In our capacity as a consulting firm specializing in assisting companies to audit, design, and establish their corporate venture arms—as well as generate deal flow—we often confront the pressing question: What are the best practices in Corporate Venture Capital (CVC)?

Against the backdrop of the sobering fact that the average lifespan of a CVC is a mere 4 years, we recently organized a panel titled “The CVC Survival Game: Insights from European Survivors,” featuring experts from BMW (Germany), EDP (Portugal), and Equinor (Norway).

Moderated by Hélène Maxwell from Aster Fab, the conversation distilled into 8 actionable tips for mastering the CVC game. Link to the YouTube video here.

1. A Clear and Dynamic Investment Mandate

Mariana Costa of EDP Ventures highlights the crucial need for a well-defined, flexible investment mandate aligned with innovation priorities. “It needs to fall within the investment mandate and align with our strategic objectives,” Costa emphasizes. This nuanced perspective underscores the importance of adaptability in the ever-changing realm of corporate venture capital, ensuring responsiveness to emerging opportunities and evolving industry trends.

2. Embracing Venture Capital Best Practices for Success

Margret Dupslaff underscores the benefits of BMW I Ventures’ single-LP, independent approach, drawing inspiration from venture capital practices. “Our independence allows us to make decisions swiftly, giving us a competitive edge in the VC space,” she emphasizes. This structure enables quick risk-taking, facilitating effective competition in the dynamic VC landscape and allowing investment decisions to be made in as little as 10 days.

3. Focus on Impactful Solutions

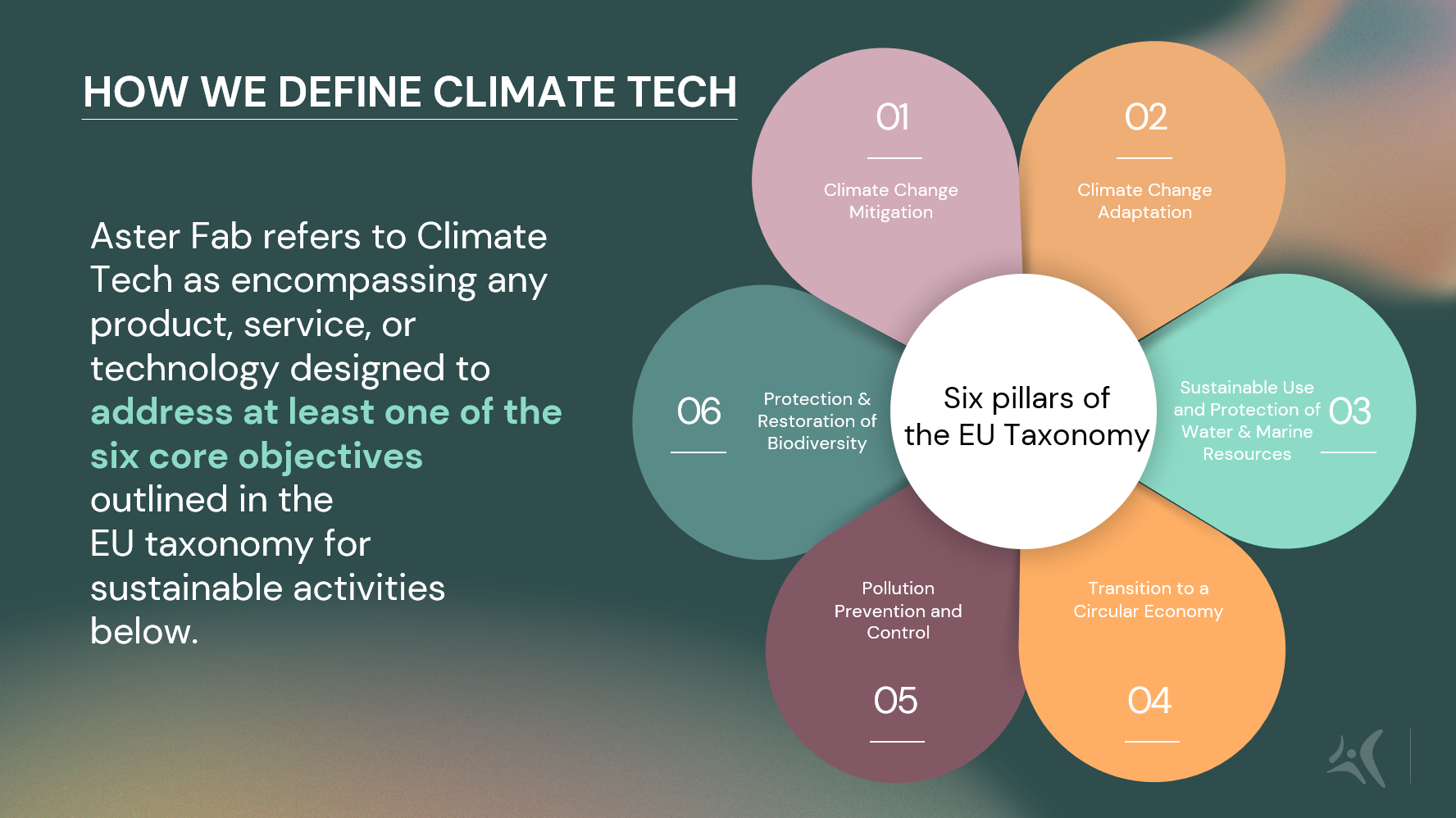

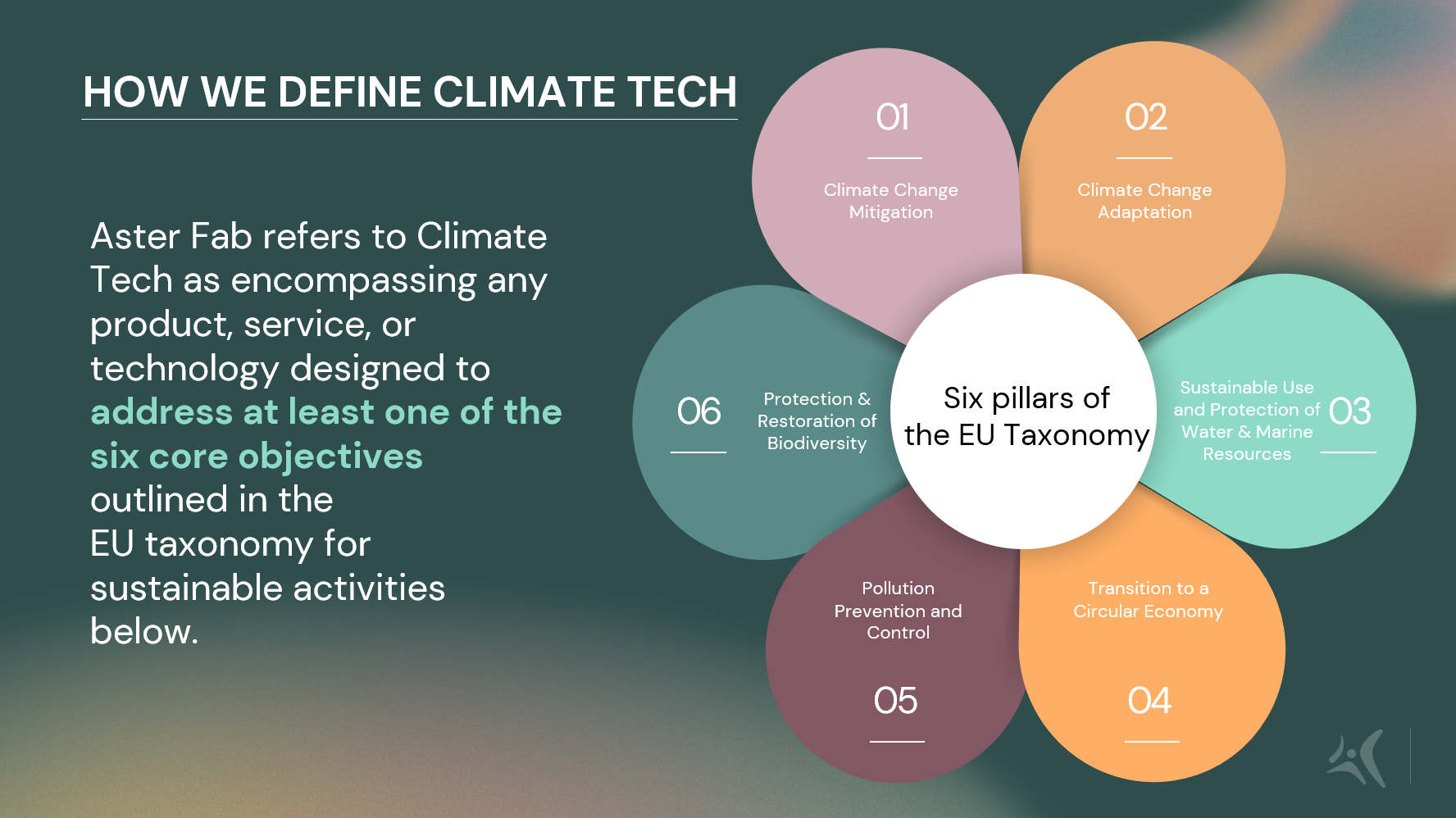

All three CVCs—EDP Ventures, Equinor Ventures, and BMW i Ventures—emphasize investments in sustainability. Startups in climate tech and energy transition are particularly sought after. Kristine Marie Kvalø Johansson of Equinor brought attention to the need for a focus on solutions that will make a tangible impact. “Working with carbon capture and value chains is something that I think will be necessary, and we have to scale faster,” Johansson stated. In a landscape teeming with possibilities, the key lies in identifying ventures that align not just with corporate goals but with the broader narrative of making a positive impact on the industry and the world.

4. Expect Failures, Embrace Learning

Both EDP Ventures and Equinor acknowledged the inevitability of failures in the CVC game. “This is Venture Capital. It is what it is. Hopefully, we try to minimize them, but they are part of the game,” said Mariana Costa. The ability to embrace failures as learning opportunities defines the resilience of a CVC player. These setbacks, rather than deterrents, become stepping stones for future successes.

Parallelly, Margaret Dupslaff from BMW i Ventures aligns with this learning ethos, advocating for startups to adopt a similar mindset. Encouraging adaptability and openness, she emphasizes the significance of absorbing insights from corporate partners, leveraging collective expertise for mutual growth.

5. Stakeholder Management is Critical

Effective stakeholder management emerged as a critical element, according to Equinor’s Kristine Marie Kvalø Johansson. She highlighted the importance of proving the value of CVC initiatives both internally and externally. “It’s all about being able to prove what we’re doing, not just externally but also internally,” she explained. This dual focus on maintaining external credibility and internal alignment underscores the delicate balancing act that defines CVC success.

6. Beyond Investment, the Transformative Power of Value Creation

CVC transcends mere financial transactions; it’s a strategic pursuit dedicated to creating lasting value. Mariana Costa from EDP Ventures emphasizes, “Focus on strategic return better reflects our DNA as a strategic investor,” prioritizing long-term collaboration over immediate financial gains. With over €100 million in signed contracts between portfolio companies and Business Units, EDP Ventures exemplifies the power of these strategic partnerships, showcasing a commitment to fostering innovation within the industry.

7. Invest in Relationships and Cultivate Notoriety

Investing in relationships is crucial in corporate venture capital, as Mariana Costa emphasizes the need for a close rapport with companies and internal stakeholders. This commitment extends beyond investments and is a partnership at all levels, with early engagement between startups and Business Units enhancing the likelihood of successful commercial contracts. Additionally, Mariana highlights that “VC is all about relationships”, evident not only in managing the investees but also externally. By cultivating external relationships, you can enrich deal flow, boost your reputation and attract startups, ultimately strengthening the reputation of the CVC.

8. Be Selective and Discern Business vs. Investment Cases

Margret further underscores this by sharing insights from BMW Startup Garage (Venture clienting unit that created POCs with Business Units), where knowledge and deal flow are generously shared. As an illustration, she cites a recent instance involving a company with smart tire technology. While the innovation was intriguing for enhancing road awareness in vehicles, it lacked a substantial investment case due to the limited market size—a perspective that aligns with strategic decision-making in the venture capital realm.

EDP Ventures established in 2008, operates globally with a focus on climate tech companies and energy companies driving the energy transition. With a substantial investment of over €60 million, EDP Ventures has invested in 37 active portfolio companies across the globe. Their investment mandate spans from seed to Series B, with an average ticket size ranging from €1 million to €10 million. The portfolio aligns with EDP Group’s innovation priorities, covering renewable energy, smart networks, distributed energy resources, storage, and more.

Contact: Mariana Costa – mariana.costa@edp.com

—

BMW I Ventures established in 2011, has thrived with a significant commitment. Operating with a fully independent fund II of BMW, they have €300 million to deploy. Having invested in more than 60 companies, BMW Ventures typically engages with startups in their Series A to C stages, with an initial ticket size of around €10 million. Notably, 13 of their portfolio companies have reached Unicorn status, showcasing the success of their financial approach. BMW I Ventures focuses on sustainability across the entire automotive value chain, leveraging BMW’s expertise for informed decision-making.

Contact: Margret Dupslaff – margret@bmwiventures.com

—

Equinor Ventures, established in 1996, is Equinor’s corporate venture capital arm dedicated to investing in ambitious early-phase and growth companies. This is based on a belief that the innovation, creativity and agility of startups can accelerate the change towards a low-carbon future. Equinor Ventures engages with startups from early to later stages, all this is supported by technical, market and financial guidance, with a strong drive for piloting and implementing the solutions. We are looking to invest around USD 750 million over the next five years and are seeking to allocate 70% of the capital to renewables, low-carbon solutions and future opportunities

Contact: Kristine Marie Kvalø Johansson – krisjo@equinor.com