The growth of Software-as-a-Service (SaaS) and big data has changed customer-supplier relationships, with clients now able to browse for a product and compare suppliers (reliability, delivery schedule, product quality, etc.) at the click of a button. Yet, as much as sourcing and procurement for individuals have changed in recent years, this is not the case for the B2B sector, where changing or adding a supplier often implies a huge amount of paperwork and certifications.

As innovation becomes a central subject for most corporations and partnerships with startups become commonplace, there is a growing need for flexible and agile procurement processes to ease and foster these partnerships. Indeed, traditional corporate procurement methods are often a barrier to such partnerships, as evidenced by the endless and complex compliance documents required from startups, where the administrative department is often non-existent. In addition, corporate payment terms are often prohibitive for startups with a high cash turnover. Thus, some startups are seeking to address the need for flexible, agile, and easy-to-use sourcing platforms by offering a new vision of these processes.

Archlet, for instance, has developed a platform to improve the quality of strategic sourcing, rather than having information scattered upon emails and excels sheet. The platform provides an overview of the suppliers with a ranking, a price heatmap, and a negotiation recommendation. This tool helps corporations access a wider range of suppliers as the process is shorter and easier, but also increases savings as suppliers compete. Vizibl has also developed a platform to centralize information and supplier operations but focuses on collaborating with them to help improve the sustainability of their value chain, develop joint IP and improve productivity, leading to a 5-10% reduction in the cost of goods sold.

As digital transformation is a turning point for every company and the complexity of solutions is growing, some startups offer sourcing and procurement software. Olive offers a software selection platform to help businesses accelerate their digital transformation. The platform features surveys to assess the needs and key characteristics needed by the company and organizes the project requirements before sending them to relevant vendors. Their responses are then rated based on their fit with the requirements. Sastrify centralizes the procurement of SaaS for companies, their solution allows corporations to centralize an overview of their SaaS tools and helps them benchmark solutions, as well as negotiate their offers with providers.

In addition to general procurement solutions, which are dedicated to streamlining the process and measuring performance indicators, we are also seeing the emergence of solutions dedicated to certain procurement segments such as shipping. Shipsta focuses on logistics procurement solutions and shortlists transporters for all transportation modes based on your needs and the carriers’ ratings. Buyco, on the other hand, targets ocean carriers and provides a platform to compare carriers and book vessels, as well as track individual cargoes and manage the estimated time of arrival of each vessel.

Some corporations are already clients of these startups: Eramet, Saint-Gobain, and Andros are using Buyco and mining giant Rio Tinto called on Vizibl to optimize their road management processes. Nevertheless, procurement remains a difficult sector to change, as the processes and habits result of decades of use, and the degree of risk, legal compliance, cost of a contract are defined at this stage. However, there are signals that point towards the automatization of the most time-consuming procurement tasks in the coming years.

2 Key Figures

132 Procurement software startups

registered by Crunchbase

Procurement software market expected to reach $11.7 Bn by 2027

The procurement software market was estimated at $6.6 Bn in 2020 and is expected to reach $11.7 Bn by 2027, at a CAGR of 8.6%

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Archlet, Olive, and Shipsta

Archlet

Founded in 2018 in Switzerland, Archlet developed an intelligent sourcing platform designed to make data sourcing processes efficient and effective. The company’s platform leverages its existing data and uses guiding and intelligent software products, enabling customers to harvest the needed data to support their decision-making and negotiation process.

Olive

Olive is a Canadian startup that developed a vendor selection software designed for teams to collaborate on and streamline digital transformation. The company’s platform replaces traditional manual evaluation processes with spreadsheets, meetings, word docs and puts it all in one platform while letting vendors promote their products and buyers evaluate their options, helping companies shorten the enterprise software buying process.

Shipsta

Based in Luxembourg, Shipsta provides logistics procurement services intended to create integrated rate management and procurement application. The company’s services optimize procurement and tendering processes, and digitally link shipping agents with freight, enabling companies to efficiently automates logistics procurement processes for spot buying and contract buying.

123Fab #43

1 topic, 2 key figures, 3 startups to draw inspiration from

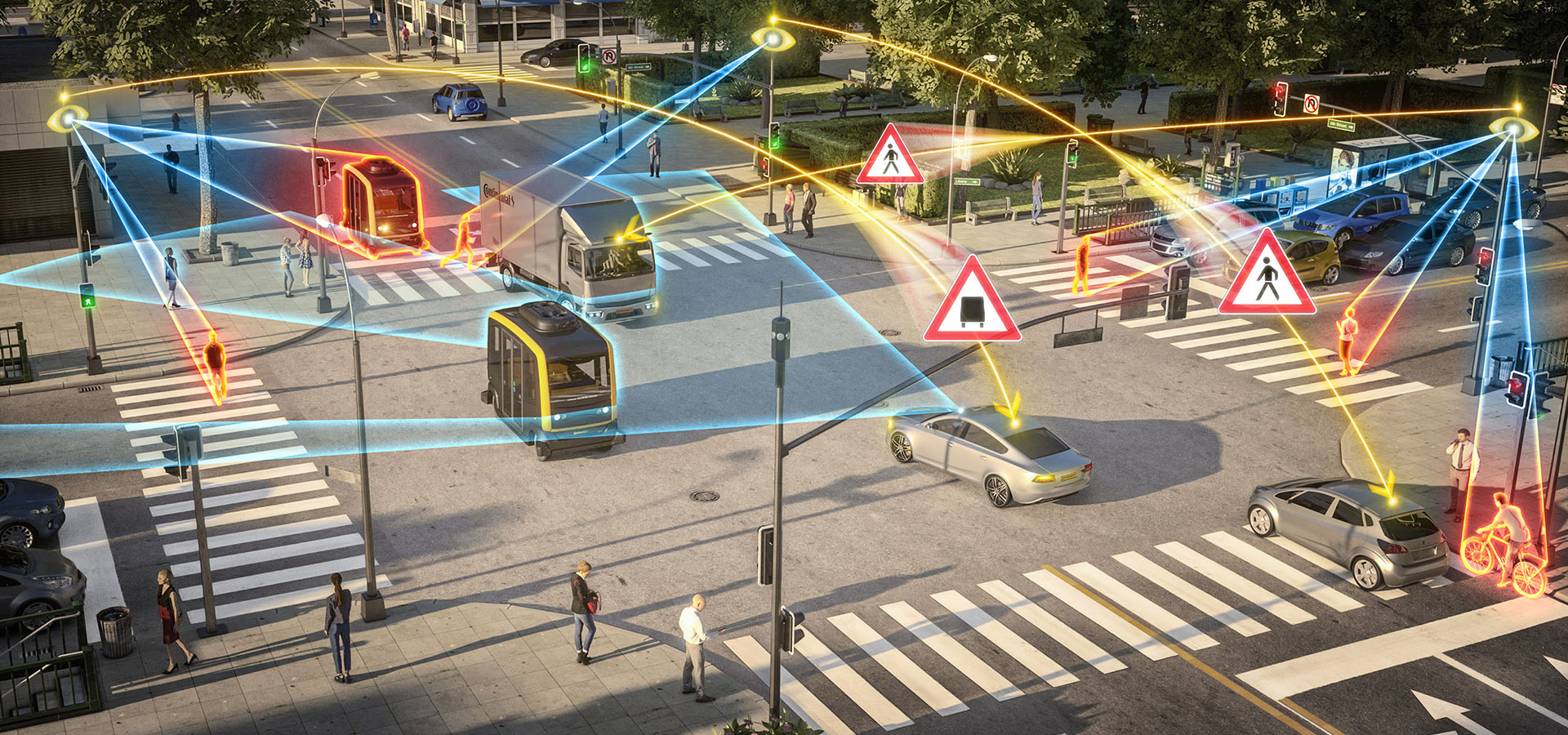

The city of Las Vegas has recently been granted permission to install and test 25 cellular-vehicle-to-everything (C-V2X) roadside units, to transition from Dedicated Short-Range Communications (DSRC) for connected vehicles, to cellular. The objective is to demonstrate the benefits of C-V2X technology, which is said to be as reliable and performant but with twice the range of DSRC. This highlights the growing presence and adoption of Vehicle-to-Everything (V2X) installations within cities. V2X refers to the transmission of information from a vehicle to any entity that may affect the vehicle and vice versa. It includes Vehicle-to-Infrastructure (V2I: data exchange between a car and equipment installed alongside roads, generally a roadside unit), Vehicle-to-Vehicle (V2V: data transfer between vehicles), Vehicle-to-Network (V2N: when a vehicle accesses the network for cloud-based services), Vehicle-to-Pedestrian (V2P), Vehicle-to-Device (V2D) and Vehicle-to-Grid (V2G: information exchange with the power grid). In this newsletter, we will focus on two key components of V2X which are V2V and V2I. The main motivations for V2X are road safety, traffic efficiency, and energy savings. Indeed, according to GSMA forecasts, by 2025, V2X could prevent 260,000 accidents (by detecting road hazards or vulnerable pedestrians and cyclists for example), save 11,000 lives, save 280 million hours of driving each year, and avoid 400,000 tonnes of CO2 emissions (for instance, with platooning, cars or trucks follow each other with short inter-vehicle distance, resulting in reduced fuel consumption and CO2 emissions).

With the advancement of V2X technologies, such as its non-line-of-sight sensing capability that allows vehicles to detect potential hazards, traffic, and road conditions, vehicles are becoming increasingly connected and are being progressively equipped to become fully autonomous. Some legacy V2I technologies are currently in operational use worldwide for relatively simple applications (e.g. for Electronic Toll Collection), while advanced V2X systems are beginning to gain widespread commercial acceptance. They rely on two underlying technologies:

- IEEE 802.11p or DSRC (Dedicated Short Range Communications): this original V2X standard is now mature and mainly used for safety use cases (such as starting to brake before a pedestrian or a hazard is visible to the driver), due to its reliability and low latency (2 ms). However, its range is rather short (less than 1 km). This technology is prevalent in North America, Japan, and Europe.

- Cellular V2X (C-V2X): this relatively new technology offers several operating modes that users can choose from, such as direct communication between vehicles or with the infrastructure and further road users (pedestrians, cyclists). For now, it is mostly used in non-safety-related use cases (vehicle operation management, traffic efficiency, etc.). While this technology has a range of 10km, it requires network support (4G/LTE/5G) and has a higher latency (1s). This technology is very present in China.

Hybrid solutions could be developed by 2030 to achieve interoperability. Startups like AutoTalks are working on such hybrid modules (capable of supporting both DSRC and C-V2X). Indeed, AutoTalks is an Israeli leader that develops fabless semiconductors for the V2X market. They address a variety of issues related to V2X communication, including communication reliability, security, positioning accuracy, and vehicle installation. AutoTalks has developed a chipset capable of supporting dedicated short-range communications (DSRC) and cellular’s C-V2X.

Many OEMs and automotive players are including V2X services into their car models. For instance, Volkswagen has premiered its all-new Golf with V2X capabilities. Car2X-signals from traffic infrastructure and information from other vehicles up to 800 meters away are notified to the driver via a display. The Golf also shares these warnings with other Car2X models. Initially focused on road safety and traffic efficiency applications, Toyota and General Motors were early adopters of IEEE 802.11p-based V2X technologies in Japan and North America. However, the momentum has lately swung in favor of C-V2X and they have expressed their willingness to invest in C-V2X technologies. This is also the path taken by Audi and Qualcomm Technologies, which are deploying a C-V2X technology pilot in Virginia. Workers wear special vests with built-in V2P technology that can alert drivers to their presence.

Besides the challenge of choosing the optimum communication bearer (DSRC, C-V2X, or hybrid), which keeps the industry and the mobile community very active, the security of V2X communication is also a key issue. The regulatory environment is the most important factor influencing the adoption of V2X technology. In China, the government has taken a stand and showcased C-V2X regulations, which should encourage automakers to position themselves quickly. In contrast, in North America and Europe, the governments and transportation ministries are struggling to bring clarity to the industry in terms of V2X, its scope and limitations.

To conclude, there is strong potential for V2X applications, the technologies exist, and it seems that the automotive industry will not wait for regulation to adopt V2X services. However, large-scale adoption will take time, due to the need to equip all infrastructures with adapted devices and the time needed for the automotive players to align on a single (or hybrid) communication technology.

2 Key Figures

433 V2X startups

registered byTracxn

Automotive V2X market expected to reach $12.9 Bn by 2028

The automotive V2X market was estimated at $689 M in 2020 and is expected to reach $12.9 Bn by 2028, at a CAGR of 44.2%.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Valerann, Commsignia, and Connected Signals

Valerann

Valerann is an Israeli start-up that develops sensor systems for installation on roads, and an associated data platform. Their smart studs, installed along the roads, can sense traffic movement, specific weather conditions, road issues and send this data to the central data centre. Combined with intended integrations with Waze, Google Maps, etc., Valerann intends to create a connected real-time traffic notifications and analytics platform.

Commsignia

Commsignia is a Hungarian start-up that develops cooperative intelligent transportation systems designed to increase traffic safety and efficiency on the road. It includes V2V and V2I communication systems that provide actionable insights pertaining to the logistics pipeline through their in-app information services, thus enabling businesses, corporate clients and logistics industry players to connect with other drivers for various road-safety programs.

Connected signals

Connected Signals (originally, Green Driver) is an American high-tech startup, focused on providing traffic signal state and predictions to drivers, automakers, and others. Knowing the current state of traffic lights and how they will change creates opportunities to increase driving safety, increase fuel efficiency, and improve the driving experience. Applications range from EnLighten, which tells drivers when the light they are stopped at will turn green, to vehicle powertrain optimisation based on the state of upcoming lights.

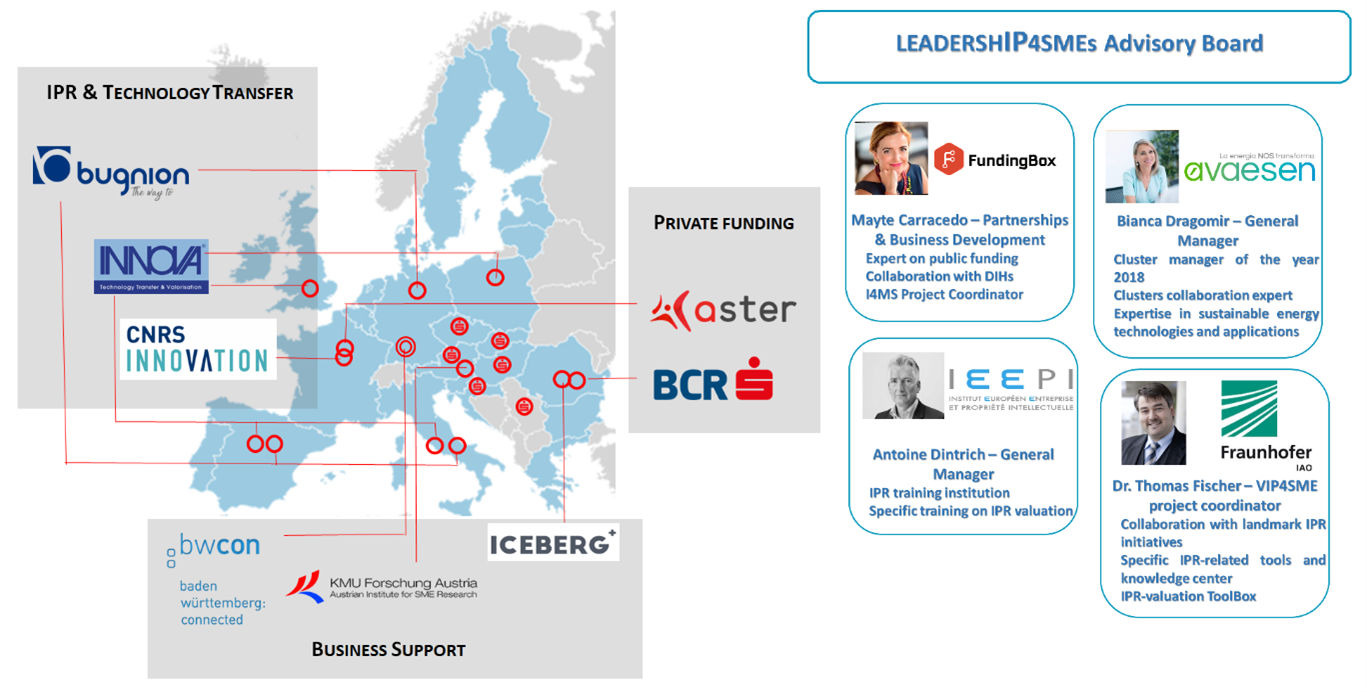

We are delighted to be part of LeadershIP4SMEs, an EU research project under H2020, which aims to help IP-centric startups & SMEs better leverage their IP assets to access adequate funding.

Intellectual property rights (IPR) can be an ignored value due to intangibility and missing ways / methods to consider it for the funding and investment of SMEs and start-ups. The EU-funded LEADERSHIP4SMEs project will support innovative SMEs and start-ups to improve and strengthen, and thus valorize their IPR, facilitating their access to adequate funding that is vital to their growth. The project will set a platform of specific tools to:

- Strategically manage and place IPR in the business model and plan to attract

funding; - To define the most value-creating business strategy;

- To better value and protect their intangible assets;

- To generate business and encourage collaborations;

- As well as to help identifying financial guarantees, at regional, national and

European level.

The platform relies on a compilation of the best practices in the domains of IPR management, business acceleration and funding that allows a better valuation of IPR and acts as an online hub of support from IPR, innovation and business support, and private and public funding and cooperation.

In addition to the implementation of this platform, a support program for startups and SMEs is being deployed, with the aim of operationally helping beneficiaries to effectively leverage their IP assets to stimulate their growth.

The LEADERSHIP4SMEs consortium is made up of 8 European partners with complementary expertise about intellectual property protection and the financing of companies with high growth potential: Aster, BCR, bwcon, Bugnion, CNRS Innovation, Iceberg, INNOVA, KMU Forschung Austria.

123Fab #42

1 topic, 2 key figures, 3 startups to draw inspiration from

Since the Paris agreement five years ago, most of the 196 signatories have taken steps to limit global warming below 2°C above pre-industrial levels. The EU has set a carbon neutrality goal by 2050 and a 55% decrease in greenhouse gas emissions by 2030 compared to 1990. Corporations across all industries are also taking action to reduce their carbon impact: from Danone’s commitment to be carbon neutral by 2050, to Carrefour’s 40% decrease in CO2 emissions by 2025 and 70% reduction by 2050 compared to 2010, to Microsoft’s goal to be carbon negative by 2030. Climate consciousness and decarbonization have gained tremendous momentum over the past decade, and customers are increasingly engaged: for a $100 product, they are willing to pay an average of $19.50 more to offset carbon emissions. Demonstrating environmental commitment is now a sine qua non condition for a leading businesses and the most impactful indicator is the quantity of CO2 equivalent released.

To assess the carbon footprint of a company, a wide variety of data is required. Emissions are segmented into 3 scopes:

- Scope 1 represents direct GHG emissions such as emissions from combustion and processes.

- Scope 2 refers to indirect emissions associated with energy consumption, the amount of GHG released to produce the electricity, heat, cold, or vapour consumed.

- Scope 3 gathers all other indirect emissions including those from the upstream and downstream value chain, transportation of persons and goods, waste, purchases of products and services, use of the sold products etc.

For each category, the emission factor (kWh used, litres of fuel consumed, kilometres travelled…) must then be translated into equivalent tons of CO2 emitted. This adds to the complexity of the process as the available data is not always in a good format or directly usable (companies can have different energy contracts in different countries, relying on a complex energy mix and an uneven contribution to energy sources depending for instance on the country’s energy policy).

This study must be carried out for each type of product at each company site, so the difficulty of gathering and translating all the data into CO2 emissions grows exponentially with the size of the company, even if all the data is available. Sometimes the necessary data is not available. For instance, a company’s carbon footprint also includes emissions from employee commuting, which requires assumptions to estimate.

The complexity and cumbersomeness of this process have led to the emergence of new tools to automate the analysis and tracking required for carbon emission accounting.

- Emission tracking: Startups such as Emitwise, Worldfavor, and Position Green have designed software and platforms that gather information from all of a company’s locations to automate sustainability reporting and track emissions. These tools give corporates a better understanding of their carbon emissions and allow them to take the most impactful actions for the environment. Other startups target specific sectors. For instance, Sustainabill focuses on tracking the environmental impact of supply chains and allows businesses to compare the sustainability ratings of their suppliers. CarbonCloud develops automated carbon footprint scoring for the food and beverage industry.

- Emission tracking and reduction: Another way to help corporates reduce their carbon footprint is to provide them with insight. Cozero has developed a platform that automates emission accounting, as well as a digital marketplace that offers low-carbon alternatives to reduce carbon emissions. Klimametrix sends its users individual action plans based on their footprint calculations to help them reduce their CO2 emissions. Planetly has built software to analyze companies’ emissions and suggest actions to reduce them, whether it’s improving production processes, switching to renewable energy or adopting greener transportation for business trips.

- Emission tracking and offsetting: Some startups help reduce carbon emissions by offsetting them, guiding corporates in financing carbon reduction projects to compensate their own emissions. Startups like ClimateSeed and Cloverly help measure your carbon footprint and select relevant carbon reduction projects. You invest in one or more projects and receive carbon credits in line with your emissions. This system allows corporates to invest in reliable and verified projects, and to receive reports on the progress of these projects.

It is more difficult for large corporates to track their emissions accurately due to their large number of inputs, locations and suppliers. In fact, most call on consulting firms to get a tailor-made solution and assessment of their emissions. Last year, Amazon invested in Pachama, a startup that offers offsetting solutions through reforestation and quantifies the carbon absorbed by planted trees. This year, Samsung partnered with Carbon Footprint Ltd to offset the carbon footprint of their washing machines and dryers over their lifetime. ERP companies have a head start on this subject, as their software already handles much of the data needed for carbon accounting. In 2019, Salesforce launched its sustainability cloud and last year SAP launched its carbon footprint analytics to meet the demand for automated carbon accounting.

In conclusion, automated emissions tracking is still an emerging topic, which makes it difficult for companies to choose a tool given the lack of differentiation between them. However, in the coming years, we expect to see an increase in investment in this area, as well as a proliferation of startups. The ones that will stand out from the rest will be those that manage to position themselves in specific and highly regulated sectors; across the entire value chain; with smooth integration within the existing IT infrastructure.

2 Key Figures

95 carbon footprint software startups

registered by Crunchbase

Carbon footprint management market expected to reach $12.2 Bn by 2025

The global carbon footprint management market was estimated at $9 Bn in 2020 and is expected to reach $12.2 Bn by 2025, at a CAGR of 6.2%.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Sustainabill, Cozero, and Cloverly.

Sustainabill

Sustainabill is a Cologne based startup,developer of supply chain management platform designed to achieve multi-tier-visibility and trace supply chains to the source. The platform analyses the entire supply chain network and source of the raw material to collects data from suppliers and sub-suppliers as well as to identify sustainability-related risks.

Cozero

Cozero developped a digital carbon action platform focused on helping companies take control of their corporate emission data. The companies platform offers tools for end-to-end carbon management, planning, emission accounting and carbon portfolio management to maintain carbon log and forecast carbon output using data analytics, thereby enabling companies to achieve carbon neutralization.

Cloverly

Cloverly’s sustainability as a service platform calculates the carbon impact of common internet activities like e-commerce shipments, rideshare and on-demand deliveries and then purchases carbon offsets to make those activities carbon-neutral, enabling buyers to view in real-time the source of the offset and through its algorithm matches customers with the closest source of renewable energy for localized impact.

123Fab #20

1 topic, 2 key figures, 3 startups to draw inspiration from

The digitization of Human Resources

The Covid-19 pandemic and the resulting lockdown period have redefined work patterns and employee behavior. With remote working becoming the new norm during lockdown, the number of remote workers has significantly increased. While 30% of employees surveyed worked remotely at least part of the time before the pandemic, Gartner analysis reveals that post-pandemic, 41% of employees are likely to work remotely at least some of the time. Other trends resulting from the current situation are also reshaping HR management, such as the increased focus on employee well-being and safety, the increase in contingent work, and the increased focus on employee engagement and productivity data.

These trends have forced HR teams to rethink corporate hiring, performance, experience, and management strategies, primarily through the adoption of integrated talent management software systems. If the digitization of HR is not something new, the pandemic has certainly accelerated a profound transformation in the way large companies convey their culture and values and ensure knowledge transfer.

The integration of digital tools into HR management has 3 main benefits for companies: 1) the automation of processes, reducing the time spent by HR teams on repetitive tasks 2) an enhanced employee experience, increasing employee satisfaction and well-being 3) the opportunity to use this freed-up time to rethink corporate HR strategies.

Covid-19 has created new business opportunities for HR tech startups that are now positioned in 4 fields:

- Digital employee onboarding, cross-boarding, and off-boarding: digital onboarding tools are a great solution to save time on administrative topics, engage employees through personalized integration journeys, and accelerate employee learning curves.

- Digital employee training and knowledge transmission: companies can transmit employee knowledge and skills through digital soft skill peer-to-peer coaching tools for white-collar workers and AR/VR training for blue-collar workers.

- Real-time employee engagement monitoring: companies can track employee performance and engagement through data processing and AI to improve productivity and employee well-being.

- Digital hiring tools, powered with AI to match candidate profiles and shortlist resumes based on the required skills, roles, and expertise level.

The integration of Artificial Intelligence into HR processes appears promising, especially to hire, engage, and retain candidates and employees. Yet, the technology has not reached its full potential and effective applications are still very limited: AI algorithms are still struggling to effectively match human skills to job descriptions because they do not fully capture and understand the human parameters and specifics of hiring standards.

2 Key Figures

1,549 HR tech startups

in the world, according to AngelList

Market size expected to reach $10bn by 2022

According to Markets and Markets, the global HR software market size was valued at $6.5bn in 2017 and is expected to reach $10bn by 2022.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Carbon Clean, Woodoo and Kenoteq.

365talents

365talents is a French startup that develops an artificial intelligence SaaS solution for HR management including strategic workforce planning, internal talent marketplace and upskilling.

Skillup

Skillup is considered as the new Tripadvisor for professional training hosting over 20k training sessions, aiming to help HR services to find the adequate training for employees.

Zapitc

Based in the UK, Zaptic is a startup that creates a connected worker platform providing job instructions for frontline operation teams.

123Fab #18

1 topic, 2 key figures, 3 startups to draw inspiration from

Green Hydrogen – Water Electrolysis for a greener future

Hydrogen (H2), alongside renewables and natural gas, could play a key role in the energy transition by fostering the decarbonization of industries, with the versatility to provide mobility, power systems, heat and industrial services. Substituting polluting fossil fuels with hydrogen — which emits water only when burned – could significantly reduce greenhouse gas emissions and stave off climate change.

Although hydrogen is a very low-carbon energy, it does not exist naturally on earth and is mainly produced from a range of more or less environmentally friendly chemical sources and processes. There are commonly three types of hydrogen: grey, blue and green.

- Grey hydrogen is produced by chemical reactions – steam methane reforming and coal gasification – and by the use of carbon-intensive fossil fuels (natural gas, oil and coal).

- Blue hydrogen is produced the same way as grey hydrogen, but the main difference is that it has a lower carbon footprint. This is because hydrogen uses carbon capture technologies that prevent the release of CO2 and allow the captured carbon to be stored and reused in industrial processes. Blue hydrogen is more expensive than grey hydrogen.

- Green hydrogen is produced by the electrolysis of water, which uses an electric current to break apart water molecules (H2O) into hydrogen (H2) and oxygen (O2). If the electrolysis is realized using renewable electricity (solar PV or offshore wind turbines), the resulting hydrogen is the cleanest variety, producing zero carbon emissions.

The global hydrogen production is dominated by grey hydrogen: according to the International Energy Agency (IEA), 96% of the hydrogen manufactured in the world is “grey”, while less than 0.1% is produced by water electrolysis. This is mainly due to the lower price of grey hydrogen production compared to blue and green hydrogen. The IEA estimates the price of grey hydrogen at around €1.50 per kilo – the main cause being the price of fossil fuels – and between €3.50 and €5 per kilo for green hydrogen. The three most critical factors for the high cost of green hydrogen are 1) the limited and costly capacity of electrolysis at the moment, 2) the high price of green electricity used in the electrolysis process and 3) the costs for safe and clean transportation.

The widespread adoption of green hydrogen remains extremely slow, but the future of clean H2 could be bright. Major players are taking action to stimulate R&D around green hydrogen production, transportation and industrial applications. The European Commission, for instance, strongly believes in the prospective use of green hydrogen to decarbonize heavy industries and transportation, as demonstrated by the adoption of the European Green Deal in January 2020 to support innovation in clean hydrogen and low-carbon resources. The Covid-19 crisis has introduced a new impetus: France and Germany plan to collaborate and invest €7bn and €9bn respectively in green hydrogen R&D projects. Large corporate companies, including Shell, Airbus and Chevron, are also seizing the opportunity to invest in clean hydrogen technologies and applications.

The market is still extremely young, and there is still room for progress. Startups are positioning themselves either in the improvement of hydrogen storage, transportation and distribution, or in the development of new applications (fuel cells for vehicles, industrial use cases), or in the development of new alternatives for H2 production and electrolysis methods (such as alkaline, Polymer electrolyte membrane (PEM) or solid oxide electrolysis)

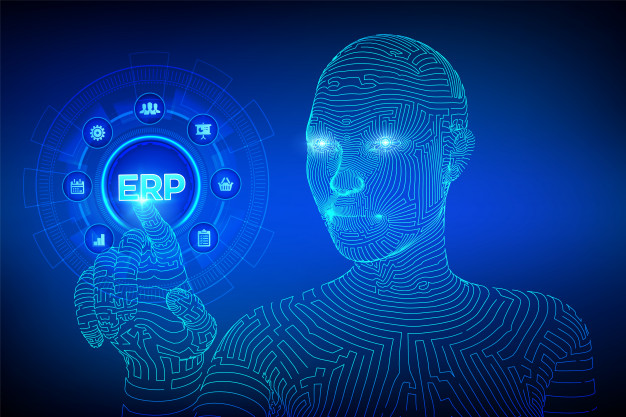

Process mining, neo-ERPs… – How can Artificial Intelligence power the next level of enterprise process automation?

IT Enterprise process automation is not something new: it began in the 1960s with the automation of white-collar work made possible by the invention of computers. Since then, the global adoption of digital technologies has transformed business process management through the integration of ERP (Enterprise Resource Planning) and other applications, but has stagnated at the basic level of screen scraping and data collection.

Enterprise automation now refers to any technology by which a manual process or procedure is performed with minimal assistance – the goal being to optimize the level of human interaction by making machines perform the repetitive manual tasks. Automatable tasks and processes exist across all business functions (Sales, Logistics, Accounting, etc.) with different levels of complexity and power of automation. Some repetitive and rule-based tasks require only basic automation while more complex and interactive tasks require AI-powered automation.

In fact, the most advanced Robotic Process Automation (RPA) systems can only automate repetitive tasks, that account for 10% to 20% of business processes. The increasing advances of Artificial Intelligence (machine learning and deep learning systems, Natural Language Processing, image analysis and predictive analytics), Internet of Things and Blockchain could take automation to the next level by creating new possibilities and benefits for enterprise automation: a next generation of neo-ERP players is emerging, challenging traditional players.

Those challengers focus on providing three types of services:

- Detecting automatable processes with digital twins and process mining tools: companies need to understand their underlying processes in order to optimize them and find opportunities to improve efficiency. In particular, process mining tools could identify trends and patterns to analyze process optimization performances.

- Automating business processes with cognitive automation tools: every company collects a large volume of raw data that needs to be structured into actionable information to be relevant. Cognitive automation tools could bring a high level of automation with better KPIs across the different business functions.

- Integrating with workflow automation solutions, which includes all automated processes in the different business functions. Integration solutions (iPaaS or cloud-based integration softwares) are particularly interesting for companies that do not wish to build in-house tools.

Enterprise automation looks promising on paper. Yet, the transition remains bumpy as integrated automation applications are still expensive and difficult to implement – it could take several years before complex automation tools are fully adopted. In particular, the emerging adoption of full automation in SaaS (at the expense of on-premise softwares) is questionable in terms of financial management (subscription based models) and cybersecurity. It is essential to balance the need for increased process management and the impact of full SaaS on the enterprise’s IT environment.

Nevertheless, the Covid-19 outbreak has urged corporates to adopt digital tools to enable business continuity and remote work. According to Appdynamics, 81% of IT leaders state that Covid-19 has created the greatest technology pressure their organization has ever faced. For this reason, the current situation could first trigger the adoption of detection tools (process mining and digital twins), that could lead to more automation.

2 Key Figures

255 process automation startups

in the world, according to Startup Insights

Market size expected to reach $12.6bn by 2023

According to Markets and Markets, the global digital process automation market size was valued at $6.8bn in 2018 and is expected to reach $12.6bn by 2023.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Logpickr, Hypatos & Celigo.

Logpickr

Logpickr is a French startup that combines Process Mining with Artificial intelligence to provide smart business process analysis and optimization.

Hypatus

Hypatos is a German process automation startup that applies natural language processing and deep learning to speed up document processing for financial functions.

Celigo

Based in the US, Celigo creates an iPaaS integration platform that allows cloud-based applications to work together both for IT and business users.

123Fab #16

1 topic, 2 key figures, 3 startups to draw inspiration from

NLP and NLU : from understanding to processing natural language

The increase in smart devices usage in all areas and industries, resulting in the rise of artificial intelligence and cloud-based solutions, have driven the progress and adoption in Natural Language Processing (NLP) technologies.

Natural Language Processing is a branch of artificial intelligence that uses machine learning algorithms to interpret and use spoken and written human language. These AI algorithms are able to analyze the utterance syntax and semantics to determine the meaning of human communications, and consequently allow to provide appropriate and comprehensive answers.

Some NLP algorithms only focus on determining what is literally said, which implies converting conversational text into structured data, but others are more sophisticated and powered with Natural Language Understanding (NLU). NLU is a major sub-topic of NLP that allows computing machines to understand the human language in all its complexity: besides semantic and syntax analysis, NLU involves a pragmatic analysis that enables machines to detect intent and sentiments in human utterances and some NLU solutions integrate noise analysis to better understand the context in which the text is captured. The powerful feature of reasoning and adaptive learning developed with NLU makes it possible for machines to determine precisely what the user is trying to achieve through each request, provide a complex answer and follow-up.

For instance, if my request is “I would like to book a flight from San Francisco to Paris on December 1st, 2020.”. The program will understand that my objective is to book a plane ticket from one location to another, with 3 query conditions: place of departure, place of arrival and date. The result should be a list of flights meeting the criteria. I could narrow the search by asking “Do you know if there is any direct flight with AirFrance?” to which the program should answer: “There is one direct flight with AirFrance from San Francisco to Paris departing at 3:15 and the lowest flight fare is €576.” To conclude, NLU algorithms are able to deal with several queries at the same time, but also engage in real and complex conversational back and forth with the users (which is usually very limited with current voice assistants and chatbots).

NLP and NLU technologies are developing rapidly thanks to the increasing awareness about the advantages and benefits of human-to-machine communication and sentiment analysis in several sectors, including healthcare, industry, mobility and customer services. Yet, real-life applications remain very limited: AI algorithms are still facing difficulties in fully capturing and understanding human languages. The technology has not fully reached its expected potential, but the market is already very dense with large companies and emerging startups competing to develop the most viable and effective NLP solution.

2 Key Figures

398 NLP startups

received funding for a total amount of $3.3bn according to a Crunchbase query.

Market size expected to reach $26.4bn by 2024

According to Markets and Markets, the global Natural Language Processing market size was valued at $10.2bn in 2019 and is expected to reach $26.4bn by 2024.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Inbenta, Agamon, Logically.

Inbenta

Inbenta is a US-based startup that provides a comprehensive automated customer service solution powered by AI, machine learning and NLP.

Agamon

Based in the US, Agamon develops an AI-powered healthcare platform that converts clinical text into structured data, by using an advanced approach to NLU.

Logically

Logically is a UK-based startup that raised £2.5M in July 2020 to develop NLP technologies to fight against misinformation from fake news to state propaganda.

123Fab #10

1 topic, 2 key figures, 3 startups to draw inspiration from

How to effectively manage large projects in the digital era

Over the past two decades, companies and industries have had to deal with unprecedented and accelerating dynamics. The rise of digital technologies and the Internet has brought about radical changes for organizations, forcing them to adapt slowly and transform their working methods and tools into a new digital fluid space for communication, creation, information processing and knowledge sharing. The COVID-19 pandemic has emphasized and accelerated this digital transition.

Digital transformation has fundamentally changed the way large companies and industries manage their projects, sustain their knowledge base and deliver value to their customers. Fully embracing the integration of web-based technologies, traditional project management has been replaced by a more digital and agile generation known as project management 2.0 (PM2).

Project management 2.0 implies the adoption and use of IT tools to monitor a large array of aspects of large complex projects to increase team performance, gain a more complete view of the project and ensure its success. In particular, data management processes, integrated with project management softwares, have been a real game changer to maximize project productivity and time management.

Digital technologies have helped redefine a more efficient approach to project management, through the development of strategic software. Key softwares for PM2 are:

- Collaborative communication tools: the use of collaborative work environment software enables a more effective cross-team communication and coordination by allowing all team members to connect, interact and organize their work while tracking the project progress in real-time.

- Document management softwares, allowing team members and co-workers to share documents on the cloud to ensure that all participants have the same level of knowledge, develop collective intelligence and capitalize on their expertise.

- Computer Aided Design and Computer Aided Manufacturing, which enables virtual models to be designed, optimized and tested while sharing information with team members. This type of software improves communication throughout the modelling process, but also to creates a useful database for manufacturing.

- Automated project management softwares, powered by artificial intelligence, use all the data generated during the project to improve planning, predictive scheduling and cost management, because managing time, resources and progress is key to get the best outcomes.

- Safety and Risk Management softwares, which also use artificial intelligence to prevent and manage risks during the project.

These analytical technologies allow project managers to have time to focus on strategy optimization and project delivery rather than on project processes and coordination.

Consequently, project management softwares are becoming crucial and strategic tools for businesses and industries, which explains the increase of innovative players on the market, both in terms of technology and business models. The market is very dense due to the presence of many startups and large corporations, but emerging startups are making their mark by developing innovative technologies and striving to become more engaged with customer while optimizing the project management processes.

2 Key Figures

97 project management startups

received early-stage in the past two years

Market size expected to reach $6.7bn by 2026

According to GlobeNewswire, Global online project management software market is expected to reach $6.68bn by 2026, due to the increasing adoption of cloud-based solutions.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Wizzcad, Sharktower AI and Sitetracker.

Wizzcad

Wizzcad is a French startup providing a BIM (Building Information Modeling) based SaaS platform for digital transformation of construction projects, from design to operations and maintenance.

Sharktower AI

Sharktower AI is a UK-based startup developing a data and AI software to transform how businesses deliver change by providing portfolio insights visualization, predictive analytics and decision-making without bias.

Sitetracker

Sitetracker is a US startup which raised $10 million to develop a cloud-based project management platform that powers successful deployment of critical infrastructure.