up that provides clean and sustainable energy services intended to help resource-scarce and off-grid areas gain easy access to electricity through energy hubs. The company designs, manufactures, implements and operates solar mini-grids which can be deployed in the most remote areas.

KemiWatt

Kemiwatt is a French start-up that develops innovative redox flow battery technology for stationary energy storage. A typical application is the storage of renewable energy (solar, wind), either off-grid for micro grid, or mini-grid services (load-shifting, peak-shaving,…).

SOLshare

SOLshare is a Bangladi stat-up that is the developer of an electricity trading platform designed to manage local electricity for households and small businesses in densely populated off-grid villages. The company’s peer-to-peer platform enables users to monetize excess solar energy, and create a network by sharing electricity.

To receive the latest Aster Fab insights directly in your inbox, you can subscribe here.

123Fab #40

1 topic, 2 key figures, 3 startups to draw inspiration from

Plastic pollution is one of the most important environmental issues of the coming years. Plastic’s low cost and ease of production have made it an indispensable material in many sectors, especially in packaging, accounting for more than 45% of plastic waste generation in 2015. Due to its slow decomposition rate and the fact that 40% of all plastic trash is single-use, plastic waste has rapidly grown, making end-of-life management a burden for policymakers. Last year, France adopted an anti-waste law, setting a goal of 100% recycled plastic by 2025 and a ban on single-use plastic packaging by 2040. In 2015, 8% of plastic was incinerated, 7% was recycled and 55% was disposed of in landfills or the natural environment, while 30% was used. There are many types of plastics, from thermoplastics and thermosetting polymers to crystalline plastics and bioplastics, but the vast majority of plastics are made of polymers.

Today, the primary means of recycling is mechanical recycling, which accounts for more than 99% of infrastructure and business. The principle is simple, it involves crushing plastics into granulates, washing them and then melting them down so that they can then be reused. To be efficient, mechanical recycling requires a clean stream of plastic waste. Thus, thorough sorting needs to be done beforehand to separate plastics by color and type, which makes it impossible to recycle laminated packaging (made of different plastics). Mechanical recycling is also limited because plastic can only be recycled a maximum of 5 to 7 times, and be reused in low-value products, which calls into question the economic viability of this method.

In recent years, chemical recycling has gained momentum, with the goal of providing a solution for hard-to-recycle products and the potential for an infinite number of recycling cycles. Among the chemical recycling processes, depolymerization has attracted the most interest from startups and corporates.

What is depolymerization? Polymers are long associations of chemical entities called monomers. Depolymerization is the process of breaking the bonds of the polymer chains to create a mix of monomers. It is very useful for plastics because the products of this chemical reaction can then be reused.

To tackle the recycling problem, depolymerization of plastic waste can be used in various ways:

- From plastic to fuel: Some, such as CPD-Swiss or Paterson energy, depolymerize any type of plastic waste using pyrolysis (heating the material without oxygen) to create “pyrofuel”, or catalysis (accelerating the chemical reaction by introducing another chemical entity) to create synthetic diesel. Part of the fuel produced can then be re-used to produce heat in the process, making it energy self-sufficient, and the product can be used as an alternative fuel and energy carrier.

- Plastic to feedstock: Nexus fuel and Polycycl focus on some categories of plastics, HDPE, LDPE, PP, and PS (#2,4,5 and 6 in recycling codes), which are not recyclable with conventional methods and represent approximately 60% of the plastics on the market. They use depolymerization to turn them either into petrochemical feedstock or back into virgin plastic (purified plastic resin). The first through pyrolysis, the second through a proprietary chemical recycling technique called Contiflow Cracker. Plastic energy uses the same categories of plastic to produce syngas (used to make the plant run) and feedstock to re-create virgin plastic.

- Plastic to plastic: Some startups focus on recycling one type of plastic such as Pyrowave, which uses microwave-based depolymerization of polystyrene (#6 recycling code) to turn it into styrene, its associated monomer. This styrene can then be re-polymerized into polystyrene indefinitely. Ioniqa on the other hand focuses on PET (#1 recycling code). The company uses a smart fluid (a fluid whose properties can be changed by applying an electromagnetic field) to dissolve the polymers constituting the PET back into monomers, which can, in turn, be used to produce brand new PET. Both these startups aim to provide a new way to attain a truly circular use of these resources.

Corporations are also interested in depolymerization techniques. Four months ago, Shell announced a partnership with Nexus Fuels to scale-up commercial production of chemicals from plastic waste. At the end of 2018, Coca-Cola announced a partnership with Ioniqa to produce new bottles containing at least 50% of recycled PET by 2030, the same year PepsiCo announced a multi-year supply agreement with Loop Industries to produce 100% recycled PET containers using Loop’s depolymerization technology. Sealed Air, a leading packaging corporation, invested in Plastic Energy last year to enhance plastic recycling circularity.

Pre-treatment of plastic waste remains a key factor for recycling. Saperatec has chosen to address the problem of laminated packaging treatment by creating separating fluids that split the various layers of such packaging. The split products can then be re-used. In 2018, adhesive giant Henkel invested in Saperatec to form a collaboration to enrich its recyclable adhesive line.

Depolymerization seems to have gained a lot of momentum in recent years, but green groups are questioning the efficiency of these processes at scale and their environmental impact. Particularly with regard to the potential release of toxins during the processes and their energy intensity compared to mechanical recycling, as well as the carbon emissions entailed by the consumption of plastic-based fuels.

2 Key Figures

39 plastic recycling startups

registered by Crunchbase

Plastic recycling market expected to reach $60.7Bn by 2025

The global plastic recycling market was estimated at $42.3Bn in 2020 and is expected to reach $60.7Bn by 2025, growing at a CAGR of 7.5%.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: CPD-Swiss, Nexus Fuels, and Pyrowave.

CPD-Swiss

CPD-Swiss is a Swiss-based startup created in 2012. It specialises in the development and implementation of projects for the production of diesel fuels and storable energy carriers from renewable residual waste materials (biomass) and from organic waste (plastic, synthetic materials, etc.). For this purpose, CPD-SWISS develops and builds industrial plants based on CPD technology (Catalytic Pressureless Depolymerization).

Nexus Fuels

Nexus Fuels is a startup based in Atlanta, provider of waste management services designed to convert waste plastics into plastic feedstocks and fuels. The company’s services reduce plastic waste from being landfilled and has low operating costs, enabling people to convert difficult-to-recycle waste plastics into fuel and virgin plastic.

Gindumac

Based in Ontario, Pyrowave is the developer of a microwave-based chemical recycling technology intended to enable plastic regeneration. The company’s technology regenerates post-consumer plastics by breaking them down into intermediate products that are used to make plastics identical to virgin plastics, thereby enabling customers to reduce plastic waste and be a part of a circular plastic economy.

123Fab #39

1 topic, 2 key figures, 3 startups to draw inspiration from

Industry 4.0 and the Internet of Things have transformed the way we view industrial machinery. Whether it’s construction equipment, farm equipment, metalworking machinery, woodworking machinery, forklifts, it’s no longer just about mechanical equipment. Most industrial machines are equipped with a large number of sensors, cameras and are connected to the company’s network. From predictive maintenance to avoid breakdowns to defect detection, connected machinery is significantly improving competitiveness and efficiency. It is also helping to address Corporate Social Responsibility (CSR) issues by increasing operator safety and facilitating their work, as well as energy use efficiency. However, there are two points to note: on the one hand, these machines are on average more expensive than conventional equipment, and on the other hand, with the evolution of technologies, they become obsolete at a higher pace.

To avoid paying the high price of these machines, industrials and corporates have found new ways to access these technologies. One of which is retrofitting. The principle of retrofitting is simple but efficient: any industrial corporate with legacy machines can send them to a retrofitting company, which will retrofit sensors and connectivity panels to make them smart. This avoids paying for a whole new machine that workers do not master and grants access to the latest technology. Some startups, like Teleo, retrofit existing construction equipment into teleoperated robots. Last month, the startup was selected by construction equipment manufacturer Deere & Co. to join its Startup Collaborator program. Other startups, like Kontrol energy corp, aim to reduce energy costs and greenhouse gas emissions in industries by retrofitting energy consumption monitors.

In recent years, another way to reduce the cost of purchasing connected industrial machinery has made inroads: second-hand machinery marketplaces. These platforms were traditionally a B2C tool, but the growing need for cost-effective solutions for industrial machines has led to an expansion of these platforms to a B2B model. Some of them are generalists like Vendaxo, which lists machines ranging from food processing to construction and heavy equipment. Others, like Moov or Makinate, target more specialized segments (semiconductor and metal/plastic industries respectively). Each has its own business model, some focusing on platform assistance, and others offering a wide range of services coupled with their platform: financing, preparation, loading, transportation, and installation like Gindumac.

Another tool to enhance the lifespan of industrial machinery is rebuilding. The machine is completely dismounted, then remounted, and end-of-life parts are replaced. This is often a service offered by Original Equipment Manufacturers (OEM) and specialized companies, as workers must have extensive knowledge of each model.

Although the second-hand market is expected to be worth more than $142 billion by 2026 for construction machinery alone, according to Global Market Insights, there are relatively few startups positioned in the second-hand machinery marketplace segment. In fact, fewer than 10 startups are registered on Crunchbase. This is because the logistics of transporting and storing these machines, as well as the financing involved, are difficult for newcomers to tackle, especially when it comes to international transactions and shipments. That is what leads us to believe, for now, why most startups positioned in the marketplace segment are working primarily on facilitating other aspects of these transactions, such as machine quality checks, escrow payment, or counseling.

One of the big obstacles standing in the way of these platforms is transportation: connecting buyers and sellers from all over the world is one thing, but transporting multi-ton machines from one to the other is another. One thing is sure, there is room for innovative solutions for the disposal of used machinery, whether it’s retrofitting, marketplaces or recycling (like French trains from SNCF). The trend seems to be toward more eco-responsible and reusable machinery.

2 Key Figures

<10 used/second-hand industrial machinery marketplace startups

registered by Crunchbase

Market size expected to reach $142Bn by 2026

The size of the used construction equipment market alone is expected to reach $142Bn by 2026.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Equippo, Moov, and Gindumac.

Equippo

Equippo is a startup founded in 2014 in Switzerland operating an online marketplace intended to simplify buying and selling of used construction equipment. The platform performs machine inspection, manages the payment, shipping, trucking, and clearance of heavy equipment for buyers from all over the world, including markets like South America, Russia, and Poland.

Moov

Moov is a San Francisco based startup providing online marketplace designed to sell used manufacturing equipment.The platform matches buyers and sellers of pre-owned semiconductor manufacturing equipment and automates documentation, information sharing and the transaction process.

Gindumac

Gindumac is a German startup operating an online platform for used machinery trading intended for sellers and buyers of industrial machinery. The company buys and sells used machines including machine tools, sheet metal, plastics processing, automation and injection molding machines from various international manufacturers in the metal, sheet metal and plastics processing industries.