Vertical take-off and landing (VTOL) projects are spurring around the world. According to Oliver Wyman, there are an estimated 170 projects for flying taxis or VTOL aircraft worldwide. This futuristic scenario is getting closer, with Airbus, ADP and RATP announcing vertical take-off flying taxis for the 2024 Paris Olympics.

VTOLs are historically military aircraft designed to bypass the runways normally required for take-off and landing. The term VTOL or eVTOL is now being used to describe the flying taxi projects that are emerging. These aircraft are now possible thanks to new multi-rotor designs ranging from four to eight or even sixteen propellers (both safer because they are redundant and much quieter), advances in pilot automation and progress in electricity storage via lithium-Ion batteries, for example.

The advantages of these vehicles are interesting from an environmental point of view: less air pollution, less noise pollution, less road congestion and speed. However, the prohibitive cost of travel will probably not allow the general public to use these vehicles in the coming years, which is unlikely to drastically reduce road congestion and air pollution in cities. The limited space in the vehicles may explain this high price and is in opposition to the ecological model of a more decarbonized public transport. In addition, the manufacture of these devices, as well as their propulsion method (lithium-ion batteries or hydrogen for the cleanest) raises questions about their lifespan and their real carbon footprint.

The relatively high cost of these technologies requires the deployment of a service that allows the cost to be spread over several people, hence the boom in the flying taxi market or in delivery-related applications. Strict airspace regulations also make it more realistic for dedicated air corridors to be operated by clearly defined companies. Other companies are also targeting longer regional or intercity air travel, relying on hybrid engines.

The market is booming and is coveted by the aeronautics giants. Last September, Airbus unveiled plans for the new, fully electric CityAirbus, equipped with fixed wings, a V-shaped tail, and eight electrically powered propellers. It is designed to carry up to four passengers on a zero-emission flight with multiple applications. Its first flight is scheduled for 2023. Boeing has entered into a joint venture with Kitty Hawk to develop a startup, Wisk, described as an Urban Air Mobility (UAM) company. Last year it signed its first contract to operate air taxis in the US. Car manufacturers are also very active in the market. Hyundai has developed a vehicle called the S-A1 in collaboration with Uber. It can accommodate four passengers plus a driver, although Hyundai plans to operate the S-A1 autonomously in the future. Toyota has filed a patent for a “dual-mode” car that can be converted from a road-legal passenger car to a light aircraft.

On the startup side, fundraising is on the rise. Last year, German startup Volocopter closed a $241 million Series D fundraising round to certify its two-seat, piloted VoloCity aircraft and launch commercial air taxi services within the next two years. The company obtained the first European certification for test flights in a restricted area. The French startup Ascendance Flight Technologies raised €10 million in September 2021 and is banking on hybrid technology to launch its helicopter alternative within four years. Its aircraft are instead designed to operate in peri-urban areas and inland regions. Elroy Air is a Silicon Valley startup that is developing autonomous cargo aircraft systems to massively extend the reach of express transport. The company is developing the Chaparral, a VTOL air cargo platform. The first version of the Chaparral will carry 300 to 500 pounds of cargo over a 300 mile-range with its hybrid-electric powertrain and simple, redundant lift and forward motors. The vehicle can land, drop a load, pick up another load and take off again, all within minutes and without operator intervention.

Finally, although there is a lot of hype around VTOLs and that they become a reality, they face many challenges, such as high costs and environmental impact. It seems too early to imagine a science fiction landscape or mainstream use. The advent of VTOL drones – particularly for delivery operations – seems more relevant and likely to develop in the coming years.

2 Key Figures

By 2035, the flying taxi market could be worth $35 billion

With 40,000 to 60,000 flying machines in 60 to 90 cities – Challenges

1,6B+ in investments for VTOL

with 70+ companies registered by Tracxn

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Volocopter, Ascendance Flight Technologies and Elroy Air.

Volocopter

The German startup develops electrical vertical take-off and landing multicopters designed to transport people safely. The company’s engines can fly completely autonomously or be easily operated using a joystick and assistive systems for support, enabling users to travel by air.

Its urban air taxi, Volocity, has 2 seats, 18 rotors and is fully electric. The company has developed another model, VoloConnect, for longer distances, which can carry up to four passengers for 100 km. It is equipped with two propulsion fans plus six electrical motors and rotors.

Ascendance Flight Technologies

The French startup is a manufacturer of hybrid-powered aircraft systems designed to change the way people move around cities. The company’s systems are able to blend into existing infrastructures and regulations to ease its deployment and maximize social acceptance.

The startup has developed the Altea VTOL aircraft, capable of carrying 4 passengers on regional or intercity routes of up to 2 hours and over 400km. It has 8 rotors integrated in two fixed wings, 2 horizontal propellers and a hybrid-electric propulsion system.

Elroy Air

The startup develops automated drones and aircraft designed to aid in defense and logistics sectors. They use a combination of light detection and ranging, radar, cameras, and air-traffic management software to enable clients to benefit from express shipping and rapid autonomous aerial resupply to troops in the field.

Elroy Air has developed the Chaparral, a VTOL aerial cargo platform. It will be able to carry 300-500lbs of cargo over a 300-mile range thanks to its hybrid electric engine and six vertical rotors. It has a robust set of applications in national defence.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #71

1 topic, 2 key figures, 3 startups to draw inspiration from

On October 28, 2021, Facebook Inc. announced the new name of its parent company: Meta. The message is strong and demonstrates the group’s strategic shift towards the 3D universe, and particularly the metaverse. The latter is a combination of multiple elements of technology, including virtual reality and augmented reality where users “engage” within a digital universe. The concept behind the metaverse is the introduction of new online environments whereby interactions between people are highly multidimensional, wherein they can immerse more interactively with digital content instead of just receiving information. For Meta, this world promises more social contact without going anywhere, whether it’s organizing a business meeting, attending a fitness class or strolling through a pixel shop.

There are several factors that explain why the metaverse is back in the spotlight. First of all, the Covid-19 epidemic and the lockdowns have greatly accelerated the digitization of our societies (zoom meetings, aperitifs or even online museum visits…) and the emergence of virtual communities as major living spaces, including interactive gaming landscapes as well as increasing adoption of mixed reality. Also from a technical point of view, digital infrastructures are becoming more and more powerful, the boom in virtual reality is becoming real and the development of 5g promises unprecedented speeds.

The race to the metaverse is therefore on and the competition is fierce. The uses are also numerous. Microsoft, for example, intends to create an “enterprise metaverse”. Its Mesh mixed reality collaboration platform, designed for Teams among other things, will begin previewing in 2022 with a set of pre-built immersive spaces for things like meetings and social gatherings. The company also specializes in the design of digital twins. Epic Games, the world of the popular game Fortnite, which raised $1 billion this year, is already hosting virtual mini-concerts with 12 million viewers. Regarding video games, one of the leaders remains Roblox, a free-to-play software that allows any user to create games and sell them. In this system of play and creation, one in five players will change their avatar every day, just as a person gets up and gets dressed every morning. Thus, the metaverse also offers luxury brands the opportunity to take advantage of digital collectibles and the rise of ‘social gaming’. Several brands, such as Gucci and Lagerfeld, have already held virtual exhibitions and digital model sales. Thanks to NFTs, linked to the blockchain, transactions are encrypted, secure and the items sold are unique, thus preserving their value.

The potential of the metaverse is therefore very large and major groups are not hesitating to join forces with the most successful startups in the field to get ahead. This is the case, for example, of Nike, which has announced the acquisition of RTFKT, a startup specialized in the creation of digital fashion objects for the metaverse. Whether it is in the development of new uses or new technical tools, startups are very active in this field. For example, Stockholm-based startup Gleechi, which launched in 2014, has developed a technology called VirtualGrasp, which enables a more natural hand interaction in virtual reality. It has partnerships with companies such as Siemens Energy, Scania and Saab Aeronautics to develop virtual training programmes. Another startup, Scapin’, based in Stockholm, is developing a mobile social communication platform that allows anyone to create personalized virtual spaces, either to connect with friends or to offer experiences to an audience.

On the basis of end-use, the global metaverse market is segmented into fashion, media & entertainment, education, aerospace & defense, and others. The media and entertainment segment is expected to account for the largest share of the global metaverse market over the next ten years, owing to the growth of the gaming industry worldwide. Although the metaverse is not yet well developed in the service of industry, its ability to deepen the digital continuity of companies, i.e. the digital availability of all product information throughout their life cycle, could also radically change the sector. Thanks to augmented reality but also to blockchain, which allows data to be authenticated and traced, the metaverse could be a real-time access point to all the information needed to manage production sites.

In short, the metaverse is not simply a new technological innovation, but rather a new technological paradigm that allows all the technologies that make up tomorrow’s digital world to converge: augmented reality, virtual reality, blockchain, NFT, etc. By enabling companies to develop their digital continuity at both the production and consumption levels, the metaverse provides them with a digital backbone that is destined to become indispensable in many sectors. However, concerns about data privacy and security in metaverse environments, user identity issues, and difficulties in convincing users to use payment systems in these environments are some of the key factors that are expected to hamper metaverse growth.

2 Key Figures

The metaverse revenue is expected to reach $828.95 bn by 2028

The global metaverse market size reached $47 bn in 2020 and is expected to register a revenue CAGR of 43.3% during the period 2020-2028 – Emergen Research

+1,300 funded companies in virtual reality

registered by Tracxn

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Gleechi, Powder and Scapin’.

Gleechi

The startup is specialized in developing software that makes it easy to animate realistic hand movement and interaction in games and virtual reality.

Powder

The French startup Powder aims to be a “metaverse camera”. It uses video recording and artificial intelligence to automatically detect and capture players’ highlights and share them with other players on the network.

Scapin’

The Stockholm-based startup has developed a mobile social communication platform that allows anyone to create personalised virtual spaces, either to connect with friends or to offer experiences to an audience.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #70

1 topic, 2 key figures, 3 startups to draw inspiration from

As the world is looking for solutions to curb CO2 emissions and mitigate climate change, Carbon Capture, Utilization and Storage (CCUS) technologies have raised hope, especially for heavy emitters in the Oil & Gas or manufacturing sectors. The principle is simple: CO2 produced when burning fossil fuel is captured before it enters the atmosphere, and either safely stored or used as feedstock to make other products. The major obstacle regarding this technology is its cost. The capture step itself is costly, both financially and energetically, especially for low CO2 concentration flows. For carbon storage, the captured CO2 needs to be compressed and shipped to its destination and stored. All of these steps are also costly and energy-intensive, resulting in relatively low adoption. Carbon reuse solutions attempt to reduce the overall cost of the process by using CO2 to produce valuable products that can be sold.

There are a wide variety of solutions to valorize captured CO2: from producing carbon fibers using algae to producing building materials such as cement, concrete, or insulation foam, the possibilities are numerous. One utilization scheme seems to have caught the attention of investors and entrepreneurs: the production of carbon-neutral fuel using CO2.

Some startups are focusing on reducing emissions in the transportation sector by producing an alternative fuel from captured CO2. Caphenia produces jet fuel using CO2 and methane as feedstock through a plasma process. Their process could reduce CO2 emissions by 92% compared to fossil fuel consumption. Other startups like Nordic Electrofuel produce it using CO2 and hydrogen produced from water electrolysis using renewable electricity. CERT systems has developed catalysts for electrodes used in electrolyzers to enhance the conversion rate of their CO2 to fuel electrochemical conversion technology.

Methanol is also an attractive alternative fuel that can be used to power cars and ships. Liquid wind and Carbon Recycling International are using CO2 and hydrogen to produce renewable methanol for maritime and road transport. Methanol has been proven to be a viable fuel for ships, and if mixed with petrol, it could also be used for cars, reducing the footprint of road transport as well. In addition, it is a widely used feedstock for the production of plastics, plywood, and synthetic fibers. The use of renewable methanol could also reduce emissions from the chemical industry.

CO2-based fuels are attracting the attention of large companies and partnerships are booming. Last month, Eramet signed a partnership agreement with Nordic Electrofuel to use the CO2 produced in Eramet’s furnace to produce kerosene. Carbon Recycling International joined forces with Johnson Matthey for catalyst supply in CRI’s methanol plants. Earlier this year, Siemens Energy partnered with Liquid Wind. Siemens will provide large electrolyzers that will produce hydrogen for liquid wind’s process.

While alternative fuels seem to be a good solution for decarbonizing the transportation industry, they have one major drawback: all these processes are very energy-intensive. Hydrogen production, which is mostly done through water electrolysis, and plasma technology both consume large amounts of electricity. These processes could use renewable energy, but it is not easy to fund such a large amount and, depending on the energy mix of the available electricity, the ecological impact varies greatly by location. These costs add to the CO2 capture cost, as the removal of CO2 from air or flue gas is very energy-intensive, lowering the ecological benefits of the process. More than that, when this fuel will be consumed, the captured CO2 is released into the atmosphere. The ecological outcome is not strictly zero as the CO2 produced in the first place is eventually released, it simply adds another step in the CO2 use cycle. Although alternative fuels appear to be crucial for lowering emissions of the transportation sector, captured industrial emissions remain untouched by the process, and reducing the number of travels remains the most efficient way to cut down emissions in the transport industry.

2 Key Figures

The global CCUS market is expected to reach $2.97 bn by 2025

The global CCUS market was estimated at $1.3 billion in 2020 and is expected to reach $2.97 billion by 2025, at a CAGR of 19.6% according to PR Newswire

20+ CO2 to fuel startups

registered by Tracxn since 2015

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Nordic Electrofuel, CERT systems and Carbon Recycling International.

Nordic Electrofuel

Producer of carbon-neutral, synthetic fuels and other fossil replacement products intended to offer renewable electrical energy to the transport sector. The company specializes in generating synthetic gas by separating CO and H2 gas through electrolysis and offers solutions to distribute and store stranded electrical energy and the conversion of renewable electric energy into liquid e-fuels.

CERT Systems

CERT Systems is a Toronto-based startup that develop a CO2 utilization system intended to catalyze the closure of the carbon cycle. The company’s system utilizes membrane electrode assembly (MEA) electrochemical cells and converts carbon dioxide into renewable fuels and chemical feedstocks using only water and electricity.

Carbon Recycling International

Carbon Recycling International produce renewable methanol intended to enhance resource efficiency by carbon recycling. Their renewable methanol is produced from carbon dioxide, hydrogen and electricity for energy storage, fuel applications and efficiency enhancement.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #67

1 topic, 2 key figures, 3 startups to draw inspiration from

Within weeks, in January 2021, the 215 million euros allocated to the conversion of agricultural equipment in France were distributed by the government as part of the 2020-2022 stimulus plan. This measure, implemented in early 2021 following the COVID19 crisis, consisted of investment assistance for the replacement of old and inefficient equipment and the acquisition of environmentally efficient equipment. Indeed, agriculture is one of the world’s biggest greenhouse gas contributors. The sector is projected to account for about 20% of total global emissions in the next 20 years (Reuters). According to a McKinsey report, of the 25 measures identified to reduce emissions, replacing tractors and combine harvesters that use fossil fuels with lower-emission vehicles would have the biggest impact, although no vehicles are commercially available now on the market. From a more global perspective, electrification is truly underway. Fully electric cars now account for 7.5% of new sales in Europe, and truck manufacturers are also moving towards sustainable mobility.

Despite the lag in the electrification of agricultural machinery, particularly the heavier ones, the seeds are sown for the electrification of farming vehicles and multiple companies already have been working on electric-powered prototypes. According to IDTechEx, the market for electric vehicles in the construction, agriculture and mining sectors could reach $149 billion in 2030. John Deere, an industry leader, has proposed a conceptual model of electric tractors that could allow autonomous operation, increasing efficiency and accuracy. Cable power could even eliminate the need for onboard batteries, so an electric version would not weigh more than its fossil-fueled counterpart. Japanese company Kubota also presented models that allow for autonomous operation and can adjust to the height in the field. The company’s concept tractor was also equipped with an onboard solar battery. California-based Solectrac already offers small tractors and agricultural utility vehicles in the 30 and 40 horsepower range. Other relatively small tractor options are offered by Fendt, Rigitrac, Escorts and others. At the same time, almost all aerial drones are electric. Research is focusing on small electric ground-based autonomous vehicles, such as robots that sense the plant environment. They could be particularly helpful for family farms in developing regions that still use non-mechanized methods for agriculture.

Some startups are also tackling this market and fundraising is on the rise. Silicon Valley-based company Monarch Tractor, which creates electric robotic tractors to make farming safer and more sustainable, raised $20 million in March as it prepares to start deliveries. The startup calls its tractor “driver optional” as it can perform programmed tasks without a driver. It is designed with roll and collision prevention and can collect and analyze data. Startup Blue White Robotics, which notably retrofits traditional tractors into fully autonomous vehicles by adding sensors and AI models, has raised $37 million in Series B funding a month ago. In the last 2 years, $1.5 billion has been funded in AI for the agriculture sector according to Tracxn. At the beginning of October, startup Sabi Agri, which develops electric agricultural equipment for agro-ecology, was named a winning company in the EIC (European Innovation Council) Accelerator program. It creates lightweight autonomous tractors that avoid degradation and compaction of cultivated soil and reduce emissions. Autonomous robots and tractors are booming, and the challenges of electrification are being met little by little by large groups as well as startups.

But there is a big step to take from prototypes and limited applications to widespread adoption. Electric engines face major logistical challenges, particularly with regard to charging, replacing diesel-burning machines in the field. Indeed, the use of agricultural machines is not very regular but requires great autonomy, they are often used a few weeks per year (16 days in average) but with durations that can go up to 15 hours per day. Planting time is limited, and the efficiency of the machines is therefore essential. Machine weight is also crucial to avoid soil compaction and Wi-Fi connectivity is an additional challenge for all onboard AI mechanisms. Beyond the technical constraints, an agricultural machine is expensive, machinery capital amounts to approximately 11% of farm income on average, and the frequency of fleet renewal does not allow for a generalized adoption as quickly as for utility vehicles. That is why niche areas for smaller electric machines and robotic equipment could probably expand more quickly because they have fewer constraints.

Agriculture today faces many mobility challenges. A balance must be struck to serve the goal of increasing yields and productivity while reducing emissions and managing land more sustainably. Beyond the modernization of machines, the development of AI, especially embedded, can contribute to this objective by providing more real-time data analysis, facilitating farmers’ decision-making and thus improving machine action.

2 Key Figures

The global agricultural machinery market is anticipated to reach $194.94 billion by 2026, registering a CAGR of 5.4% between 2020 and 2026

The market was valued at $138.59 billion in 2020 – Mordor Intelligence

+300 funded companies in AI for Agriculture

Tracxn – 2021

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Blue White Robotics, Sabi Agri and Monarch Tractor.

Blue White Robotics

The startup has developed a robot-as-a-service platform intended to deliver remote control capabilities for land and air autonomous robots. The platform transforms existing fleets, manages both air and ground robots, and collects data seamlessly, thereby enabling businesses to improve efficiency and provide actionable insights.

Sabi Agri

The startup has developed electric agricultural equipment for agro-ecology. The light autonomous tractors will be able to replace all thermal tractors, regardless of their power in multiple agricultural projects (viticulture, field crops, breeding…). They enable farmers to incorporate cost-effective agro-ecological farming practices.

Monarch

The startup has developed electric tractors intended to make the transition to productive and sustainable farming practices. The company’s tractors run on artificial intelligence and are equipped with sensors and 360° cameras to implement, identify and eliminate plant ailments and estimate yields, enabling farmers to enhance the existing growing operations.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #66

1 topic, 2 key figures, 3 startups to draw inspiration from

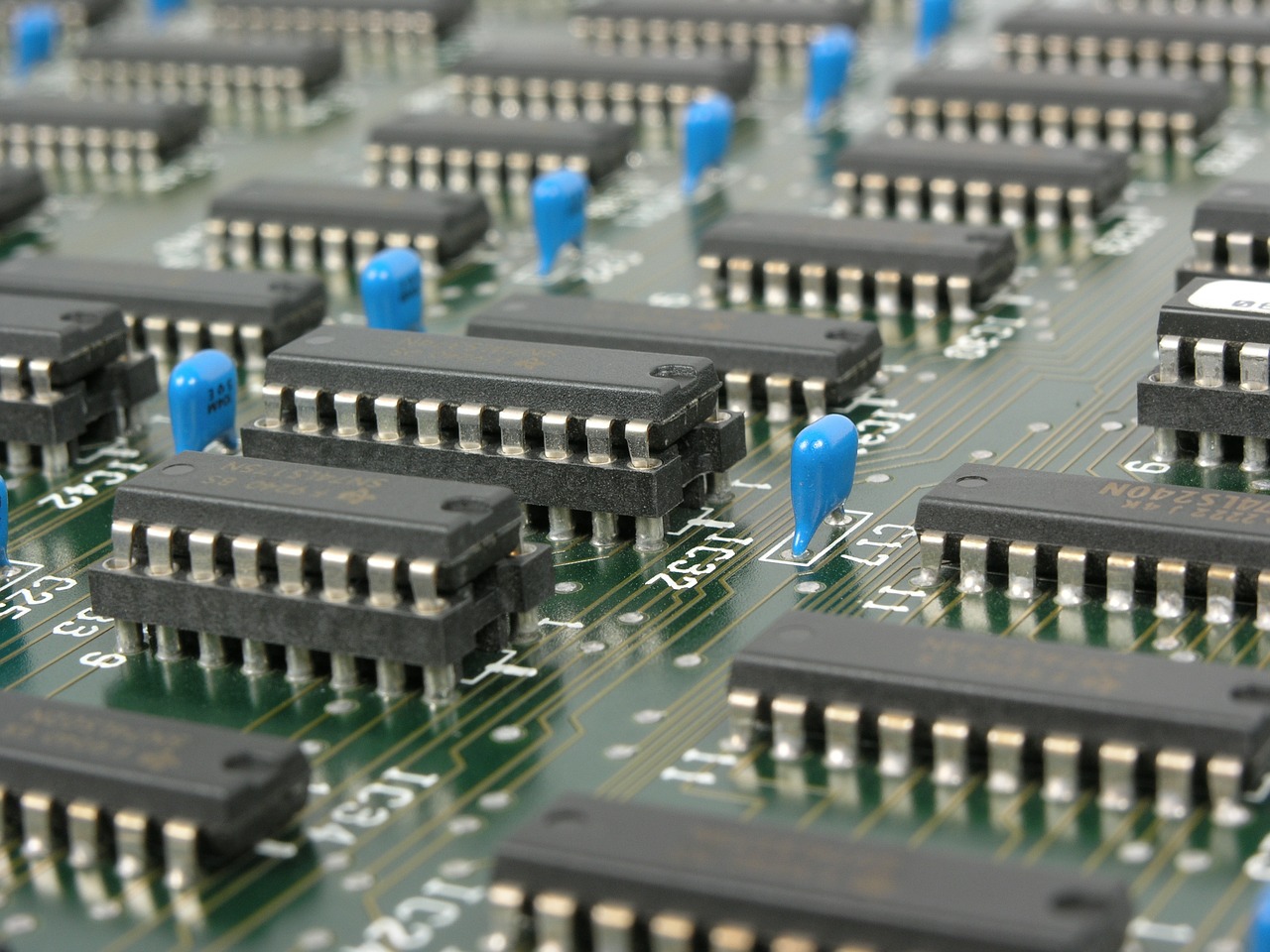

German technology group Bosch announced a few days ago that it would invest more than 400 million euros in microchip production in Germany and Malaysia next year. Similarly, Intel, the largest maker of processor chips for PCs and data centers, said last month that it could invest up to 80 billion euros in Europe over the next decade. These announcements follow the global chip shortage that has plagued the world since the end of the Covid-19 crisis. This shortage is the result of an unforeseen increase in demand, plant closures due to the pandemic, chip stockpiling due to geopolitical tensions, and extreme weather events. It is primarily affecting the consumer electronics and the automotive sectors, with losses that could reach $210 billion according to AlixPartners. Intel and TSMC, two of the world’s largest semiconductor companies, have suggested that the global chip shortage could continue until 2022 or beyond.

Chip is a general term for semiconductor component-based products and is the carrier of integrated circuits, which are divided into wafers. Semiconductors are materials that lie between a conductor and an insulator: they manage and control the flow of current in electronics. They are often made from raw materials such as silicon and germanium, gallium arsenide or silicon carbide. Production is a complex process, taking more than three months and involving giant factories, dust-free rooms, multi-million-dollar machines, molten tin and lasers. To reduce costs, almost all players have specialized in one part of their production chain or in certain types of components.

At a time when chip shortages are hitting many industries, this constraint seems to be ushering the semiconductor industry into a new era of innovation. Big companies are doing what they can to boost production, such as Taiwan Semiconductor Manufacturing Company and Samsung Electronics, for example, which this year achieved the increasingly difficult feat of placing more transistors on each wafer. In May, IBM announced that it had achieved a record level of miniaturization in chip manufacturing (2 nanometers). Recent years have also been marked by the emergence of more and more startups in the semiconductor landscape. While for years venture capitalists considered semiconductor companies too expensive to start, in 2020 they invested more than $12 billion in 407 chip-related companies, according to CB Insights. That is more than double what the industry received in 2019 and eight times the total in 2016. Cerebras, a startup that sells massive artificial intelligence processors that span an entire wafer, for example, has attracted more than $475 million. The firm claims 2.6 trillion transistors in its latest chip, an impressive number compared to the 5.4 billion transistors in the most powerful conventional processor. In April, SambaNova raised $676 million for its reconfigurable artificial intelligence chips. This growth may be related to the need to design new chips capable of running increasingly complex artificial intelligence models, especially for neural networks and convolution.

Beyond chip production and manufacturing, startups are trying to tackle the complexity of semiconductor creation by improving planning and productivity in fabs. Startup Flexciton has created software based on mixed integer linear programming for better factory scheduling. This reduces the time it takes the plant to produce each semiconductor by 7-10%, which would translate into savings of $3-5 million per month. The startup raised £15 million in August. Motivo, a five-year-old startup, is creating software to speed up chip design using AI. The product examines, among other things, the layout of the chip, the underlying RTL code that makes the chip work and the netlist. The company’s ultimate goal is to cut the chip design process from three years to three months. In August, the company announced a $12 million Series A round.

The current chip shortage is causing quite a stir and is pushing companies of all sizes to innovate in order to increase production and meet the growing demand. States are also mobilizing for their sovereignty: South Korea announced a push worth $450-billion over ten years, the United States is pushing legislation worth $52 billion, and the EU could plow up to $160-billion into its semiconductor sector. The current situation reveals our dependence on these critical resources and also shows us what is in store for us in the next 30 years. Indeed, the exploitable resources of certain rare metals, which are essential for the production of chips, could be exhausted within a few decades. Other threats to the sector include climate change. In Taiwan, the world’s number one chipmaker, TSMC, which alone uses 156,000 tons of water per day, had to innovate to cope with the historic drought last spring. Minimizing waste and making progress on chip recycling will be crucial for the future.

2 Key Figures

The global semiconductor market is expected to reach $778 billion by 2026 with a CAGR of 7.7% from 2021 to 2026

Reportlinker

+400 semiconductor startups

Crunchbase – 2021

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Untether IA, Flexciton and Motivo.

Untether AI

The startup is specialized in the production of AI acceleration chips for data centers, network edge equipment and embedded systems. It combines the eco-efficiency of near-memory computing and the robustness of digital processing for neural network inference. Intel has participated in the financing of the startup.

Flexciton

The startup has developed a solution to improve the efficiency and productivity of fab manufacturing processes. Using AI-powered mathematical algorithms and Mixed Integer Linear Programming, the solution analyse real-time data to make the best choices possible and decide which actions need to be taken to optimise production.

Motivo

The startup has developed a platform to to accelerate chip design utilizing a learning-on-graph methodology for automated data-driven feature extraction. This enables the platform to recognize and find patterns in the layout and make millions of improvements automatically and in an intelligent way all within the design rules.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #65

1 topic, 2 key figures, 3 startups to draw inspiration from

In March 2020, the European Commission presented an industrial policy to support the twin green and digital transitions to make the EU industry more competitive globally, and strengthen Europe’s open strategic autonomy. Indeed, today’s industry, and more particularly the manufacturing sector, has a real problem of productivity and difficulties to innovate, especially in comparison with other sectors. As an illustration, the manufacturing sector in the US has experienced the steepest decline in productivity growth of any sector, according to Economics TD. In the EU, productivity growth for industrial companies fell from an average of 2.9% over the 1996–2005 period to just 1.6% percent from 2006–2015. This can be explained by the fact that digitalization in manufacturing is low compared to sectors such as transportation, utilities or finance. Manufacturing also represents less than 10% of venture capital investments in the US and EU. This looks set to change, as Industrial Tech Investment levels have grown 8.8x since 2014, nearly three times faster than overall European VC investment. AI-based use-cases can really help improve the productivity of manufacturing companies.

AI can improve the productivity of the manufacturing sector at different levels. First, it can help to optimize processes. Machines become self-optimized systems that adjust their parameters in real-time by continuously analyzing and learning from current and historical data. It can also be used for predictive maintenance by continuously analyzing machine data to predict and avoid breakdowns. AI may help to automate quality control by using image or time-series sensor data to identify defects and deviations in product features. Finally, AI can be used to train cobots and enable them to perform a wide range of tasks.

Some large companies have started to integrate AI into their operations to improve productivity. For example, Mitsubishi Electric has developed its own system internally to adjust the parameters of its industrial robots. It has reduced process times by 90%. But overall, according to PWC, only about 9% of manufacturing companies have successfully implemented AI in their operations. They face certain difficulties, particularly in the development and deployment of AI models. Factory data can come from many sources and in many forms, making data collection and integration challenging. Labeling manufacturing data is also a cumbersome and time-consuming process. It often requires domain knowledge which means that manufacturing companies may be reluctant to work with labeling service providers. There are also many challenges in terms of security, processing power, scalability and explainability.

This is why startups seem to have a role to play alongside manufacturers. Startups can help in a variety of activities: improve data sourcing, improve data labelling and quality, facilitate model deployment and provide final use cases. Some players have already joined forces with startups such as Alcoa, which partnered with the UK startup Senseye to build a predictive maintenance solution. In total, Alcoa has reduced unplanned downtime by nearly 20%. A French Tier-1 automotive manufacturer partnered with the startup Scortex to automate the inspection of painted plastic parts. Scortex’s solution reduced inspection time by 80%. There is also a growing appetite among venture capital firms to invest in this sector. Cognite, which provides an IIoT platform as well as use-cases such as predictive maintenance, raised €128m in May 2021, Kili Technology which enables large companies to transform their raw data into high-quality annotated data raised €21m in June 2021…

However, the market is young, small and niche, which explains the low number of startups that manage to emerge. For data sourcing, hyperscalers like Amazon or Microsoft or incumbents like Siemens are competing with startups, and in-house solutions are being developed by industrial companies. With the exception of time-series data labeling and quality monitoring, there is no need for a specific tool for manufacturing and a generalist tool can be applied (H2O.ai for example is an AI Cloud Platform designed to operate in any environment).

In short, it is clear that AI and more specifically machine learning are full of promise for the manufacturing sector, to improve processes and boost productivity. However, the market is still not yet mature and developed. Startups attempting to conquer the market seem to have difficulty scaling or to competing with hyperscalers like Amazon. As a result, generalist tools are being applied to the manufacturing sector, especially in the deployment of models. It is likely that such tools will see a stronger adoption from the manufacturing sector as it matures, but the first step is to improve data sourcing, annotation and quality monitoring.

2 Key Figures

The Global Artificial Intelligence in Manufacturing Market is expected to reach $11.5 Bn by 2027, with a growing CAGR of 27.2%

The market was valued at $2.1bn in 2020 – AllTheResearch (Sept 2021)

318 funded companies in AI in manufacturing

$3.1bn total funding and $1.5bn funding in last 2 years – Tracxn (Sept 2021)

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Scortex, Senseye and Kili technology.

Scortex

The startup has developed a a machine intelligence platform designed to set up a solution for the factory production line. It transforms quality inspection and offers an automated defect detection and analytics solution to more accurately identify defective products in real-time.

Senseye

The startup has developed a cloud-based machine monitoring and diagnostics platform intended to deliver a way to predict machine failure. The platform automatically tracks and sends depreciation data of machinery and notifies manufacturers about machine conditions.

Kili technology

The startup has developed an annotation platform intended to create and manage data sets for artificial intelligence training. The platform allows for easy management of the training data for annotation, quality control, data management and labeling workforce.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #64

1 topic, 2 key figures, 3 startups to draw inspiration from

Copper plays a major role in the global economy. From thermal and electrical conductivity to corrosion resistance, copper is an extremely versatile metal that has long contributed to the way the world works. By way of illustration, it is used in numerous industries such as telecommunications (cables, wires), electronics (printed circuits, chips), transportation (injection systems, braking circuits), construction (pipes, tubing), currency, etc. In fact, one tonne of copper brings functionality to 40 cars, powers 100,000 mobile phones, runs 400 computers and distributes electricity to 30 homes.

This year, the price of copper broke the $10,000 per ton mark for the first time in 10 years. This indicates an expected increase in global demand, which should benefit Chile, Peru and China (47% of global production). Described as the ‘new oil’, demand for copper has been driven in recent years by its vital role in a number of rapidly growing industries, such as electric vehicle batteries and semiconductor wiring. According to Citigroup Global Markets, demand related to renewable power generation, battery storage, electric vehicles, charging stations and related grid infrastructure accounts for about 20% of copper consumption. Thus, copper is lauded as an essential, structural metal for the energy transition. However, the recent price surge threatens to make decarbonization more costly. At the same time, the global average copper ore grade is expected to decrease, as mines with higher ore grades become exhausted. As a result, there is growing concern about the availability of copper, and several studies have sought to estimate the peak of global copper production using Hubbert’s model, which has been estimated to be between 8 and 40 years from now.

Given the importance of copper, innovation is beginning to spur in the industry. Continuous research and testing of new concepts are being deployed to make processes more efficient, minimize environmental impact, lower energy consumption and improve design. In 2015, Aurus III, a $65 million venture fund focused solely on copper mining innovation, was launched in Chile. Among the startups they have invested in are Ceibo (formerly known as Aguamarina), which focuses on soil stabilization through biomineralization, and Scarab Recovery Technologies, which is centered on recovering valuable materials from tailings. Recycling is also receiving increased interest because copper – like gold, silver and other non-ferrous metals – suffers no loss in quality from the process, making it infinitely repeatable. In addition, it requires up to 85% less energy than primary production. Hamburg-based Aurubis is one of the companies leading the charge on the recycling of copper and other metals by a pyrometallurgy method. This year it announced that it is investing €27 million in a new recycling plant at its Beerse country site. The ASPA plant will process anode sludge, a valuable intermediate product from the electrolytic refining of copper, from the recycling sites in Beerse and Lünen, Germany. New Zealand startup Mint Innovation, however, uses a unique biohydrometallurgy method. Launched in 2016, it has developed a low-cost biotech process to recover precious metals from e-waste. It raised NZ$20 million last year to build its first two biorefineries in Sydney, Australia and northwest England.

It should be noted, however, that the copper recycling business requires considerable financial resources, particularly in terms of working capital and cash flow. This is what led to the near bankruptcy and takeover of the French factory M.Lego, which employs 110 people. Likewise, while secondary production of refined copper has increased in volume and percentage, it is growing at a much slower rate than the waste stockpile. This is primarily due to the fact that the sectors with the highest recycling rates (construction and infrastructure) have their copper tied up for several decades due to the life of the structures built. In contrast, consumer goods, which have a shorter life span, are only recycled at rates between 25 and 40%

In short, copper is projected to be a critical metal in the coming years, with a vital role to play in the energy transition. The gradual depletion of its reserves and dependence on certain countries is driving companies to innovate in the field of recycling, in order to make it both more profitable and sustainable. However, the copper industry will need strong government support to stimulate innovation to avoid a gradual shortage that would contribute to a sharp increase in prices.

2 Key Figures

About 50% of the copper used in Europe comes from recycling

International Copper Study Group (ICSG)

Copper consumption is predicted to rise more than 40% by 2035 compared to 2018

European Copper Institute (2018)

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Mint Innovation, Sortera Alloys and Weeecycling.

Mint Innovation

The New-Zealand startup has scaled biological processes that recover valuable metals like copper from electronic waste and other residues. The company’s firm uses microbes to selectively and rapidly recover precious metals from various low concentration materials under environmentally benign conditions.

Sortera Alloys

The American startup has developed a sorting system designed to reuse metals recovered from end-of-life products. The company’s system sorts metal by its type and alloy composition through a combination of X-ray fluorescence and optical sensor fusion, artificial intelligence (AI) and machine learning image processing.

Weeecycling

The French startup WeeeCycling has set up a circular economy loop for recycling strategic metals. The company buys electrical and electronic scrap in the world and, via its Morphosis brand, manufactured products. The rare metals are then extracted through a thermal and electrochemical stage to be resold for reuse.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #60

1 topic, 2 key figures, 3 startups to draw inspiration from

While the boom in e-commerce had already prompted physical stores to innovate in the customer experience space, the pandemic has further accentuated this trend. Beyond the emergence of new click and collect experiences, consuming patterns have been reshaped with the rise of local shopping or curbside, instant delivery. Consumers, more demanding than ever, are looking for faster delivery, a more diverse product selection and more competitive prices than traditional retailers.

Recently, especially across Europe, incredible amounts of VC money have been invested in ‘dark stores’, modifying considerably the urban logistics order. While German startup Gorillas raised €244 million after an initial round of €36 million in December 2020, French startup Cajoo has just announced a €40 million fundraising this month. Originated in the United States with goPuff, the ‘dark store’ model involves setting up local fulfillment centers within cities that prepare only internet grocery orders. While consumers can either pick up their order on the curb or in-store, they can have it delivered to their homes within minutes. Although often confused, ‘dark stores’ differ from ‘dark warehouses’ in that the latter are unlit, unmanned facilities with automated operations. As for ‘dark kitchens’, they are restaurants without a storefront, offering menus available for delivery exclusively.

It is undeniable that ‘dark stores’ offer many advantages in view of the investments made in this field. Beyond the convenience for the consumer to be able to be delivered 24 hours a day, 7 days a week, investors perceive in ‘dark stores’ a financial gain. First, thanks to a more integrated value chain (from wholesaler to courier) eliminating the need for intermediaries. Secondly, ‘dark stores’ can be located in industrial areas where real estate costs are much lower than in retail locations. ‘Dark stores’ also have greater fulfillment capacities than the combined capacity of stores they replace, thereby increasing the overall revenue-generating capacity. Inventory management can be more accurate, resulting in fewer out-of-stocks.

On the flip side, light has also been shed on the units economics of such a business. Transportation costs, for instance, are significantly higher due to increased costs of home delivery. At the same time, the business model is criticized for the form of cannibalization it causes. Moving the fulfillment of online orders to a ‘dark store’ shifts revenue generation from self-service stores to dark stores without reducing the fixed costs of operating the stores. Thus, as e-commerce increases, profit erosion accelerates, raising the question of whether self-service stores will cease to be financially viable as operating entities if e-grocery penetration reaches levels now being projected.

In short, ‘dark stores’ may well be an immediate supplement to stores that are currently overwhelmed by the pandemic-driven surge in demand. Partnerships between Carrefour and Cajoo, Casino and Deliveroo and Monoprix and Stuart are illustrations. However, ‘dark stores’ appear to be short- rather than long-term solutions to the problems of e-grocery. In the long run, retailers will be challenged to operate profitably by serving both physically and digitally shopping customers.

2 Key Figures

182 dark store startups

registered by Traxcn

The global online grocery market is expected to reach $1.1 tn by 2027

The global online grocery market size was estimated at $189.8 billion in 2019 and is expected to reach $1.1 trillion by 2027.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Urbantz, Locai Solutions and Quicup.

Urbantz

The Belgian startup Urbantz is a last-mile delivery management platform for enterprises designed to respond to the delivery needs of retailers, logistics operators, e-commerce, grocery players, among others. Urbantz provides an enterprise SaaS solution for real-time visibility and complete control over the entire last-mile delivery chain.

Locai Solutions

The American startup Locai has designed a suite of picking, inventory and stock management tools to optimise the operations of food retailers operating in e-commerce. These tools are based on machine learning and artificial intelligence algorithms that improve operational efficiency and enable predictive analysis.

Quicup

The British startup Quicup has developed a platform to easily book and manage deliveries. They give access to a fleet of 3000+ professional couriers and live tracking facilities, enabling clients to have on-demand, same day and next day delivery services with seamless integration.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.