In March 2020, the European Commission presented an industrial policy to support the twin green and digital transitions to make the EU industry more competitive globally, and strengthen Europe’s open strategic autonomy. Indeed, today’s industry, and more particularly the manufacturing sector, has a real problem of productivity and difficulties to innovate, especially in comparison with other sectors. As an illustration, the manufacturing sector in the US has experienced the steepest decline in productivity growth of any sector, according to Economics TD. In the EU, productivity growth for industrial companies fell from an average of 2.9% over the 1996–2005 period to just 1.6% percent from 2006–2015. This can be explained by the fact that digitalization in manufacturing is low compared to sectors such as transportation, utilities or finance. Manufacturing also represents less than 10% of venture capital investments in the US and EU. This looks set to change, as Industrial Tech Investment levels have grown 8.8x since 2014, nearly three times faster than overall European VC investment. AI-based use-cases can really help improve the productivity of manufacturing companies.

AI can improve the productivity of the manufacturing sector at different levels. First, it can help to optimize processes. Machines become self-optimized systems that adjust their parameters in real-time by continuously analyzing and learning from current and historical data. It can also be used for predictive maintenance by continuously analyzing machine data to predict and avoid breakdowns. AI may help to automate quality control by using image or time-series sensor data to identify defects and deviations in product features. Finally, AI can be used to train cobots and enable them to perform a wide range of tasks.

Some large companies have started to integrate AI into their operations to improve productivity. For example, Mitsubishi Electric has developed its own system internally to adjust the parameters of its industrial robots. It has reduced process times by 90%. But overall, according to PWC, only about 9% of manufacturing companies have successfully implemented AI in their operations. They face certain difficulties, particularly in the development and deployment of AI models. Factory data can come from many sources and in many forms, making data collection and integration challenging. Labeling manufacturing data is also a cumbersome and time-consuming process. It often requires domain knowledge which means that manufacturing companies may be reluctant to work with labeling service providers. There are also many challenges in terms of security, processing power, scalability and explainability.

This is why startups seem to have a role to play alongside manufacturers. Startups can help in a variety of activities: improve data sourcing, improve data labelling and quality, facilitate model deployment and provide final use cases. Some players have already joined forces with startups such as Alcoa, which partnered with the UK startup Senseye to build a predictive maintenance solution. In total, Alcoa has reduced unplanned downtime by nearly 20%. A French Tier-1 automotive manufacturer partnered with the startup Scortex to automate the inspection of painted plastic parts. Scortex’s solution reduced inspection time by 80%. There is also a growing appetite among venture capital firms to invest in this sector. Cognite, which provides an IIoT platform as well as use-cases such as predictive maintenance, raised €128m in May 2021, Kili Technology which enables large companies to transform their raw data into high-quality annotated data raised €21m in June 2021…

However, the market is young, small and niche, which explains the low number of startups that manage to emerge. For data sourcing, hyperscalers like Amazon or Microsoft or incumbents like Siemens are competing with startups, and in-house solutions are being developed by industrial companies. With the exception of time-series data labeling and quality monitoring, there is no need for a specific tool for manufacturing and a generalist tool can be applied (H2O.ai for example is an AI Cloud Platform designed to operate in any environment).

In short, it is clear that AI and more specifically machine learning are full of promise for the manufacturing sector, to improve processes and boost productivity. However, the market is still not yet mature and developed. Startups attempting to conquer the market seem to have difficulty scaling or to competing with hyperscalers like Amazon. As a result, generalist tools are being applied to the manufacturing sector, especially in the deployment of models. It is likely that such tools will see a stronger adoption from the manufacturing sector as it matures, but the first step is to improve data sourcing, annotation and quality monitoring.

2 Key Figures

The Global Artificial Intelligence in Manufacturing Market is expected to reach $11.5 Bn by 2027, with a growing CAGR of 27.2%

The market was valued at $2.1bn in 2020 – AllTheResearch (Sept 2021)

318 funded companies in AI in manufacturing

$3.1bn total funding and $1.5bn funding in last 2 years – Tracxn (Sept 2021)

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Scortex, Senseye and Kili technology.

Scortex

The startup has developed a a machine intelligence platform designed to set up a solution for the factory production line. It transforms quality inspection and offers an automated defect detection and analytics solution to more accurately identify defective products in real-time.

Senseye

The startup has developed a cloud-based machine monitoring and diagnostics platform intended to deliver a way to predict machine failure. The platform automatically tracks and sends depreciation data of machinery and notifies manufacturers about machine conditions.

Kili technology

The startup has developed an annotation platform intended to create and manage data sets for artificial intelligence training. The platform allows for easy management of the training data for annotation, quality control, data management and labeling workforce.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #64

1 topic, 2 key figures, 3 startups to draw inspiration from

Copper plays a major role in the global economy. From thermal and electrical conductivity to corrosion resistance, copper is an extremely versatile metal that has long contributed to the way the world works. By way of illustration, it is used in numerous industries such as telecommunications (cables, wires), electronics (printed circuits, chips), transportation (injection systems, braking circuits), construction (pipes, tubing), currency, etc. In fact, one tonne of copper brings functionality to 40 cars, powers 100,000 mobile phones, runs 400 computers and distributes electricity to 30 homes.

This year, the price of copper broke the $10,000 per ton mark for the first time in 10 years. This indicates an expected increase in global demand, which should benefit Chile, Peru and China (47% of global production). Described as the ‘new oil’, demand for copper has been driven in recent years by its vital role in a number of rapidly growing industries, such as electric vehicle batteries and semiconductor wiring. According to Citigroup Global Markets, demand related to renewable power generation, battery storage, electric vehicles, charging stations and related grid infrastructure accounts for about 20% of copper consumption. Thus, copper is lauded as an essential, structural metal for the energy transition. However, the recent price surge threatens to make decarbonization more costly. At the same time, the global average copper ore grade is expected to decrease, as mines with higher ore grades become exhausted. As a result, there is growing concern about the availability of copper, and several studies have sought to estimate the peak of global copper production using Hubbert’s model, which has been estimated to be between 8 and 40 years from now.

Given the importance of copper, innovation is beginning to spur in the industry. Continuous research and testing of new concepts are being deployed to make processes more efficient, minimize environmental impact, lower energy consumption and improve design. In 2015, Aurus III, a $65 million venture fund focused solely on copper mining innovation, was launched in Chile. Among the startups they have invested in are Ceibo (formerly known as Aguamarina), which focuses on soil stabilization through biomineralization, and Scarab Recovery Technologies, which is centered on recovering valuable materials from tailings. Recycling is also receiving increased interest because copper – like gold, silver and other non-ferrous metals – suffers no loss in quality from the process, making it infinitely repeatable. In addition, it requires up to 85% less energy than primary production. Hamburg-based Aurubis is one of the companies leading the charge on the recycling of copper and other metals by a pyrometallurgy method. This year it announced that it is investing €27 million in a new recycling plant at its Beerse country site. The ASPA plant will process anode sludge, a valuable intermediate product from the electrolytic refining of copper, from the recycling sites in Beerse and Lünen, Germany. New Zealand startup Mint Innovation, however, uses a unique biohydrometallurgy method. Launched in 2016, it has developed a low-cost biotech process to recover precious metals from e-waste. It raised NZ$20 million last year to build its first two biorefineries in Sydney, Australia and northwest England.

It should be noted, however, that the copper recycling business requires considerable financial resources, particularly in terms of working capital and cash flow. This is what led to the near bankruptcy and takeover of the French factory M.Lego, which employs 110 people. Likewise, while secondary production of refined copper has increased in volume and percentage, it is growing at a much slower rate than the waste stockpile. This is primarily due to the fact that the sectors with the highest recycling rates (construction and infrastructure) have their copper tied up for several decades due to the life of the structures built. In contrast, consumer goods, which have a shorter life span, are only recycled at rates between 25 and 40%

In short, copper is projected to be a critical metal in the coming years, with a vital role to play in the energy transition. The gradual depletion of its reserves and dependence on certain countries is driving companies to innovate in the field of recycling, in order to make it both more profitable and sustainable. However, the copper industry will need strong government support to stimulate innovation to avoid a gradual shortage that would contribute to a sharp increase in prices.

2 Key Figures

About 50% of the copper used in Europe comes from recycling

International Copper Study Group (ICSG)

Copper consumption is predicted to rise more than 40% by 2035 compared to 2018

European Copper Institute (2018)

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Mint Innovation, Sortera Alloys and Weeecycling.

Mint Innovation

The New-Zealand startup has scaled biological processes that recover valuable metals like copper from electronic waste and other residues. The company’s firm uses microbes to selectively and rapidly recover precious metals from various low concentration materials under environmentally benign conditions.

Sortera Alloys

The American startup has developed a sorting system designed to reuse metals recovered from end-of-life products. The company’s system sorts metal by its type and alloy composition through a combination of X-ray fluorescence and optical sensor fusion, artificial intelligence (AI) and machine learning image processing.

Weeecycling

The French startup WeeeCycling has set up a circular economy loop for recycling strategic metals. The company buys electrical and electronic scrap in the world and, via its Morphosis brand, manufactured products. The rare metals are then extracted through a thermal and electrochemical stage to be resold for reuse.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #63

1 topic, 2 key figures, 3 startups to draw inspiration from

On Sunday, October 10, ten European Union countries signed a declaration supporting nuclear energy and its role in the fight against global warming. The debate has been raging for many years on the use of this energy and some countries such as Germany and Austria are opposed to it, as well as many NGOs that consider it a risky technology. This initiative comes at a time of rising energy prices, but also ahead of the European Commission’s classification of energies, which will open up access to green finance and give a competitive advantage to sectors recognized as virtuous for the climate and the environment.

Nuclear energy production involves three main stages: uranium mining, production in nuclear power plants and the treatment of radioactive waste.

Uranium ore is found in uranium mines, mainly in the following countries: Kazakhstan, Canada, Australia, Namibia and Niger. After purification, the uranium is enclosed in a nuclear reactor, which uses the principle of nuclear fission to produce electricity. In this way, uranium nuclei replace the fossil fuels (coal, oil) used in thermal power plants. When a neutron strikes a uranium nucleus, it breaks up, releasing other neutrons and energy in the form of heat. The neutrons released will collide with other uranium nuclei, and so on: the reaction is self-perpetuating, and we speak of a chain reaction. The heat released during the chain reaction is used to produce water vapor. In the same way as in thermal power plants, this steam drives a turbine and its alternator to produce electricity. Once the uranium has been used, there remains a material that can no longer be used to fuel reactors, but which remains radioactive. This is nuclear waste, which is sent to a processing plant, where it is sorted according to its degree of radioactivity. Then, nuclear waste is stored or buried deep underground.

The great advantage of nuclear power is its ability to produce large quantities of energy at a moderate cost. Moreover, this energy is available all year round and the life span of the power plants is quite long (40 years). In terms of CO2 emissions, nuclear power only emits water vapor. Consequently being classified as a low-carbon energy source together with renewables.

However, nuclear power also comes with very complex issues. Among the most frequently cited drawbacks is the management of nuclear waste in the long run, which is still radioactive and harmful to health. Similarly, in case of an accident, the consequences on health can be serious, as shown by the example of the Chernobyl or Fukushima nuclear accidents. Moreover, uranium resources are not unlimited, as can be seen in France, where the mines have been almost exhausted, which leads to energy dependence on other states. In a much shorter term, the construction of nuclear plants is facing drastic challenges as cost and planning are hardly met by the commissioners, hence a trend to also look at smaller reactor technologies.

An increasing number of startups and organizations have entered the nuclear energy business to address these issues. One such case is Transmutex, a Swiss startup, which is developing cutting-edge technologies to transform nuclear waste into clean energy. Its first plant is planned for 2030. Recently, the firm also announced the development of a thorium reactor. Another notable initiative is that of Oklo, a Silicon Valley-based startup, that wants to build tiny nuclear reactors that can run off spent fuel from much bigger, conventional nuclear reactors. Large groups such as EDF in France, with the Nuward project, are also turning to the construction of mini-reactors, with much shorter production times and greater modularity.

The recent litany of announcements in the field of nuclear fusion has highlighted the effervescence of the sector, driven by public research institutes and start-ups. According to the think-tank Zenon Project, about 30 start-ups worldwide are seriously working on this subject. Nuclear fusion consists of transforming two light atoms into a heavier atom to release energy. To do this, a medium must be heated to over 150 million degrees, which requires a lot of energy. This process does not produce any carbon dioxide and uses a very small amount of fuel readily available in nature, unlike nuclear fission of uranium. The fuels necessary for its operation are present in large quantities on earth. Moreover, it generates little radioactive waste with a short life span, and the risks of explosion or runaway are zero. With the ITER project, 35 countries are engaged in the construction of the largest tokamak ever conceived, a machine that is intended to demonstrate that fusion can be used on a large scale to produce electricity.

Although nuclear power has been strongly criticized, it seems necessary, particularly in large consumer countries, to support the energy transition and reduce CO2 emissions. This is why a new wave of countries is now investing in nuclear power, such as England and Finland. Coupled with the development of renewable and low-carbon energies, it has every chance of being a major player in future decarbonization.

2 Key Figures

World’s installed nuclear capacity by 2050: 792 GW

International Atomic Energy Agency

27 companies in nuclear fusion with $592M invested in the last two years

Tracxn

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Transmutex, Commonwealth Fusion Systems and ARC Clean Energy.

Transmutex

Geneva-based start-up Transmutex is developing technologies combining a proton accelerator and a subcritical thorium reactor (an alternative fuel to uranium) to transmute the most dangerous nuclear waste into stable elements for producing electricity and hydrogen.

Commonwealth Fusion Systems

The American startup intended to combine proven physics with magnet technology to accelerate the path to commercial fusion energy. The company engages in the design and building of fusion machines that provide limitless and clean fusion energy.

ARC Clean Energy

The Canadian startup intended to offer inherently safe, reliable, and economical carbon-free power. The company focuses on developing an advanced small modular reactor (SMR) which has a simple, modular design providing 100 megawatts of electricity that is cost-competitive with fossil fuels.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #61

1 topic, 2 key figures, 3 startups to draw inspiration from

According to a McKinsey report, the prediction that machines and automation would destroy more jobs than they would create has proven wrong. On the contrary, even the most advanced factories in terms of automation, the “lighthouses”, are hiring heavily. However, as many as 375 million workers may need to switch occupational categories and learn new skills. At the same time, recruiting and retaining skilled workers is becoming increasingly difficult for manufacturers. According to a study by Deloitte and The Manufacturing Institute, U.S manufacturers say it is 36% harder to find the right talent today than it was in 2018, even as the unemployment rate has nearly doubled the number of available workers. This highlights the gap between the skills manufacturers are looking for and the skills available in the labour market. As many as 2.1mn manufacturing jobs will be unfilled by 2030 and this shortage could ultimately cost the U.S. economy up to $1tr dollars.

In its traditional sense, a blue-collar worker refers to workers who perform strenuous manual labor and mindless tasks, typically in agriculture, manufacturing, construction, logistics, or maintenance. Nowadays, these activities are typically performed by machines and new-age jobs in these sectors have evolved with the advancement in technology and robotics. They now require a certain level of digital literacy to successfully manage tasks and ensure intelligent workflows. Today, the focus is on building a workforce that can operate, repair and maintain technology rather than perform physical tasks. This knowledge gap makes it difficult for both historical blue-collar workers to find jobs and for manufacturers to recruit qualified people for the job. And the desire of many Western countries to reshore some of their activities and downsize the supply chain may increase the need for these new blue-collars.

This significant shortfall of medium-skilled jobs requiring a certain level of training could be addressed by investing more in further skilling and upskilling the blue-collar workforce. Many startups are trying to tackle this problem and are offering solutions to address this worker shortage and knowledge gap. They are supporting the development of blue-collar skills through training, sometimes even putting them in touch with employers. Some focus directly on training and knowledge management tools, others more on intelligent equipment to assist them in their daily tasks. There are also platforms for planning assignments and fostering coordination according to individual skills. Recently, Indian startup Apna became a unicorn in less than two years. The startup connects blue-collar workers with each other, as well as with employers and offers training to upskill. Large groups are also turning to these startups to skill their employees and improve their recruitment process. Toyota, Casio, Shell and several others, for example, use RapL, a micro-learning workforce training platform. Beyond technical, practical or digital knowledge, training can also include use cases on company safety procedures or on new standards like EHS (environment, health, safety) and ESG (environment, social, governance).

Beyond the benefits to the company, employee training has many advantages. According to Gartner, in 2018, 70% of employees reported not mastering the skills they need for their jobs. Structured training for blue-collar workers will not only diversify their skill sets but will also motivate them to be more productive while increasing their analytical thinking and problem-solving abilities.

While investment in blue-collar training seems necessary to address the worker shortages, it comes at a significant cost and does not directly guarantee productivity. Globally, the average cost per employee is $1,252, according to the Association for Talent Development’s 2016 State of the Industry Report. On the other hand, training via digital platforms or trainers does not ensure that employees will have the necessary skills to master the new technologies and truly progress.

With the shortage of blue-collar workers, training is becoming a priority, both for in-house employees and for recruiting new workers. Many large groups are teaming up with startups or external organizations to undertake these trainings. This market is now very important for blue-collars in factories, logistics and construction but it is increasingly expanding to other sectors and topics such as data, artificial intelligence or machine learning.

2 Key Figures

3,100+ startups in Corporate Learning

More than one-third of the funding has been raised in the last years (2019-2020) according to Tracxn

$26.2 billion on internal and external training initiatives for new and existing employees

According to The Manufacturing Institute, manufacturers spent $26.2 billion in 2020 on internal and external training initiatives for new and existing employees.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Knowron, How.FM and Betterplace.

Knowron

The German startup created an AI-based digital assistant for industrial workers. It provides on-spot diagnosis of machine problems, automated workflows using NLP technology, and real-time information on the machine.

How.FM

The German startup How.FM is a multi-language training software built to onboard, upskill, and support the blue-collar workforce. The digital coach can cover off everything from health and safety, and compliance training, to actual work procedures such as packing processes.

Betterplace

The Indian startup helps companies with a all-in-one lifecycle platform intended to offer digital support for blue-collar workforce management.The plateform proposes to upskill every employee with a chatbot based app.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #60

1 topic, 2 key figures, 3 startups to draw inspiration from

While the boom in e-commerce had already prompted physical stores to innovate in the customer experience space, the pandemic has further accentuated this trend. Beyond the emergence of new click and collect experiences, consuming patterns have been reshaped with the rise of local shopping or curbside, instant delivery. Consumers, more demanding than ever, are looking for faster delivery, a more diverse product selection and more competitive prices than traditional retailers.

Recently, especially across Europe, incredible amounts of VC money have been invested in ‘dark stores’, modifying considerably the urban logistics order. While German startup Gorillas raised €244 million after an initial round of €36 million in December 2020, French startup Cajoo has just announced a €40 million fundraising this month. Originated in the United States with goPuff, the ‘dark store’ model involves setting up local fulfillment centers within cities that prepare only internet grocery orders. While consumers can either pick up their order on the curb or in-store, they can have it delivered to their homes within minutes. Although often confused, ‘dark stores’ differ from ‘dark warehouses’ in that the latter are unlit, unmanned facilities with automated operations. As for ‘dark kitchens’, they are restaurants without a storefront, offering menus available for delivery exclusively.

It is undeniable that ‘dark stores’ offer many advantages in view of the investments made in this field. Beyond the convenience for the consumer to be able to be delivered 24 hours a day, 7 days a week, investors perceive in ‘dark stores’ a financial gain. First, thanks to a more integrated value chain (from wholesaler to courier) eliminating the need for intermediaries. Secondly, ‘dark stores’ can be located in industrial areas where real estate costs are much lower than in retail locations. ‘Dark stores’ also have greater fulfillment capacities than the combined capacity of stores they replace, thereby increasing the overall revenue-generating capacity. Inventory management can be more accurate, resulting in fewer out-of-stocks.

On the flip side, light has also been shed on the units economics of such a business. Transportation costs, for instance, are significantly higher due to increased costs of home delivery. At the same time, the business model is criticized for the form of cannibalization it causes. Moving the fulfillment of online orders to a ‘dark store’ shifts revenue generation from self-service stores to dark stores without reducing the fixed costs of operating the stores. Thus, as e-commerce increases, profit erosion accelerates, raising the question of whether self-service stores will cease to be financially viable as operating entities if e-grocery penetration reaches levels now being projected.

In short, ‘dark stores’ may well be an immediate supplement to stores that are currently overwhelmed by the pandemic-driven surge in demand. Partnerships between Carrefour and Cajoo, Casino and Deliveroo and Monoprix and Stuart are illustrations. However, ‘dark stores’ appear to be short- rather than long-term solutions to the problems of e-grocery. In the long run, retailers will be challenged to operate profitably by serving both physically and digitally shopping customers.

2 Key Figures

182 dark store startups

registered by Traxcn

The global online grocery market is expected to reach $1.1 tn by 2027

The global online grocery market size was estimated at $189.8 billion in 2019 and is expected to reach $1.1 trillion by 2027.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Urbantz, Locai Solutions and Quicup.

Urbantz

The Belgian startup Urbantz is a last-mile delivery management platform for enterprises designed to respond to the delivery needs of retailers, logistics operators, e-commerce, grocery players, among others. Urbantz provides an enterprise SaaS solution for real-time visibility and complete control over the entire last-mile delivery chain.

Locai Solutions

The American startup Locai has designed a suite of picking, inventory and stock management tools to optimise the operations of food retailers operating in e-commerce. These tools are based on machine learning and artificial intelligence algorithms that improve operational efficiency and enable predictive analysis.

Quicup

The British startup Quicup has developed a platform to easily book and manage deliveries. They give access to a fleet of 3000+ professional couriers and live tracking facilities, enabling clients to have on-demand, same day and next day delivery services with seamless integration.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #59

1 topic, 2 key figures, 3 startups to draw inspiration from

Over the past decades, content creation and data collection at scale have been at the center of attention: web scraping, growth hacking, cookie tracking, anything to gather information. Today, the focus is on the organizational efficiency of all this content, as the consequences of sub-optimal knowledge management techniques are becoming increasingly well known: from duplication of work to knowledge loss, to time wasted waiting for information from co-workers or giving it to others, employees spend a huge amount of time searching for data. Fortunately, startups are tackling these productivity problems, targeting companies of all sizes.

Knowledge management faces two major obstacles. The first is the multiplicity of the knowledge sources supported within the company (e.g. spreadsheets, presentations, codes, notes, videos, vocals, emails, internal chats, and more). Storing this variety of documents efficiently is complex enough, but the real challenge lies in managing legacy storage systems. Many companies have been gathering data for years, even decades, in a variety of ways. Most of the time, the information is scattered across various folders and sometimes on multiple servers. Some documents are duplicates, others are outdated and some provide no information without context or proper consistent labeling. Searching and assessing which document best fits a request can be a colossal task. However, advances in computing power and algorithm performance provide tools that startups are using to tackle this problem. ambeRoad has developed a smart search engine to be used within the company to find data. Once a query is sent to the engine, it retrieves as many documents (images, video, and audio files) as possible that treat the subject within the company’s database and sends them back, significantly reducing the time spent searching and saving documents and allowing knowledge to be shared across all entities of the company. Shelf also uses AI and machine learning to improve the efficiency of document search within companies, and provides insight into the quality of the document, to help find easily the most adapted document to the query.

Other startups such as Forethought focus on knowledge management solutions for the retail and industry sectors, especially for customer service. They provide a smart search engine for employees to reduce search time and address another critical aspect of knowledge management: finding the adequate contact for each question among the employees. To reduce resolution time and avoid rerouting the call to another agent, the algorithm pinpoints the agent with the appropriate knowledge to answer the most complex questions, ensuring that the knowledge gathered by the agents is used to its full potential. Solvvy also provides an automated chatbot that learns from agent ticket resolution as well as a guidance bot for online shopping sites. The shopping assistant finds the best-fitted item based on the answers given by the client. The answers also allow the program to gain insight and provide metrics on customer behaviors.

Another trend emerging in knowledge management is Knowledge as a Service (KaaS): information, data, and experts are available on-demand via the cloud. This service allows companies to avoid hiring external consultants or experts and drastically speeds up the problem-solving process. Startups like Lynk manage KaaS platforms to provide insights for growth strategies in companies like M&A, asset management, or branding. Their network of experts shares their experience on the platform for an hour, a day, or longer if they choose so. On the other hand startups like Techspert.io leverage AI to browse online public datasets like academic journals or commercial registries to extract experts in a field and use sentiment analysis to assess the fit between the expert and the mission. Experts are then called by the company and their profiles are sent to the client to schedule a meeting. The added value of KaaS startups lies in their capacity to attract the most skilled experts and their ability to redirect questions to the most appropriate expert of their database.

Multinational companies are also positioned on the knowledge management segment: Cisco’s Business Critical Services is an IT platform providing KaaS as well as knowledge management workflows for its users. IBM’s Watson discovery smart search engine uses AI and Natural Language Processing to search through company files and avoid data silos. Between these initiatives and those of startups, the knowledge management segment seems crowded, but with the rise of teleworking, the need for an intuitive and comprehensive way to store information and documents so that they can be easily and rapidly accessed by anyone, from anywhere, is becoming increasingly evident. At the same time, companies are experiencing a higher employee churn rate than ever before, raising the bar even further for efficiency in onboarding new talent and retaining the knowledge of departing employees.

2 Key Figures

221 knowledge management startups

registered by Traxcn since 2015

The knowledge management industry market is expected to reach $1.1 tn by 2027

The knowledge management industry market was estimated at $366.8 billion in 2020 and is expected to reach $1.1 trillion by 2027, at a CAGR of 16.8% according to GlobeNewswire

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: ambeRoad, Forethought and Lynk

ambeRoad

ambeRoad is developing an intelligent enterprise search engine to help employees to find all relevant documents easily and quickly by integrating all company internal data sources into one search engine. Our solution allows access to all company-wide files from anywhere.

Forethought

Forethought is an AI company that creates order, removes redundant work, and provides efficiency for businesses everywhere. Forethought is helping customer support organizations with a natural language understanding platform.

Lynk

Lynk’s platform unlocks the insights, experience, and expertise of experts from around the world, helping people and companies make better-informed decisions. Lynk’s Knowledge Graph uses data to understand, map, and organize experts and their knowledge, facilitating timely, intelligent connections.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #58

1 topic, 2 key figures, 3 startups to draw inspiration from

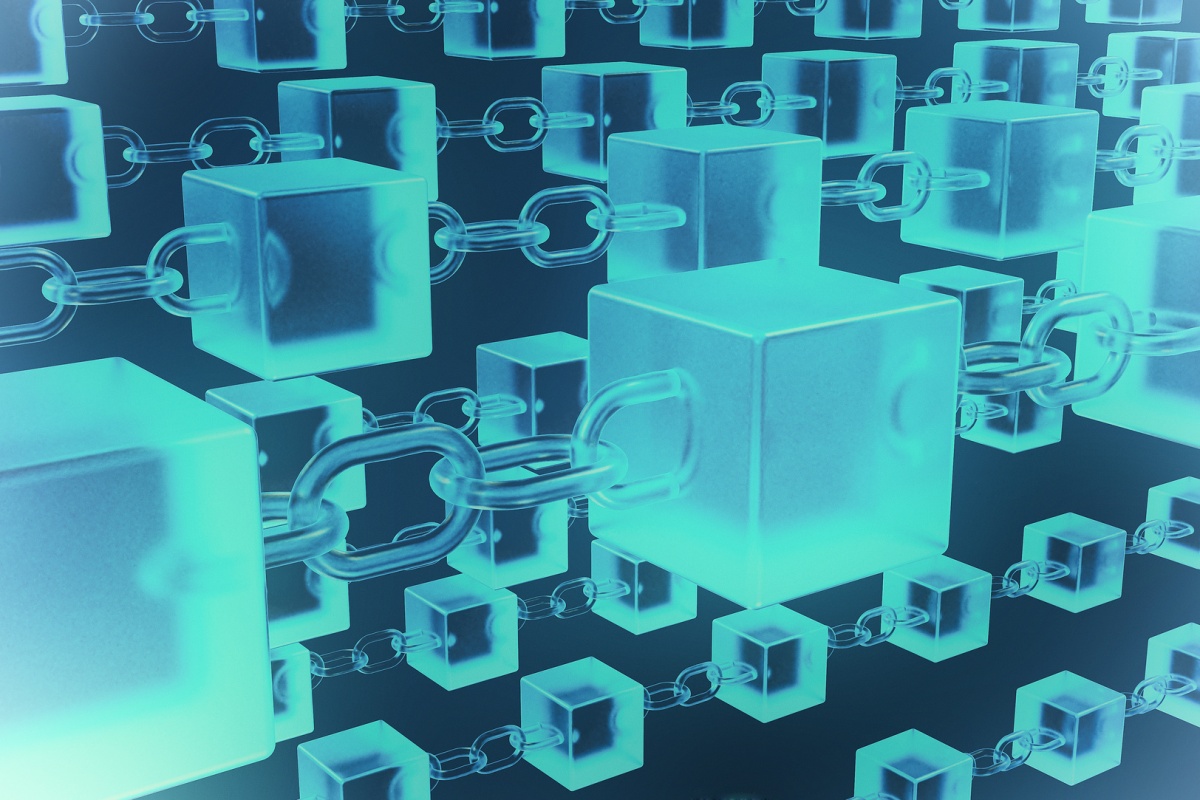

In January 2019, SystemX, a French technological research institute, launched the “Blockchain Wallet for Mobility” project. It aims to use blockchain technology to improve transport services, and thus accompany the transformation of territories. So far, the solutions developed have been tested and validated in the Lyon metropolitan area.

In recent years, the urban mobility sector has evolved rapidly. Mobility providers have invested heavily to offer their customers the best user experience. Free-floating, Mobility-as-a-service, mobility passes, open data, are some of the key drivers. In France, the founders of startup Mobichain even talk about MaaS 4.0. According to them, this new type of mobility is based on the principles of the circular economy and relies on a shared digital infrastructure under blockchain.

Blockchain can be defined as a technology for storing and transmitting information. It uses databases that contain the history of all exchanges made between its users since its creation. Made up of “nodes”, it hosts a copy of the transaction history that all stakeholders can access. Each new node consists of a validated transaction whose data has been encrypted. The integration is chronological, indelible and unforgeable. Smart contracts, for example, rely on blockchain to ensure the terms and conditions of a contract are unfalsifiable and to guarantee its execution when the conditions are met. Blockchain also allows for uneven speed of transactions, as well as significant productivity and efficiency gains, by operating without a central control body and with few intermediaries.

Applied to mobility, blockchain allows several uses cases. Firstly, it allows the history and life cycle of a vehicle to be traced or verified. Telemetry data, such as mileage or battery level, can be downloaded autonomously via the vehicle or via a supplier, as well as accidents, repairs, or maintenance work. This reduces fraud and has a significant impact on resale value, which opens up opportunities for insurance companies. Transparency and global vision of information can also serve the supply chain and contribute to better information sharing and traceability. In August 2021, Tesla published its 2020 Impact Report and revealed its use of 2 blockchain solutions to trace raw materials used in electric vehicle batteries, ensuring that they are sustainably sourced. One of the blockchain solutions, Re|Source, traces cobalt from the Democratic Republic of Congo, and the other traces nickel sourced from BHP in Australia.

Blockchain technology also enables sharing economy initiatives. In the case of peer-to-peer (P2P) systems, it allows stakeholders to easily access and share relevant data and information about cars and people. Interaction and trust between different stakeholders (customers, drivers, vehicle owners, transportation network companies, software providers, etc.) can be greatly facilitated by an immutable digital identity for each stakeholder, as well as by recording each transaction in a shared registry that cannot be modified. This visibility and transparency can also be a strong asset for leasing.

Blockchain and smart contracts also allow for greater automation, especially with regard to payments. Without the intermediary of banks and credit accounts, transactions are made automatically based on certain parameters. One can imagine, for example, automatic billing when using public transport or automatic deactivation of cars when leasing rates have not yet been paid. The centralization of payment for different modes of transportation, especially in urban centers, can be facilitated by blockchain, which considerably reduces the cost per transaction.

With all its features, blockchain presents many opportunities. In the case of electric cars, it can be used to coordinate recharging, record preferences, and facilitate payment. Share&Charge is a German Ethereum-based application that connects electric cars to available residential and commercial charging stations and facilitates payments. The blockchain technology can also help promote green mobility. Indeed, the traceability of electricity would be very easy to ensure.

Despite the increasing adoption of blockchain in mobility, there are barriers. From a technical point of view, the lack of a central body raises questions about security management, liability and ownership of certain assets. In addition, there is a need to integrate new technologies into existing systems. From an economic point of view, it is necessary to be able to manage the various transaction costs, to monitor the profitability and to succeed in federating the mobility sector by going beyond competition.

2 Key Figures

16,922 blockchain industry startups

registered by Traxcn

The automotive blockchain market is expected to reach $3.1bn by 2028

The automotive blockchain market was estimated at $0.35 billion in 2020 and is expected to reach $3.1 billion by 2028, at a CAGR of 31.2%

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: DriveOn, MVL Automotive and CHAMPtitles.

DriveOn

The Brazilian startup DriveOn has developed a mobility platform that collects data from connected cars using blockchain technology related to individual driving behavior of policyholders. The company’s platform also provides auto insurance, informing about the problems and behavior of the fleet.

MVL Automotive

MVL Automotive, based in Singapore, has developed an incentive-based blockchain mobility platform that connects different services and records data related to driving, traffic accidents, repairs and other car-related transactions. The company will roll out its first electric vehicle by the end of 2021.

CHAMPtitles

CHAMPtitles has developed a blockchain technology intended to digitize the process of vehicle titling. The company’s application uses a patent-pending technology that is secure and optimizes vehicle title management (easily transferable and verified).

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #57

1 topic, 2 key figures, 3 startups to draw inspiration from

The space industry is changing. After long being dominated by governments and billion-dollar corporations, access to space is becoming increasingly affordable, allowing smaller companies to enter the market. This is due in part to advances in satellite miniaturization over the past decade, which have drastically reduced the cost of access with the mass production of satellites. While nanosatellites (satellites weighing between 1 and 10kg) have been in use since the late 1990s, the number of launches has exploded in recent years: twice as many nanosatellites have been launched in the last 3 years as in the previous 15 years. This is because their production cost is a fraction of that of their heavier counterparts and they are much faster to build.

Startups are embarking on the development of nanosatellites. For example, German Orbital System builds CubeSats, classic nanosatellites in the form of a 10-centimeter large cube. They contain tailor-made equipment, from solar panels to data transmitters to sensors and cameras, to accommodate as many missions as possible. Picosats provides 3D-printed plastic CubeSats that are lighter than the commonly used aluminum. More than just saving weight for launch, the plastic melts when the satellite reaches its end life and re-enters the atmosphere, reducing the number of space debris left in the atmosphere. Alba Orbital is currently working on PocketQube, a picosatellite (weighing less than a kilo) with performances close to those of CubeSat. This miniaturization step could be a game-changer for reducing the cost of space exploration, because the more satellites a launch vehicle can hold, the lower the price per satellite launch.

Along with these size improvements, some startups have been working to develop affordable launchers for these small satellites. Equatorial Space Systems offers small-size launchers that can carry 3 CubeSats up to 4 km into space. Their rockets use a hybrid propulsion technology that allows them to reduce the cost of the launch. While this solution is more suitable for academic or small-size projects, they are also working on a 17-meter high launch vehicle that could carry more than 150kg anywhere in the Low Earth Orbit (up to 2,000 km from the earth) from their oceanic platform. Beyond Earth, on the other hand, offer a mobile satellite launcher that can carry a 30kg payload up to 400km from earth. Rather than launching the satellite from one launch site owned by them, their launchers are sent by shipping containers to their client’s launchpad anywhere on earth. These large-size launchers are often used to “rideshare” small satellites, such as Starlink’s 143 satellite launch last January to lower the overall launch cost per object. Aphelion Aerospace also offers launch vehicles for nanosatellites using environmentally friendly propellants as well as CubeSats manufacturing to be launched in their rockets.

The growing number of satellite missions in Low Earth Orbit (LOE) is making this part of space cluttered with satellites and debris. In space, even the smallest collision with an object can have colossal repercussions, and as more objects enter space, the likelihood of a collision increases. But some startups are trying to tackle this problem. Altius Space Machines is minimizing the number of debris by improving the life of satellites. Indeed, it specializes in on-orbit inspection and repair services to other satellites, as well as refueling, upgrades, or assistance in leaving LOE at the end of their mission. Starfish Space is pursuing the same goals and building autonomous space tugs for satellite servicing missions to extend their life expectancy and actively remove debris from space to avoid pollution and reduce the risk of collision.

As the number of satellite internet megaconstellations continues to grow (SpaceX’s Starlink projected 42,000 satellites, 2,000 satellites in OneWeb’s constellation, and more than 3 000 for Amazon’s Kuiper’s), concerns about the Kessler syndrome are rising. Thus, solutions to reduce space debris are expected to become increasingly popular, as evidenced by Swiss startup ClearSpace with its collaboration with the European Space Agency on the world’s first space debris removal mission that will begin in 2025.

2 Key Figures

500 NewSpace startups

registered by Traxcn since 2015

The space industry market is expected to reach $558bn by 2026

The global space industry market was estimated at $360 million in 2018 and is expected to reach $558 billion by 2026, at a CAGR of 5.6%

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Equatorial Space Systems, Picosats, and Starfish Space.

Equatorial Space Systems

Equatorial Space Systems developed a hybrid rocket propulsion system intended to make orbital launch better and effective. The company’s propulsion system uses a combination of liquid oxidizer and solid fuel to reduce the cost and risk of spaceflight, enabling space organizations to launch space vehicles for planetary or space missions safely and affordably.

Picosats

Founded in 2014 in Italy, Picosats developed telecommunication systems for CubeSats. The company engages in the research and development of telecommunication systems allowing space-based communication services. Picosat also builds 3D printed CubeSats, lowering the amount of debris left at the end of their mission.

Starfish Space

The Washington-based startup was founded in 2018 and developed an orbital transportation infrastructure designed to provide in-space transportation and maintenance service. The company’s proximity operations software uses a combination of breakthrough orbital mechanics and a low-thrust electric propulsion system, enabling satellite companies to relocate, deorbit and extend the life of satellites.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.