Because electricity is the main cost of computing, data centers are becoming the world’s fastest innovation engine for energy efficiency, and industry will benefit.

Data centers are often criticized for how much electricity they consume, and that criticism is justified. Nevertheless, it overlooks another an indirect innovation perk: as electricity is the main direct cost of running a data center and power directly determines their profitability, data center operators are trying to use it more efficiently. This is why the expected $5 trillion investment in computing infrastructure is not only for building more servers, but also for making those servers as energy-efficient as possible.

To improve their margins and keep up with the demand driven by AI, data centers are rapidly improving chips, cooling systems, and software that controls how electricity is used. These efficiency gains are happening faster than in most other industries, precisely because energy costs are so central to their economics and because the demand is increasing so rapidly, making it a such a strong investable sector.

These energy-efficiency innovations are already spreading to other sectors. Telecom is an early example. As 5G networks pushed electricity demand higher, operators such as AT&T (US telecom) began using GPUs (Graphics Processing Units) originally developed for data centers to run network equipment more efficiently, cutting power use and operating costs by around 20%, according to an Nvidia case study.

In this article, we focus on two questions:

- What pillars are used to improve the energy efficiency of data centers?

- Which technologies could benefit from this investment wave, and how far will these gains extend into industry, manufacturing, and utilities?

The data center energy trend in numbers:

In 2024, data centers consumed approximately 415 TWh of electricity globally, roughly 1.5% of total electricity consumption. Geographically, the United States accounts for 45%, followed by China (25%) and Europe (15%).

Data center energy use has grown at 12% annually over the last five years, four times faster than total global demand, according to the International Energy Agency (IEA). These projections indicate this could reach 945 TWh by 2030 (nearly 3% of global demand).

Why does energy efficiency matter?

Despite high growth projections, the relationship between digital activity and energy use within our data centers is not linear.

Between 2005 and 2024, while internet traffic increased from 1 to 5.5 billion users and the digital economy’s share of GDP surged, data center energy use only rose from 1% to 1.5% of global demand. Historically, efficiency gains have prevented digital growth from triggering a proportional explosion in energy demand.

The three pillars of data center efficiency innovation

- Next-generation hardware

Each new generation of chips becomes much more energy-efficient than the previous one. For example, the current Nvidia B200 GPU uses 60% less energy per unit of computing than the previous generation, which itself was 80% more efficient than the one before. These chips are not used only in data centers; they also make robots and factory automation systems more energy efficient.

- Intelligent software

AI-powered tools are increasingly used for predictive maintenance and heat management in an industrial context. In a landmark case in 2016, DeepMind reduced Google’s cooling costs by 40% using its machine learning algorithm on its own servers.

- Integrated systems

The integration of optimized hardware with intelligent software management yields even better results. Today, industrial giants like Siemens and GE are applying these algorithms combined with custom hardware to reduce manufacturing energy use by 15-20%, thanks to predictive maintenance and real-time energy efficiency improvements.

From server to factory floor: five technologies already crossing over

Technologies first developed for data centers are now allowing new heavy industry usage. Both settings face similar challenges, managing complex systems, high energy use, and cooling or process optimization. Thus, improvement in data centers should be transferable to those industrial cases.

The following five technologies are examples of how improvement into the pillars are being put to work on the factory floor:

| Data Center Pillar | Industrial Crossover | How they link |

| Next-gen Hardware | Digital Twins | Powerful chips allow factories to run complex virtual simulations. |

| Intelligent Software | Process & Thermal Optimization | AI that cools servers is now used to manage furnace heat and pump speeds. |

| Integrated Systems | Predictive Maintenance & Smart Grids | Combining sensors with AI helps factories predict repairs and balance power use. |

- Predictive maintenance

Machine learning models originally designed to monitor servers (e.g., the example of DeepMind data centers) can now predict failures in industrial equipment before they happen by analyzing sensor data (vibrations, temperature, power draw).

Example: Siemens’ AI-driven maintenance platform identifies early signs of bearing wear in motors, cutting maintenance costs and lowering energy use in manufacturing lines.

- Real-time process optimization

Software that adjusts cooling, airflow, and load balancing in data centers now helps optimize industrial process parameters, furnace temperature, compressor load, or pump speed, in real time. These AI optimizers can lower the energy intensity of industrial processing plants by 5-15%, and increase EBITDA by 3-5%, according to McKinsey.

- Digital twins and simulation tools

Digital twins, realistic virtual models of physical assets, were first used for data center planning and fault forecasting. In a factory, these digital replicas simulate production lines to test process improvements safely and improve resource flows. Plants using digital twins often achieve up to 10% energy savings.

- Smart grid and demand response systems

Cloud computing-inspired dynamic energy scheduling systems now balance industrial electricity loads with real-time grid conditions. AI can plan when to run high-consumption equipment during periods of low cost or high renewable energy availability, reducing total energy use by 5–20% according to the IEA calculations.

Example: BASF’s chemical plants in Europe integrate AI platforms that shift noncritical processes to coincide with peak renewable power supply, lowering both emissions and costs.

- Thermal management technologies

High-efficiency cooling from data centers, such as liquid cooling and waste heat recovery, is being adapted for heat-intensive manufacturing. These techniques capture waste heat from furnaces and reuse it for pre-heating or other steps, minimizing total fuel input.

To conclude, while data centers are indeed an energy pit, electricity being the dominant operating cost, they are becoming one of the world’s most well-funded R&D labs for energy efficiency innovation worldwide. And of course, these advancements will not remain confined to server halls. As shown in telecom, manufacturing, chemicals, and utilities, some technologies developed to minimize data center energy use are now already finding new usage in other energy-intensive industries, where even small percentage gains translate into big absolute savings.

2 Key Figures

945 TWh

Projected global electricity consumption of data centers by 2030, representing just under 3 percent of total global demand and equivalent to twice France’s current electricity consumption.

$5 trillion

Expected spending on AI-related infrastructure over the next five years, an amount roughly equivalent to Germany’s 2025 GDP.

3 startups to draw inspiration from

NLM Photonics

Recently closed a Series A (Jan 2025). Their organic electro-optic modulators enable up to a 30% reduction in network power consumption and can be manufactured in standard CMOS fabs.

Lightmatter

Following a $400M Series D (Oct 2024), they are commercializing photonics-based computing, using light instead of electricity to perform calculations with drastically lower thermal output.

EcoDataCenter

Focuses on climate-positive data centers by utilizing Nordic cold climates and integrating waste heat recovery into district heating networks.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

123Fab

1 topic, 2 key figures, 3 startups to draw inspiration from

Until recently, the main conversation around data centers focused primarily on reducing their environmental footprint: transitioning to renewable energy, improving Power Usage Effectiveness (PUE), and optimizing cooling systems. These efforts remain crucial, but the landscape is shifting.

Data centers are rapidly becoming deeply integrated into both local and national energy systems, playing an increasingly strategic role in grid stability and energy flexibility. This transformation not only impacts the way data centers consume energy but also how they can contribute to a more resilient and balanced energy infrastructure. Rather than merely absorbing power, data centers are now playing a pivotal part in balancing supply and demand, enabling the integration of renewable energy, and even creating new industrial symbioses. Here’s how:

1. Demand Response: Leveraging Renewable Energy to Drive Efficiency

Data centers, especially those operated by major tech companies like Google, are employing advanced systems such as carbon-intelligent computing to dynamically adjust their workloads in response to the availability of local solar and wind energy. By syncing their computing power with times of high renewable generation, Google reduces its energy demand during periods of low renewable production and maximizes energy use when renewable sources are abundant. This ability to adapt to fluctuating energy conditions means that data centers are no longer just passive consumers but active participants in managing the grid’s load, helping to integrate renewables more effectively into the overall energy mix.

2. Grid Balancing: Data Centers as Auxiliary Services Providers

Tech giants like Microsoft are experimenting with innovative solutions to turn their data centers into grid-supporting assets. One such approach is using data center batteries in a grid-interactive UPS mode, in collaboration with Eaton, to provide auxiliary services to the electrical grid. These services include regulating frequency and voltage, ensuring stability during times of peak demand or grid instability. The ability of data centers to act as “shock absorbers” for the grid through energy storage and balancing offers a significant step forward in making energy systems more resilient and flexible.

As part of this, Microsoft’s batteries could offer energy back to the grid during periods of excess demand, helping stabilize the grid while also benefiting from economic incentives. This kind of grid interaction transforms data centers from isolated consumers of energy into active, responsive entities that aid in maintaining grid stability.

3. Decentralized Production & Self-Consumption: A Move Toward Energy Independence

Amazon is another key player exploring decentralized energy production. The company is integrating renewable energy projects such as wind farms and storage systems directly into their energy supply chains for data centers. This integration not only helps stabilize energy availability but also reduces the reliance on centralized power grids. In doing so, Amazon is creating a more self-sufficient energy ecosystem, where their data centers can operate with a greater degree of energy autonomy, even in the event of grid disruptions.

In addition to reducing operational costs and environmental impact, this approach aligns with the growing trend of self-consumption and local energy production, where data centers both produce and consume the energy they need. This decentralization of energy sources supports broader national efforts to transition to more resilient and sustainable energy infrastructures.

4. Waste Heat Recovery & Industrial Symbiosis: Turning Energy Loss Into Value

Some data centers are going beyond simply consuming and generating energy—they are also innovating in how they use the waste heat produced by their operations. Qarnot Computing, for example, has pioneered the concept of energy symbiosis by using excess heat from its servers to warm residential buildings, office spaces, and even swimming pools. This process of waste heat recovery transforms what would otherwise be a byproduct of data center operations into valuable local heating energy, further enhancing the sustainability of their operations.

This symbiotic approach to energy usage also supports local economies by providing affordable heating to nearby communities, reducing the need for traditional heating methods like gas or electricity, which can be more resource-intensive.

5. Integrating Data Centers into National Grid Systems: A Strategic Experimentation

As energy systems evolve, so too does the role of data centers in maintaining grid stability. RTE, the French transmission system operator, along with Data4 and Schneider Electric, is leading a groundbreaking project in Marcoussis to experiment with flexible data center management. The goal is to ensure that if there are disruptions to a data center’s energy supply, it won’t disrupt the broader stability of the electrical grid. This is especially important as data centers are projected to represent 4% of electricity consumption in France by 2035.

The RTE-Data4-Schneider Electric collaboration is Europe’s first large-scale experiment in integrating data centers into the national energy system. It focuses on testing the ability of data centers to interact dynamically with the grid, allowing for a more seamless integration that could prevent potential issues from arising when large numbers of data centers are connected to the system. This project could pave the way for a new standard in managing the energy consumption and supply of data centers, ensuring grid stability even as their numbers and energy needs increase.

Conclusion: A New Era for Data Centers

Data centers are no longer just the massive energy consumers they once were. They are emerging as key players in the energy landscape, contributing to the stability and flexibility of our energy systems. As they increasingly integrate with renewable energy sources, offer grid-balancing services, and help create local energy symbioses, they are redefining the concept of what a data center can be.

This shift represents a crucial step in the transition toward a more resilient, sustainable energy future, where data centers are no longer viewed solely through the lens of consumption, but as active participants in shaping the energy ecosystem. The strategic role they play in energy systems will only continue to expand, making them essential not just for powering the digital economy but for helping to drive the broader transformation of global energy infrastructure.

2 Key Figures

3 days

A new data center opens every 3 days

70%

Projected growth in AI electricity consumption through 2027

3 startups to draw inspiration from

Qarnot Computing

A French start-up, that has developed an innovative technology, which combines computer servers and mechanical equipment to capture the waste heat generated by the servers and repurpose it for use in heating systems.

Iceotope

Iceotope is redefining the future of data center cooling with its precision liquid cooling solutions, specifically designed for the era of AI and ultra-high-density computing, offering energy-efficient and sustainable cooling technologies.

Netsooon.ai

A deep tech start-up specializing in artificial intelligence, Netsooon.ai developed DataGreen, combining eco-friendly GPUs, cooling systems, and AI expertise to optimize energy efficiency, reduce carbon footprint, and enhance data center performance through the circular use of residual heat.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.

With a global push toward decarbonization, scientists and innovators keep on exploring next-generation solutions to meet energy demands sustainably. Fourth-generation fuels, a cutting-edge development in renewable energy, are gaining attention for their ability to tackle climate challenges head-on. But what exactly are fourth-generation fuels, and how could they reshape our economy, society, and environment?

What Are Fourth-Generation Fuels?

Fourth-generation fuels are advanced biofuels that integrate renewable energy technologies with carbon capture and storage (CCS). They are designed to be carbon-negative, meaning they actively remove more CO₂ from the atmosphere than they emit during their lifecycle.

Key Characteristics:

- Feedstocks: Fourth-generation fuels are produced using non-food biomass, algae, or synthetic methods that leverage captured CO₂ and renewable hydrogen.

- Carbon Capture Integration: The production process involves capturing CO₂ from the atmosphere or industrial sources, storing it underground or utilizing it in other processes.

- Technological Advances: These fuels often rely on innovative technologies like artificial photosynthesis, engineered microorganisms, or bioreactors.

Examples include synthetic fuels made by combining captured CO₂ with green hydrogen and biofuels derived from carbon-absorbing crops paired with BECCS (Bioenergy with Carbon Capture and Storage).

Economic impact

The development of fourth-generation fuels has the potential to revolutionize the global economy. By driving significant investments in advanced manufacturing, biotechnology, and carbon capture infrastructure, these fuels can catalyze economic growth and establish technological leadership for nations that embrace them. They also offer an opportunity to enhance energy security by reducing dependence on imported fossil fuels, as their production relies on locally available feedstocks and renewable energy sources. However, the economic promise of fourth-generation fuels comes with challenges. High initial costs for production and infrastructure development remain substantial barriers, and scaling these technologies will require policy support, subsidies, and sustained private-sector investment.

Societal impact

Fourth-generation fuels can significantly influence societal structures, starting with job creation. The rise of this industry is expected to generate high-quality jobs in sectors such as research, engineering, agriculture, and clean energy. Rural communities, in particular, may benefit from new opportunities in biomass cultivation and carbon storage projects. Additionally, the adoption of cleaner alternatives to fossil fuels will lead to reduced air pollution, improving public health by minimizing respiratory illnesses, especially in urban and industrialized areas. Moreover, these fuels encourage collaboration between governments, businesses, and local communities, fostering a collective commitment to sustainable practices and empowering citizens to participate in the fight against climate change.

Environmental impact

The environmental benefits of fourth-generation fuels are profound. By capturing and storing atmospheric CO₂, they offer a tangible solution for achieving net-negative emissions, which is essential for addressing climate change. This ability to offset emissions is particularly valuable for sectors that are difficult to decarbonize, such as aviation and heavy industry. Furthermore, these fuels are produced using non-arable land or algae-based systems, which reduces competition with food production and helps preserve biodiversity. By integrating renewable energy sources like wind and solar into their production processes, fourth-generation fuels align seamlessly with broader decarbonization strategies and further minimize reliance on fossil fuels, setting a new benchmark for environmental responsibility.

Challenges and Future Outlook

While the promise of fourth-generation fuels is immense, several challenges remain:

- High Development Costs: Achieving commercial viability requires substantial R&D and infrastructure investments.

- Policy and Regulatory Support: Clear and consistent policies, including carbon pricing and subsidies, are essential to incentivize adoption.

- Technological Uncertainty: Scaling up these advanced technologies involves overcoming technical hurdles and ensuring reliability.

Despite these obstacles, the potential benefits make fourth-generation fuels a critical component of the global energy transition. With coordinated efforts from governments, industries, and researchers, these fuels could help pave the way toward a sustainable, carbon-negative future.

Context

Our client operates manufacturing sites worldwide and is proactively addressing the challenges of the energy transition to ensure the long-term resilience and sustainability of its operations.

In response to a changing energy landscape, the company launched a strategic foresight initiative to assess potential stress on national electric grids in countries hosting key production sites. The goal was to anticipate risks related to electricity availability.

Missions

In this context, we supported our client in:

- Electricity Outlook: Projecting electricity generation trends through 2040 in 19 countries across Asia, the Americas, and Europe, based on national policies, energy mix evolution, and infrastructure developments.

- Low-Carbon Share: Evaluating the share of low-carbon electricity in each country’s electricity mix today and in 2040.

- Mobility Electrification: Estimating the adoption of electric vehicles and its projected impact on national electricity demand

Key figures

19

Country-specific one-pagers

3

Core market indicators assessed

2040

Projection horizon

1

Market sizing model

Context

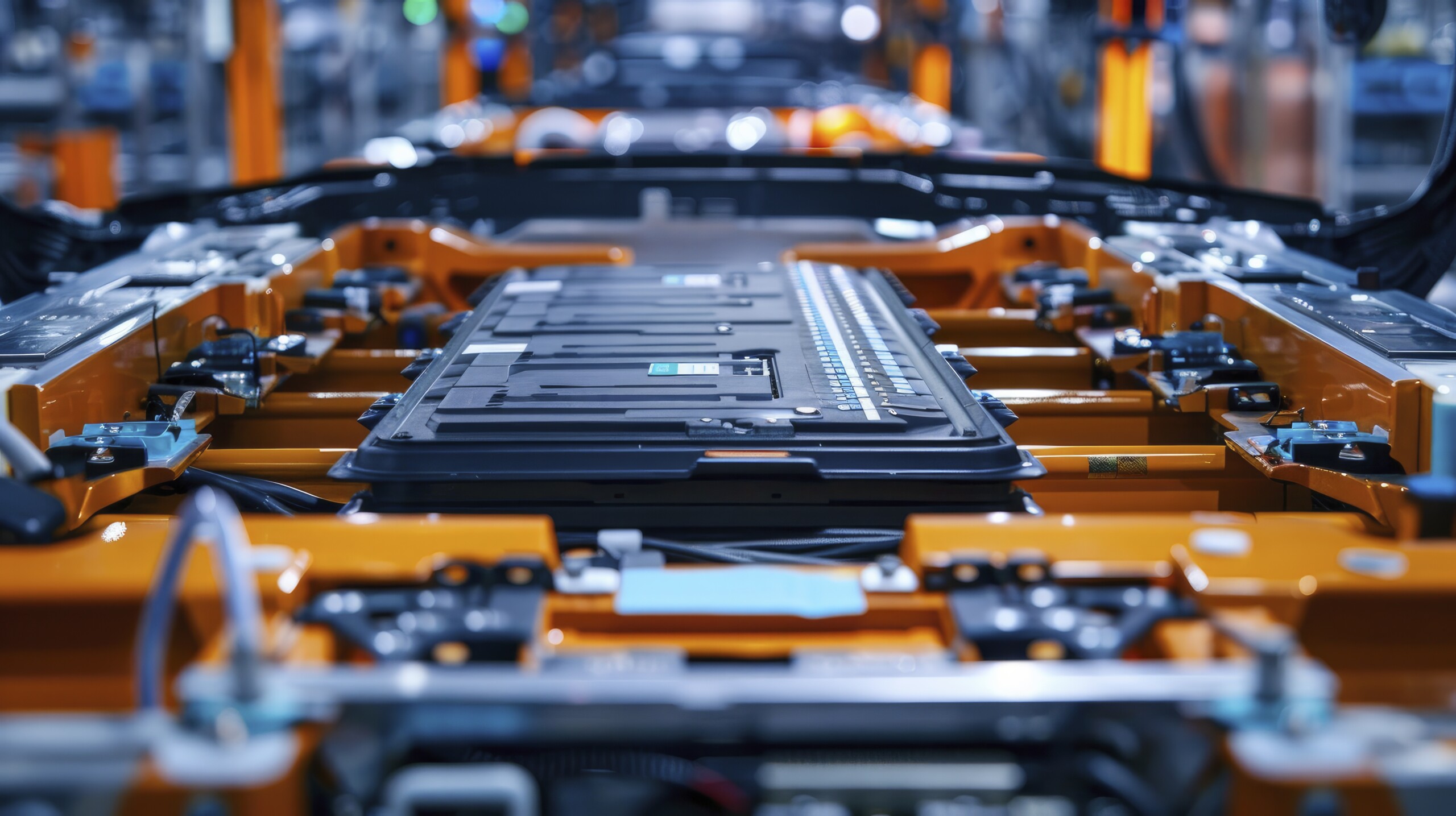

Our client has developed a strong innovation activity to fuel its transformation. In this context, our client asked us to explore market demand for a new offering in dismantling and extracting valuable components from lithium-ion batteries.

Mission

We carried out a study to define the go-to-market strategy:

- Map of the second-life battery value chain, from manufacturing to end-of-life

- Segmentation of second-life component buyers

- Real-world applications of second-life components

- Interviews with 8 potential customers on interest and technical needs

- List of existing technical standards for selling second-life battery cells

- Review of the EU battery regulation compliance

- Recommendations on the go-to-market strategy and prioritization of potential customers to address first

Key figures

27

Key players identified

4

Target customer groups

8

Interviews conducted

1

Go-to-market strategy defined

Context

In view of the declining potential of its historical Oil & gas business, our client investigated several diversification opportunities in adjacent markets, consistent with its know-how and energy transition roadmap.

In this context, the Innovation department wanted to evaluate the potential for diversification in the field of Carbon Capture Utilization and Storage (CCUS) and to identify innovative partners with whom to create a complementary business.

Mission

We carried out a deep dive study divided into three steps:

- A market study to paint a complete picture of all the megatrends (new business models, technologies, use cases)

- A startup landscape to identify the innovative players driving CCUS forward worldwide

- A startup scoring to establish recommendations on the most relevant options for collaboration (R&D agreement, commercial partnership, investment, acquisition, etc.)

Key figures

433

Startups sourced in Europe, US & Israel

41

Startups assessed & ranked

5

Partnerships

123Fab #99

1 topic, 2 key figures, 3 startups to draw inspiration from

People generally link global warming with carbon dioxide (CO2) but, as the Intergovernmental Panel on Climate Change (IPCC) explains, 30% of the increase in global temperature since pre-industrial levels is due to higher methane (CH4) concentrations in the atmosphere. This is because methane is extremely more effective at trapping heat.

Where does methane come from?

The IEA has estimated that 40% of methane comes from natural sources (wetlands, biomass burning…), and the remaining 60% from human activities (agriculture, oil & gas production, waste). The two pathways to methane production are:

- Gas leaks – methane is the main component of natural gas. Thus, it can leak from pipelines and drilling.

- Decomposition of organic matter – when organic matter is in oxygen-free environments, particular microbes called methanogens take the lead in breaking down the organisms. This process, called methanogenesis, leads to the creation of methane.

According to McKinsey, five industries could reduce global annual methane emissions by 20% by 2030 and 46% by 2050. Those are agriculture, oil and gas, coal mining, solid-waste management, and wastewater management.

What about methane capture from the air?

Methane is 200 times less abundant in the atmosphere than CO2 — a scarcity that makes removing it a technical challenge. Capturing methane would require processing a lot of air, which could require an extremely large amount of energy. And unlike CO2, which can be captured both physically and chemically in a variety of solvents and porous solids, methane is completely non-polar and interacts very weakly with most materials. However, researchers claim to have found a promising solution. A class of crystalline materials, called zeolites, capable of soaking up the gas. Regardless of this solution, the difficulty of capturing methane from the air is the reason why most technologies focus on oxidizing the greenhouse gas rather than “hooking” it out.

Startups are developing innovations to curb methane emissions

For the decomposition of organic matter:

- in the gut of ruminants (like cows and cattle) – Australian startup Rumin8 and Swedish startup Volta Greentech are fighting this issue by developing seaweed-based nutritional supplements that inhibit methane production.

- on landfills and wastewater – US startup LoCi Controls bolsters the methane capture process using solar-powered devices.

- on wetlands – UK methane capture startup bluemethane has developed a technology to capture methane from water, enabling to mitigate the methane production from rice cultivation.

For gas leaks:

- oil & gas production – UK startup Kuva Systems uses short-wave infrared cameras to autonomously monitor and alert oil and gas companies about methane leaks. Whereas US startup BioSqueeze has developed a biomineralization technology that seals miniscule leakage pathways in oil and gas wells.

- melting permafrost – the trapped organic matter in the frozen seafloors or shallow seas is emitted when they thaw. US startup Blue Dot Change is investigating whether releasing ion particles into the exhaust steam of ship vessels crossing the ocean can accelerate the destruction of methane.

A methane tax just like carbon taxes

Norway was one of the first countries to introduce a carbon tax in 1991. Aside from carbon, the harmful gases regulated by the tax also include methane. All Oil & Gas operators on the country’s continental shelf are now required to report all methane emissions from their activities. As a result, studies show that the country has succeeded to consistently maintain low methane emissions. Canada is proposing to require companies to inspect their infrastructure monthly, fixing the leaks they find as part of efforts to reduce the sector’s methane emissions by 75% by 2030 (compared with 2012). Although the EU is among 150 signatories to the Global Methane Pledge – an agreement to cut emissions of methane by 30% – EU energy chief warned early March that the EU was lagging in the race to curb methane emissions. Since the proposals on methane in 2021, they have been watered down.

In short, methane will be critical to solving the net-zero equation. The good news is that mature technologies are at hand. From feed additives for cattle to new rice-farming techniques, to advanced approaches for oil and gas leak detection and landgas methane capture. Where costs are prohibitive, there is a need for coordinated action to create the infrastructure and fiscal conditions that would support further action. Finally, across the board, there is a need for more monitoring and implementation.

2 Key Figures

Budget of $60-110 billion annually up to 2030

Full deployment of the methane abatement measures would cost an estimated $150-$220 billion annually by 2040 and $230-$340 billion annually by 2050.

< 100 funded companies

Tracxn

3 startups to draw inspiration from

Kayyros

French-based startup founded in 2016 which is a developer of an energy analytics platform for traders, investors, operators and governments. Kayrros powers part of the Global Methane Tracker.

BioSqueeze

US-based startup founded in 2021 that has developed a biomineralization technology that seals miniscule leakage pathways in oil and gas wells.

Rumin8

Australian-based startup founded in 2021 which is a manufacturer of seaweed-based nutritional supplements for livestock that inhibit methane production. The startup is backed by Bill Gates’ fund Breakthrough Energy Ventures.

Interested in a startup landscape or in an insights report?

Please fill out our contact form so that we can get back to you very quickly with our product offer.

Want to subscribe to our 123Fab?

Fill out our form to receive the latest insights into your inbox.