Over the past decades, content creation and data collection at scale have been at the center of attention: web scraping, growth hacking, cookie tracking, anything to gather information. Today, the focus is on the organizational efficiency of all this content, as the consequences of sub-optimal knowledge management techniques are becoming increasingly well known: from duplication of work to knowledge loss, to time wasted waiting for information from co-workers or giving it to others, employees spend a huge amount of time searching for data. Fortunately, startups are tackling these productivity problems, targeting companies of all sizes.

Knowledge management faces two major obstacles. The first is the multiplicity of the knowledge sources supported within the company (e.g. spreadsheets, presentations, codes, notes, videos, vocals, emails, internal chats, and more). Storing this variety of documents efficiently is complex enough, but the real challenge lies in managing legacy storage systems. Many companies have been gathering data for years, even decades, in a variety of ways. Most of the time, the information is scattered across various folders and sometimes on multiple servers. Some documents are duplicates, others are outdated and some provide no information without context or proper consistent labeling. Searching and assessing which document best fits a request can be a colossal task. However, advances in computing power and algorithm performance provide tools that startups are using to tackle this problem. ambeRoad has developed a smart search engine to be used within the company to find data. Once a query is sent to the engine, it retrieves as many documents (images, video, and audio files) as possible that treat the subject within the company’s database and sends them back, significantly reducing the time spent searching and saving documents and allowing knowledge to be shared across all entities of the company. Shelf also uses AI and machine learning to improve the efficiency of document search within companies, and provides insight into the quality of the document, to help find easily the most adapted document to the query.

Other startups such as Forethought focus on knowledge management solutions for the retail and industry sectors, especially for customer service. They provide a smart search engine for employees to reduce search time and address another critical aspect of knowledge management: finding the adequate contact for each question among the employees. To reduce resolution time and avoid rerouting the call to another agent, the algorithm pinpoints the agent with the appropriate knowledge to answer the most complex questions, ensuring that the knowledge gathered by the agents is used to its full potential. Solvvy also provides an automated chatbot that learns from agent ticket resolution as well as a guidance bot for online shopping sites. The shopping assistant finds the best-fitted item based on the answers given by the client. The answers also allow the program to gain insight and provide metrics on customer behaviors.

Another trend emerging in knowledge management is Knowledge as a Service (KaaS): information, data, and experts are available on-demand via the cloud. This service allows companies to avoid hiring external consultants or experts and drastically speeds up the problem-solving process. Startups like Lynk manage KaaS platforms to provide insights for growth strategies in companies like M&A, asset management, or branding. Their network of experts shares their experience on the platform for an hour, a day, or longer if they choose so. On the other hand startups like Techspert.io leverage AI to browse online public datasets like academic journals or commercial registries to extract experts in a field and use sentiment analysis to assess the fit between the expert and the mission. Experts are then called by the company and their profiles are sent to the client to schedule a meeting. The added value of KaaS startups lies in their capacity to attract the most skilled experts and their ability to redirect questions to the most appropriate expert of their database.

Multinational companies are also positioned on the knowledge management segment: Cisco’s Business Critical Services is an IT platform providing KaaS as well as knowledge management workflows for its users. IBM’s Watson discovery smart search engine uses AI and Natural Language Processing to search through company files and avoid data silos. Between these initiatives and those of startups, the knowledge management segment seems crowded, but with the rise of teleworking, the need for an intuitive and comprehensive way to store information and documents so that they can be easily and rapidly accessed by anyone, from anywhere, is becoming increasingly evident. At the same time, companies are experiencing a higher employee churn rate than ever before, raising the bar even further for efficiency in onboarding new talent and retaining the knowledge of departing employees.

2 Key Figures

221 knowledge management startups

registered by Traxcn since 2015

The knowledge management industry market is expected to reach $1.1 tn by 2027

The knowledge management industry market was estimated at $366.8 billion in 2020 and is expected to reach $1.1 trillion by 2027, at a CAGR of 16.8% according to GlobeNewswire

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: ambeRoad, Forethought and Lynk

ambeRoad

ambeRoad is developing an intelligent enterprise search engine to help employees to find all relevant documents easily and quickly by integrating all company internal data sources into one search engine. Our solution allows access to all company-wide files from anywhere.

Forethought

Forethought is an AI company that creates order, removes redundant work, and provides efficiency for businesses everywhere. Forethought is helping customer support organizations with a natural language understanding platform.

Lynk

Lynk’s platform unlocks the insights, experience, and expertise of experts from around the world, helping people and companies make better-informed decisions. Lynk’s Knowledge Graph uses data to understand, map, and organize experts and their knowledge, facilitating timely, intelligent connections.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #57

1 topic, 2 key figures, 3 startups to draw inspiration from

The space industry is changing. After long being dominated by governments and billion-dollar corporations, access to space is becoming increasingly affordable, allowing smaller companies to enter the market. This is due in part to advances in satellite miniaturization over the past decade, which have drastically reduced the cost of access with the mass production of satellites. While nanosatellites (satellites weighing between 1 and 10kg) have been in use since the late 1990s, the number of launches has exploded in recent years: twice as many nanosatellites have been launched in the last 3 years as in the previous 15 years. This is because their production cost is a fraction of that of their heavier counterparts and they are much faster to build.

Startups are embarking on the development of nanosatellites. For example, German Orbital System builds CubeSats, classic nanosatellites in the form of a 10-centimeter large cube. They contain tailor-made equipment, from solar panels to data transmitters to sensors and cameras, to accommodate as many missions as possible. Picosats provides 3D-printed plastic CubeSats that are lighter than the commonly used aluminum. More than just saving weight for launch, the plastic melts when the satellite reaches its end life and re-enters the atmosphere, reducing the number of space debris left in the atmosphere. Alba Orbital is currently working on PocketQube, a picosatellite (weighing less than a kilo) with performances close to those of CubeSat. This miniaturization step could be a game-changer for reducing the cost of space exploration, because the more satellites a launch vehicle can hold, the lower the price per satellite launch.

Along with these size improvements, some startups have been working to develop affordable launchers for these small satellites. Equatorial Space Systems offers small-size launchers that can carry 3 CubeSats up to 4 km into space. Their rockets use a hybrid propulsion technology that allows them to reduce the cost of the launch. While this solution is more suitable for academic or small-size projects, they are also working on a 17-meter high launch vehicle that could carry more than 150kg anywhere in the Low Earth Orbit (up to 2,000 km from the earth) from their oceanic platform. Beyond Earth, on the other hand, offer a mobile satellite launcher that can carry a 30kg payload up to 400km from earth. Rather than launching the satellite from one launch site owned by them, their launchers are sent by shipping containers to their client’s launchpad anywhere on earth. These large-size launchers are often used to “rideshare” small satellites, such as Starlink’s 143 satellite launch last January to lower the overall launch cost per object. Aphelion Aerospace also offers launch vehicles for nanosatellites using environmentally friendly propellants as well as CubeSats manufacturing to be launched in their rockets.

The growing number of satellite missions in Low Earth Orbit (LOE) is making this part of space cluttered with satellites and debris. In space, even the smallest collision with an object can have colossal repercussions, and as more objects enter space, the likelihood of a collision increases. But some startups are trying to tackle this problem. Altius Space Machines is minimizing the number of debris by improving the life of satellites. Indeed, it specializes in on-orbit inspection and repair services to other satellites, as well as refueling, upgrades, or assistance in leaving LOE at the end of their mission. Starfish Space is pursuing the same goals and building autonomous space tugs for satellite servicing missions to extend their life expectancy and actively remove debris from space to avoid pollution and reduce the risk of collision.

As the number of satellite internet megaconstellations continues to grow (SpaceX’s Starlink projected 42,000 satellites, 2,000 satellites in OneWeb’s constellation, and more than 3 000 for Amazon’s Kuiper’s), concerns about the Kessler syndrome are rising. Thus, solutions to reduce space debris are expected to become increasingly popular, as evidenced by Swiss startup ClearSpace with its collaboration with the European Space Agency on the world’s first space debris removal mission that will begin in 2025.

2 Key Figures

500 NewSpace startups

registered by Traxcn since 2015

The space industry market is expected to reach $558bn by 2026

The global space industry market was estimated at $360 million in 2018 and is expected to reach $558 billion by 2026, at a CAGR of 5.6%

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Equatorial Space Systems, Picosats, and Starfish Space.

Equatorial Space Systems

Equatorial Space Systems developed a hybrid rocket propulsion system intended to make orbital launch better and effective. The company’s propulsion system uses a combination of liquid oxidizer and solid fuel to reduce the cost and risk of spaceflight, enabling space organizations to launch space vehicles for planetary or space missions safely and affordably.

Picosats

Founded in 2014 in Italy, Picosats developed telecommunication systems for CubeSats. The company engages in the research and development of telecommunication systems allowing space-based communication services. Picosat also builds 3D printed CubeSats, lowering the amount of debris left at the end of their mission.

Starfish Space

The Washington-based startup was founded in 2018 and developed an orbital transportation infrastructure designed to provide in-space transportation and maintenance service. The company’s proximity operations software uses a combination of breakthrough orbital mechanics and a low-thrust electric propulsion system, enabling satellite companies to relocate, deorbit and extend the life of satellites.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #56

1 topic, 2 key figures, 3 startups to draw inspiration from

Since the first flight using blended biofuel took off in 2008, more than 150,000 flights have used biofuels. In May 2021, Air France-KLM flew an Airbus A350 from Paris to Montreal with a 16% mix of sustainable aviation fuel (SAF) in its fuel tanks, produced in France by Total from used cooking oil. This example illustrates the growing concern to limit aviation-related emissions. Indeed, aviation will account for 3.5% of global energy-related CO2 emissions by 2030, compared to just over 2.5% today. Thus, the development and promotion of biofuels for aviation will be essential to reducing carbon emissions of the industry.

Biofuels are fuels derived immediately from living matter, plants or waste. Depending on the type of biomass used, they could lower CO2 emissions by 20–98% compared to conventional jet fuel. The biofuels with the highest emission savings are those derived from photosynthetic algae (98% savings, not yet a mature technology) and non-food crops and forest residues (91-95% savings), taking into account the GHG emissions associated with the production of algal oil but not with transportation.

Worldwide, major aviation players are showing an increased interest in this technology. As a first step, some pioneering airports have already integrated bio-jet fuels into their refueling systems. Today, five airports have regular biofuel distribution: Bergen, Brisbane, Los Angeles, Oslo and Stockholm. Long-term agreements between airlines (like KLM and Lufthansa) and biofuel producers are another sign of their commitment to the use of SAF. They now cumulatively cover around 6 billion liters of fuel (1.6% of total annual consumption).

Meeting this demand will require further production facilities. This is why some airlines have invested directly in aviation biofuel refinery projects or biofuel startups. The first example is a partnership announced in October 2020, between Virgin Atlantic and LanzaTech, on renewable jet fuel that will power planes from Shanghai and Delhi to Heathrow within two to three years. Recently, United Airlines has also joined the biofuel race, investing $30 million in Fulcrum BioEnergy. United Airlines will be both an investor and a regular customer of Fulcrum, a California-based company that has developed a technology turning municipal waste into sustainable aviation fuel. In January 2021, Qatar Airways announced it would invest in Byogy Renewables, a US startup that produces advanced biofuels (jet fuel and gasoline) from any source of bioethanol.

Corporate investment in biofuels is a rising and necessary trend, as most aviation biofuel production pathways are not yet mature. The four major ones are:

- HEFA bio-jets (Hydroprocessed Esters and Fatty Acids): a process that uses oleochemical feedstocks such as oilseed crops and fats. It is currently the only technically mature and commercialized process. It is therefore expected that HEFA will be the main biofuel used in aviation in the short to medium term.

- FT fuels (gasification through the FischerTropsch): a method that uses municipal solid waste or woody biomass as feedstock.

- SIP fuels (Synthesised Iso-Paraffinic): biochemical conversion processes, such as the biological conversion of biomass (sugars, starches or lignocellulose-derived feedstocks) into longer chain alcohols and hydrocarbons.

- ATJ fuels (Alcohol-to-jet based on isobutanol): a process that includes “hybrid” thermochemical or biochemical technologies; the fermentation of synthesis gas; and catalytic reforming of sugars or carbohydrates.

However, before we witness the widespread use of biofuels in aviation, several challenges must be overcome. The major constraint is the high cost of the technologies compared to fossil-based jet fuels. For instance, the production cost of HEFA is about $1,500/ton of bio-jet fuels, and fuel costs are the largest overhead expense for airlines, accounting for an average of 22% of direct costs. Secondly, to fulfill the potential of aviation biofuels, further technological developments are needed.

Policy frameworks have a key role to play in this crucial early phase of SAF industry development. Without a supportive policy landscape, the aviation industry is unlikely to scale biofuel consumption to levels where costs fall and SAF becomes self-sustaining.

To conclude, the aviation biofuels market is likely to grow exponentially. Several startups are seizing this opportunity and collaborating with larger players, such as airlines. Government support, through policies and financial incentives, is essential to secure this growth potential and pave the way for more decarbonized air transport.

2 Key Figures

43 sustainable aviation fuel startups

registered by Traxcn

The sustainable aviation fuel market is expected to reach $15.3bn by 2030

The global aviation biofuel market was estimated at $66 million in 2020 and is expected to reach $15.3 billion by 2025, at a CAGR of 72.4%

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: BioRefly, Sundrop Fuels, and Fulcrum Bio-energy.

BioRefly

The German startup BioRefly is an operator of an industrial scale demonstration biorefinery to produce lignin-based aviation fuels. It is developing technologies allowing an increased and more economical utilization of selected renewable lignocellulosic raw materials for the production of second-generation biofuel for aviation.

Sundrop Fuels

This US startup is the developer of renewable energy technology. It is using a proprietary high-temperature bioreforming system to transform cellulosic biomass into clean, affordable, renewable gasoline, jet and diesel fuels. It uses a high-temperature solar gasification process that turns natural gas combined with any plant material into liquid transportation biofuels.

Fulcrum

Fulcrum is an American startup that produces sustainable fuel intended to reduce reliance on imported oil. The company’s technology involves a process of converting municipal solid waste into low-carbon transportation, enabling clients to provide customers with low-cost and low-carbon drop-in fuel that is competitively priced with traditional petroleum fuel.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab #52

1 topic, 2 key figures, 3 startups to draw inspiration from

In June 2021, to meet the increased demand for bioprocessing assemblies, Entegris announced that it would invest $30 million to expand three manufacturing facilities. If the idea of using living components in industrial processes is not new – humans were already using yeast to make bread and beer in 4,000 BC – today, bioprocessing is taking it to the next level.

Bioprocessing is any process that uses complete living cells or their components (e.g., bacteria, enzymes, chloroplasts) to obtain their desired products. It is key to several emerging industries and technologies, including the production of renewable biofuels such as ethanol and biodiesel, therapeutic stem cells, or new vaccines. Bioprocessing has several advantages. First, it is an extremely efficient process (a small amount of enzyme quickly yields a lot of product) that operates under mild conditions, thus saving energy. The products are biodegradable and pure and the process is safe (any contamination by an enzyme or known microbe is harmless) and waste-free.

The bioprocess consists of an upstream and a downstream stage. Upstream bioprocessing is the first step in which the microorganisms or cells are grown. They go through several stages of cultivation in a controlled environment within a bioreactor, to be multiplicated. Then, downstream bioprocessing is there to meet purity and quality requirements through cell isolation and purification. Five main types of technologies can be used:

- Conventional bioreactors: These are manufactured systems that support a biologically active environment.

- Single-use bioreactors: These are bioreactors equipped with a disposable bag or instead of a reusable culture vessel. This reduces the cross-contamination risk, requires fewer maintenance requirements and less stringent validation protocols for regulatory approvals.

- Cell culture media: These encompass gels or liquids compounds and nutrients created to support the growth of cells in artificial environments.

- Filtration & concentration: The two types of filtration used in bioprocessing are Direct Flow Filtration (DFF) that uses a single pass of the process fluid through the filter membrane, and Tangential Flow Filtration (TFF), where the process fluid flows parallel (tangential) to the membrane surface.

- Process chromatography: It consists of a pilot- or process-scale system used to separate and purify biomolecules.

The innovations associated with these technologies partly explain the increasing adoption of bioprocessing. First, productivity has increased during the upstream process thanks to new micro-bioreactors (like the Ambr of Sartorius) that allow rapid screening of a large number of media, feeds, and operating conditions such as temperature to determine those producing the highest titers. There are also innovations in the downstream process, with the use of new proteins for purification or improved architecture of the chromatographic resins for faster flow rates. Companies like Pall are continuously working on such innovative solutions. Finally, the switch from batch to continuous bioprocessing, to develop more efficient processes and to reduce time and costs, is enabled by new precisely controlled valves, sensors, and filtration technologies (inline ultrafiltration, diafiltration).

These innovations have an impact on several industries. The main application sectors are biopharmaceuticals, agriculture and food, energy, and waste treatment. Many startups are addressing this surging market in various fields. The American start-up Mango Materials has developed a patented, low-impact biological process that produces bioplastic from methane. Methane from landfill facilities is converted into biodegradable plastic by non-genetically modified bacteria. Their solution is competitive with conventional petrochemical-based plastics and has a capacity of over 10 million pounds of bioplastic per year. Bioprocess engineering in the agriculture and food industry offers opportunities to design and produce new or improved agricultural and food products and their manufacturing processes. In the energy sector, bioprocessing is more and more used for producing biofuels. Start-up TerViva, backed by agricultural-technology businesses, uses the Pongamia plant to produce oil from its seeds. Pongamia produces ten times more amount of oil per acre than soybean and requires only a fraction of resources (water, fertilizers, and pesticides). On top of biodiesel and renewable diesel, Pongamia seed oil can be converted into lubricants, animal feed supplements, or fertilizer. Algae is another way of bio-producing biofuels. The American startup Algenol produces ethanol by using algae, sunlight, CO2, and seawater. When it comes to large corporations, the use of bioprocessing is often limited to specific activities, notably biopharmaceuticals, and the scale. For instance, GE Healthcare (General Electric) reported revenues of $1.5 billion in 2015 from bioprocessing and acquired in 2017 the bioprocessing startup Puridify.

While bioprocessing is a mature field, challenges remain. First of all, the transition from batch to continuous operation is a source of complexity (investment in equipment, process updates, contamination risks, etc.). Furthermore, bioprocessing 4.0 still has progress to make, in terms of digitalization of processes and more systematic data collection and analysis.

To conclude, bioprocessing is becoming an increasingly used technique in various fields. While regulations and norms may be a hindrance in the pharmaceutical industry, in other sectors such as waste treatment, bioprocessing has a huge untapped potential. Single-use bioreactors are expected to be the most widely adopted in the coming years as they are more flexible and can be set up into operation very quickly.

2 Key Figures

180 bioprocessing startups

registered by Tracxn

Global bioprocessing market expected to reach $51.9 Bn by 2028

The global bioprocessing market is estimated at $19.4 Bn in 2021 and is expected to reach $51.9 Bn by 2028, at a CAGR of 16.0%.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Ingenza, Microvi, and Cytoo.

Ingenza

Founded in 2002, Ingenza is an industrial biotechnology startup with a broad customer base across the chemicals, pharmaceuticals, food, feed and fuel industries. They apply synthetic biology to the manufacture of industrial products including enhanced biofuels, sustainable manufacturing of chemicals and the production of protein therapeutics. They also license their proprietary bioprocess technologies.

Microvi

Microvi is a biotechnology startup that discovers, develops, manufactures, and commercializes innovative biocatalytic solutions for the water, energy, and chemical industries. Its MicroNiche Engineering platform is a microenvironment of biological systems is precisely designed to enhance microbial life and optimize metabolic performance.

Cytoo

Cytoo is a French startup that develops, manufactures, and distributes products that make cellular analysis robust and reliable by dramatically decreasing cell variability. Their portfolio includes a proprietary cell adhesive micropattern technologies to target High Content Screening and Analysis companies within the large cell biology market.

123Fab #48

1 topic, 2 key figures, 3 startups to draw inspiration from

While many of the early exoskeletons were focused on military and medical applications, in recent years there has been an increase of new use cases due to decreasing costs. Exoskeletons are being used in a range of industries from manufacturing and construction to agriculture. BMW, Honda and Hyundai use them in the automotive industry; Samsung, Panasonic, Mitsubishi and Siemens in electronics; and Geodis, Pon and AT in logistics and shipping.

According to ASTM International, exoskeletons can be defined as wearable devices that work in tandem with the user. They are different from autonomous robots in that they don’t work in place of the blue-collar worker. They are placed on their body and act as amplifiers that augment, reinforce or restore human performance, as opposed to mechanical prosthetics, such as a robotic arm or leg, that replace original body parts.

The global exoskeleton market can be segmented on the basis of two main criteria. On the basis of extremity, the market can be divided into lower extremity, upper extremity and full-body. In terms of product, the market can be classified into two categories:

- Powered exoskeletons — they use batteries or electric cable connections to run sensors and actuators

- Passive exoskeletons — they do not have any electrical power source and can be used for weight distribution, energy capture, locking, etc.

In recent years, exoskeletons have emerged in industries that are less amenable to automation. For example, industries such as construction or oil and gas, which operate in unstructured environments, or manufacturing industries that produce a wide variety of parts of different shapes and sizes. In these industries, blue-collar workers handle the most complicated tasks, resulting in wear-and-tear experiences. While some repetitive tasks have been handed over to autonomous robots, exoskeletons fill the automation gap for non-repetitive and hazardous tasks by allowing workers to perform strenuous tasks safely and efficiently. The EksoZeoG developed by Ekso Bionics, for example, helps construction workers use heavy hand tools by bearing the weight of the heavy equipment.

Advances in enabling technologies (actuators, batteries, advanced materials, etc.) have reduced the costs and increased the functionality of exoskeletons in recent years, but they still represent a significant investment. While the price varies between passive and active exoskeletons, full-body, lower and upper, the average exoskeleton costs several thousand dollars. Given the significant cost, a handful of startups have sought to lower the barrier to adoption via more innovative business models. The concept of Robotics-as-a-Service (RaaS) is gaining ground. Sarcos, which is one of its proponents, allow customers to shift their CAPEX to OPEX, and thus deploy solutions without upfront costs. Based on its research, Sarcos’ customers perceive other benefits to RaaS, such as the elimination of technology risk and the absence of maintenance costs. Other startups are looking to democratize the use of exoskeletons, especially passive ones that are less expensive. With the help of crowdfunding, French startup HMT wants to use a low-cost model to sell its products at €200.

While the market is still looking for an accurate combination of hardware, the competition to make the best, powered exoskeleton is slowly shifting from a race for the best hardware to a race for the best software. In this sense, the industry can be compared to the semiconductor industry in the late 2000s with wafer handlers. The robots all managed to move a wafer from A to B, regardless of the hardware, but it turned out that it was the software that made the difference. The winners were the ones with the best software and the most reliable architecture with less downtime. Today, exoskeleton research is moving in this direction and increasingly focusing on complex software. It seeks to develop more intelligent exoskeletons, via features such as balance control or energy transfer optimization. The BioMot project, based at the Human Locomotion Laboratory in Madrid, is a weak signal of this shift. They are trying to develop more wearable equipment, that is lightweight and compact, and which is especially better able to anticipate and detect the intended movements of the worker. Through dynamic sensorimotor interactions, the exoskeletons have real-time adaptability and flexibility, increasing the symbiosis between the wearable and the user. Such projects pave the way to a new generation of lighter and smarter exoskeletons.

In short, the future of industrial exoskeletons looks bright. Barriers to adoption are expected to further decrease as costs drop and lightweight exoskeletons are increasingly developed. Regulation should also emerge, as evidenced by ASTM International’s creation of an exoskeleton and exosuit committee in 2017 to define international standards. Just as it is illegal to walk in construction areas without the proper PPE, it may one day be illegal for blue-collar workers on construction sites, in warehouses and manufacturing plants to use tools without the adequate exoskeleton. What’s more, advances in materials, battery and actuator technologies suggest that new applications are in the offing, which should boost adoption even further.

2 Key Figures

129 exoskeleton startups

registered by Tracxn

Global exoskeleton market expected to reach $5.7Bn by 2027

The global exoskeleton market was estimated at $310M in 2019 and is expected to reach $5.7B by 2027, at a CAGR of 43.4%

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Laevo, Noonee and StrongArm Technologies.

Laevo

Laevo is a Netherlands based startup that is developing a light and comfortable exoskeleton for work and industry. It redistributes forces away from the user’s back muscles while bending forward.

Noonnee

German startup Noonee manufactures a lower-body exoskeleton that is designed to function as a chair. Their product is called Chairless Chair and is specifically made for workers in the automotive industry. Its main purpose is to prevent worker disruptions due to injuries or muscle fatigue and also to help an aging workforce.

StrongArm Technologies

StrongArm Technologies is a developer of a safety platform designed to actively manage industrial safety, productivity and performance. The company’s platform uses wearable sensors and AI-based analytics to collect, analyze and predict insights on industrial workers to mitigate the injury risk, increase worker productivity and comfort.

123Fab #46

1 topic, 2 key figures, 3 startups to draw inspiration from

Given its impact on the environment, the mining industry is challenged to become green, or at least as sustainable as possible for an extraction company. Drilling changes landscapes and biodiversity, generates waste, uses large amounts of water and polluting machinery, and the mine environment is dangerous to work in. And this is all the more problematic because most of the products used in the world depend on the mining industry, from the pipes in our homes to the materials in our smartphones. It also plays a key role in sustainable transformation, producing, among other materials, lithium for electric car batteries, silica for solar panels, nickel for electrodes in hydrogen production. As the mines are often located in the emerging countries of the southern hemisphere and the extracted materials are most often used in the developed countries of the north, this accentuates the climatic debt of the “North” to the “South”.

However, some startups are looking at this issue to transform the mining industry into a greener and more sustainable activity.

Sustainable drilling technologies

The drilling phase has the most visible impact on the environment. Huge amounts of soil are moved, roads are built to make way for trucks and heavy machinery, and trenches are dug to divert water. Some startups have focused on designing new drilling methods that reduce the environmental disruption of this process. Earth AI uses artificial intelligence to locate prospective sites for rare materials and is patenting its “zero disturbance drilling hardware” to determine drilling parameters without prior groundwork. Novamera has developed Sustainable Mining by Drilling (SMD) technology, a surgical mining method that extracts ore but leaves waste in the ground. It drastically reduces emissions and waste and consumes less water than conventional drilling methods by recycling it.

Turning to renewable energy

Mining operations often take place in parts of the world that use fossil fuels to power their machinery. As a result, there is growing interest in renewable energy to reduce this significant portion of GHG. Independent energy producer Tugliq provides off-grid, autonomous power supply from solar, wind, and biomass that can be used for mining operations, lowering their dependency on fossil fuels and their carbon footprint. Raglan mine and Tuglic’s partnership has avoided the use of 10 million liters of diesel since 2014 in their Canadian arctic mining operations. Heliogen’s Heliopower solution generates electricity from sunlight to power mining operations with renewable energy. Two months ago, Rio Tinto announced a partnership with Heliogen to reduce their carbon footprint in their Boron mine, targeting a reduction of up to 24% in their CO2 emissions.

Effluent treatment

Part of the negative environmental impact of mining comes from wastewater, which, once used during the mining process, is polluted and difficult to dispense or treat. Some startups like Auxilium Technology Group are addressing this challenge by treating mine effluents and wastewater, retrieving valuable materials such as heavy metals and rare earth elements, and limiting evaporation, thereby reducing the overall water consumption of the process. As for soil contamination, Allied Microbiota develops microbes that break down contaminants in the soil. Instead of moving contaminated soil to a landfill, it can be efficiently treated.

Zero carbon lithium

While some startups have designed greener mining processes, others have developed their own sustainable mining technologies. Lithium, for example, is critical to the transition to electric mobility. Yet conventional mining techniques release a lot of greenhouse gases and use a lot of water. In addition, most of the lithium in Europe is imported, which adds transportation-related emissions. Vulcan energy, GeoCubed, and Cornish Lithium offer zero-carbon production of lithium and geothermal electricity production by extracting a lithium-rich geothermal brine before harvesting the lithium and re-injecting the brine. Because the brine is at a high temperature when pumped at the surface (~165°C), the heat is used to provide geothermal electricity, so the entire process produces more energy than it consumes.

To conclude, the mining industry has yet to be fully transformed. Although a few startups are positioned in the market, it remains complicated to enter given the high upfront capital expenses required. But consumer expectations are putting increasing pressure on players to become more sustainable. Ultimately, recycling remains a solution to reduce mining-related emissions, while improving the lifespan of these materials, reducing the reliance on extraction in developing countries and avoiding emissions related to the transportation of raw materials around the world.

2 Key Figures

35 sustainable mining startups

registered by Tracxn

Green mining market expected to reach $12.9 Bn by 2024

The sustainable mining market was estimated at $9 Bn in 2019 and is expected to reach $12.9 Bn by 2024, at a CAGR of 7.5%

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Tugliq, Allied Microbiota , and Cornish Lithium.

Tugliq

Tugliq Energy is a Montreal, QC based private company whose line of business is Electric services. TUGLIQ is a specialist Independent Power Producer (IPP) focused on remote and complex energy diversification for off-grid and/or hybrid applications with solutions tailored to the mining industry, remote villages and islands.

Allied Microbiota

Allied Microbiota developed biotechnology products designed to clean-up environmental contamination. The company’s products are microbes and their enzymes to create sustainable bio-chemicals, enabling customers to use such microbes for environmental and industrial applications to break down pollutants and reduce contamination.

Cornish Lithium

Cornish Lithium is a UK based startup operating a lithium mining and exploration company intended to provide environmentally sustainable extraction of lithium. The company’s services aim to create a new, environmentally-responsible, lithium extraction industry, enabling clients to have sustainable products essential for the transition to a green economy.

123Fab #43

1 topic, 2 key figures, 3 startups to draw inspiration from

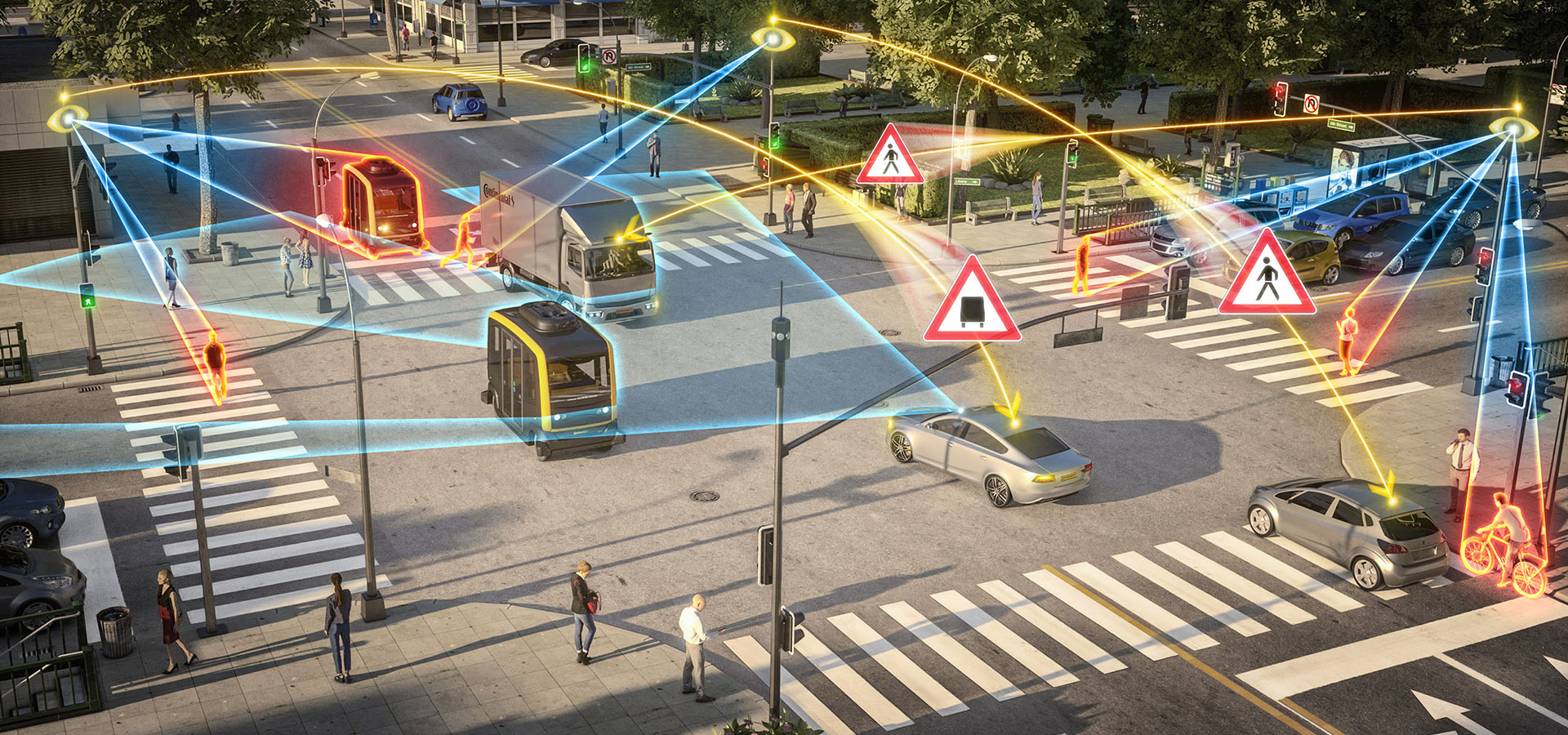

The city of Las Vegas has recently been granted permission to install and test 25 cellular-vehicle-to-everything (C-V2X) roadside units, to transition from Dedicated Short-Range Communications (DSRC) for connected vehicles, to cellular. The objective is to demonstrate the benefits of C-V2X technology, which is said to be as reliable and performant but with twice the range of DSRC. This highlights the growing presence and adoption of Vehicle-to-Everything (V2X) installations within cities. V2X refers to the transmission of information from a vehicle to any entity that may affect the vehicle and vice versa. It includes Vehicle-to-Infrastructure (V2I: data exchange between a car and equipment installed alongside roads, generally a roadside unit), Vehicle-to-Vehicle (V2V: data transfer between vehicles), Vehicle-to-Network (V2N: when a vehicle accesses the network for cloud-based services), Vehicle-to-Pedestrian (V2P), Vehicle-to-Device (V2D) and Vehicle-to-Grid (V2G: information exchange with the power grid). In this newsletter, we will focus on two key components of V2X which are V2V and V2I. The main motivations for V2X are road safety, traffic efficiency, and energy savings. Indeed, according to GSMA forecasts, by 2025, V2X could prevent 260,000 accidents (by detecting road hazards or vulnerable pedestrians and cyclists for example), save 11,000 lives, save 280 million hours of driving each year, and avoid 400,000 tonnes of CO2 emissions (for instance, with platooning, cars or trucks follow each other with short inter-vehicle distance, resulting in reduced fuel consumption and CO2 emissions).

With the advancement of V2X technologies, such as its non-line-of-sight sensing capability that allows vehicles to detect potential hazards, traffic, and road conditions, vehicles are becoming increasingly connected and are being progressively equipped to become fully autonomous. Some legacy V2I technologies are currently in operational use worldwide for relatively simple applications (e.g. for Electronic Toll Collection), while advanced V2X systems are beginning to gain widespread commercial acceptance. They rely on two underlying technologies:

- IEEE 802.11p or DSRC (Dedicated Short Range Communications): this original V2X standard is now mature and mainly used for safety use cases (such as starting to brake before a pedestrian or a hazard is visible to the driver), due to its reliability and low latency (2 ms). However, its range is rather short (less than 1 km). This technology is prevalent in North America, Japan, and Europe.

- Cellular V2X (C-V2X): this relatively new technology offers several operating modes that users can choose from, such as direct communication between vehicles or with the infrastructure and further road users (pedestrians, cyclists). For now, it is mostly used in non-safety-related use cases (vehicle operation management, traffic efficiency, etc.). While this technology has a range of 10km, it requires network support (4G/LTE/5G) and has a higher latency (1s). This technology is very present in China.

Hybrid solutions could be developed by 2030 to achieve interoperability. Startups like AutoTalks are working on such hybrid modules (capable of supporting both DSRC and C-V2X). Indeed, AutoTalks is an Israeli leader that develops fabless semiconductors for the V2X market. They address a variety of issues related to V2X communication, including communication reliability, security, positioning accuracy, and vehicle installation. AutoTalks has developed a chipset capable of supporting dedicated short-range communications (DSRC) and cellular’s C-V2X.

Many OEMs and automotive players are including V2X services into their car models. For instance, Volkswagen has premiered its all-new Golf with V2X capabilities. Car2X-signals from traffic infrastructure and information from other vehicles up to 800 meters away are notified to the driver via a display. The Golf also shares these warnings with other Car2X models. Initially focused on road safety and traffic efficiency applications, Toyota and General Motors were early adopters of IEEE 802.11p-based V2X technologies in Japan and North America. However, the momentum has lately swung in favor of C-V2X and they have expressed their willingness to invest in C-V2X technologies. This is also the path taken by Audi and Qualcomm Technologies, which are deploying a C-V2X technology pilot in Virginia. Workers wear special vests with built-in V2P technology that can alert drivers to their presence.

Besides the challenge of choosing the optimum communication bearer (DSRC, C-V2X, or hybrid), which keeps the industry and the mobile community very active, the security of V2X communication is also a key issue. The regulatory environment is the most important factor influencing the adoption of V2X technology. In China, the government has taken a stand and showcased C-V2X regulations, which should encourage automakers to position themselves quickly. In contrast, in North America and Europe, the governments and transportation ministries are struggling to bring clarity to the industry in terms of V2X, its scope and limitations.

To conclude, there is strong potential for V2X applications, the technologies exist, and it seems that the automotive industry will not wait for regulation to adopt V2X services. However, large-scale adoption will take time, due to the need to equip all infrastructures with adapted devices and the time needed for the automotive players to align on a single (or hybrid) communication technology.

2 Key Figures

433 V2X startups

registered byTracxn

Automotive V2X market expected to reach $12.9 Bn by 2028

The automotive V2X market was estimated at $689 M in 2020 and is expected to reach $12.9 Bn by 2028, at a CAGR of 44.2%.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Valerann, Commsignia, and Connected Signals

Valerann

Valerann is an Israeli start-up that develops sensor systems for installation on roads, and an associated data platform. Their smart studs, installed along the roads, can sense traffic movement, specific weather conditions, road issues and send this data to the central data centre. Combined with intended integrations with Waze, Google Maps, etc., Valerann intends to create a connected real-time traffic notifications and analytics platform.

Commsignia

Commsignia is a Hungarian start-up that develops cooperative intelligent transportation systems designed to increase traffic safety and efficiency on the road. It includes V2V and V2I communication systems that provide actionable insights pertaining to the logistics pipeline through their in-app information services, thus enabling businesses, corporate clients and logistics industry players to connect with other drivers for various road-safety programs.

Connected signals

Connected Signals (originally, Green Driver) is an American high-tech startup, focused on providing traffic signal state and predictions to drivers, automakers, and others. Knowing the current state of traffic lights and how they will change creates opportunities to increase driving safety, increase fuel efficiency, and improve the driving experience. Applications range from EnLighten, which tells drivers when the light they are stopped at will turn green, to vehicle powertrain optimisation based on the state of upcoming lights.

123Fab #42

1 topic, 2 key figures, 3 startups to draw inspiration from

Since the Paris agreement five years ago, most of the 196 signatories have taken steps to limit global warming below 2°C above pre-industrial levels. The EU has set a carbon neutrality goal by 2050 and a 55% decrease in greenhouse gas emissions by 2030 compared to 1990. Corporations across all industries are also taking action to reduce their carbon impact: from Danone’s commitment to be carbon neutral by 2050, to Carrefour’s 40% decrease in CO2 emissions by 2025 and 70% reduction by 2050 compared to 2010, to Microsoft’s goal to be carbon negative by 2030. Climate consciousness and decarbonization have gained tremendous momentum over the past decade, and customers are increasingly engaged: for a $100 product, they are willing to pay an average of $19.50 more to offset carbon emissions. Demonstrating environmental commitment is now a sine qua non condition for a leading businesses and the most impactful indicator is the quantity of CO2 equivalent released.

To assess the carbon footprint of a company, a wide variety of data is required. Emissions are segmented into 3 scopes:

- Scope 1 represents direct GHG emissions such as emissions from combustion and processes.

- Scope 2 refers to indirect emissions associated with energy consumption, the amount of GHG released to produce the electricity, heat, cold, or vapour consumed.

- Scope 3 gathers all other indirect emissions including those from the upstream and downstream value chain, transportation of persons and goods, waste, purchases of products and services, use of the sold products etc.

For each category, the emission factor (kWh used, litres of fuel consumed, kilometres travelled…) must then be translated into equivalent tons of CO2 emitted. This adds to the complexity of the process as the available data is not always in a good format or directly usable (companies can have different energy contracts in different countries, relying on a complex energy mix and an uneven contribution to energy sources depending for instance on the country’s energy policy).

This study must be carried out for each type of product at each company site, so the difficulty of gathering and translating all the data into CO2 emissions grows exponentially with the size of the company, even if all the data is available. Sometimes the necessary data is not available. For instance, a company’s carbon footprint also includes emissions from employee commuting, which requires assumptions to estimate.

The complexity and cumbersomeness of this process have led to the emergence of new tools to automate the analysis and tracking required for carbon emission accounting.

- Emission tracking: Startups such as Emitwise, Worldfavor, and Position Green have designed software and platforms that gather information from all of a company’s locations to automate sustainability reporting and track emissions. These tools give corporates a better understanding of their carbon emissions and allow them to take the most impactful actions for the environment. Other startups target specific sectors. For instance, Sustainabill focuses on tracking the environmental impact of supply chains and allows businesses to compare the sustainability ratings of their suppliers. CarbonCloud develops automated carbon footprint scoring for the food and beverage industry.

- Emission tracking and reduction: Another way to help corporates reduce their carbon footprint is to provide them with insight. Cozero has developed a platform that automates emission accounting, as well as a digital marketplace that offers low-carbon alternatives to reduce carbon emissions. Klimametrix sends its users individual action plans based on their footprint calculations to help them reduce their CO2 emissions. Planetly has built software to analyze companies’ emissions and suggest actions to reduce them, whether it’s improving production processes, switching to renewable energy or adopting greener transportation for business trips.

- Emission tracking and offsetting: Some startups help reduce carbon emissions by offsetting them, guiding corporates in financing carbon reduction projects to compensate their own emissions. Startups like ClimateSeed and Cloverly help measure your carbon footprint and select relevant carbon reduction projects. You invest in one or more projects and receive carbon credits in line with your emissions. This system allows corporates to invest in reliable and verified projects, and to receive reports on the progress of these projects.

It is more difficult for large corporates to track their emissions accurately due to their large number of inputs, locations and suppliers. In fact, most call on consulting firms to get a tailor-made solution and assessment of their emissions. Last year, Amazon invested in Pachama, a startup that offers offsetting solutions through reforestation and quantifies the carbon absorbed by planted trees. This year, Samsung partnered with Carbon Footprint Ltd to offset the carbon footprint of their washing machines and dryers over their lifetime. ERP companies have a head start on this subject, as their software already handles much of the data needed for carbon accounting. In 2019, Salesforce launched its sustainability cloud and last year SAP launched its carbon footprint analytics to meet the demand for automated carbon accounting.

In conclusion, automated emissions tracking is still an emerging topic, which makes it difficult for companies to choose a tool given the lack of differentiation between them. However, in the coming years, we expect to see an increase in investment in this area, as well as a proliferation of startups. The ones that will stand out from the rest will be those that manage to position themselves in specific and highly regulated sectors; across the entire value chain; with smooth integration within the existing IT infrastructure.

2 Key Figures

95 carbon footprint software startups

registered by Crunchbase

Carbon footprint management market expected to reach $12.2 Bn by 2025

The global carbon footprint management market was estimated at $9 Bn in 2020 and is expected to reach $12.2 Bn by 2025, at a CAGR of 6.2%.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Sustainabill, Cozero, and Cloverly.

Sustainabill

Sustainabill is a Cologne based startup,developer of supply chain management platform designed to achieve multi-tier-visibility and trace supply chains to the source. The platform analyses the entire supply chain network and source of the raw material to collects data from suppliers and sub-suppliers as well as to identify sustainability-related risks.

Cozero

Cozero developped a digital carbon action platform focused on helping companies take control of their corporate emission data. The companies platform offers tools for end-to-end carbon management, planning, emission accounting and carbon portfolio management to maintain carbon log and forecast carbon output using data analytics, thereby enabling companies to achieve carbon neutralization.

Cloverly

Cloverly’s sustainability as a service platform calculates the carbon impact of common internet activities like e-commerce shipments, rideshare and on-demand deliveries and then purchases carbon offsets to make those activities carbon-neutral, enabling buyers to view in real-time the source of the offset and through its algorithm matches customers with the closest source of renewable energy for localized impact.