Examining recent economic history reveals a nuanced narrative surrounding the trajectory of Cleantech, characterized by periods of growth, setback, and adaptation.

From 2006 to 2011, the emergence of Cleantech 1.0 marked a notable surge in investment efforts aimed at addressing environmental concerns. Cleantech, an umbrella term encompassing various innovations in the energy industry, such as renewable energy and resource efficiency, garnered significant attention and resources during this phase. However, the initial enthusiasm was later tempered by what is colloquially termed the Cleantech Bubble.

During the Cleantech 1.0 era, prominent ventures such as Solyndra (solar panel manufacturing) and KiOR (biofuels production) symbolized the aspirations and subsequent challenges of the movement. These companies, supported by substantial investments, initially highlighted promising solutions for energy-related issues. Nevertheless, their eventual downturn, marked by Solyndra’s bankruptcy filing in 2015 and KiOR’s similar fate in 2014, underscored the complexities and uncertainties inherent in Cleantech ventures.

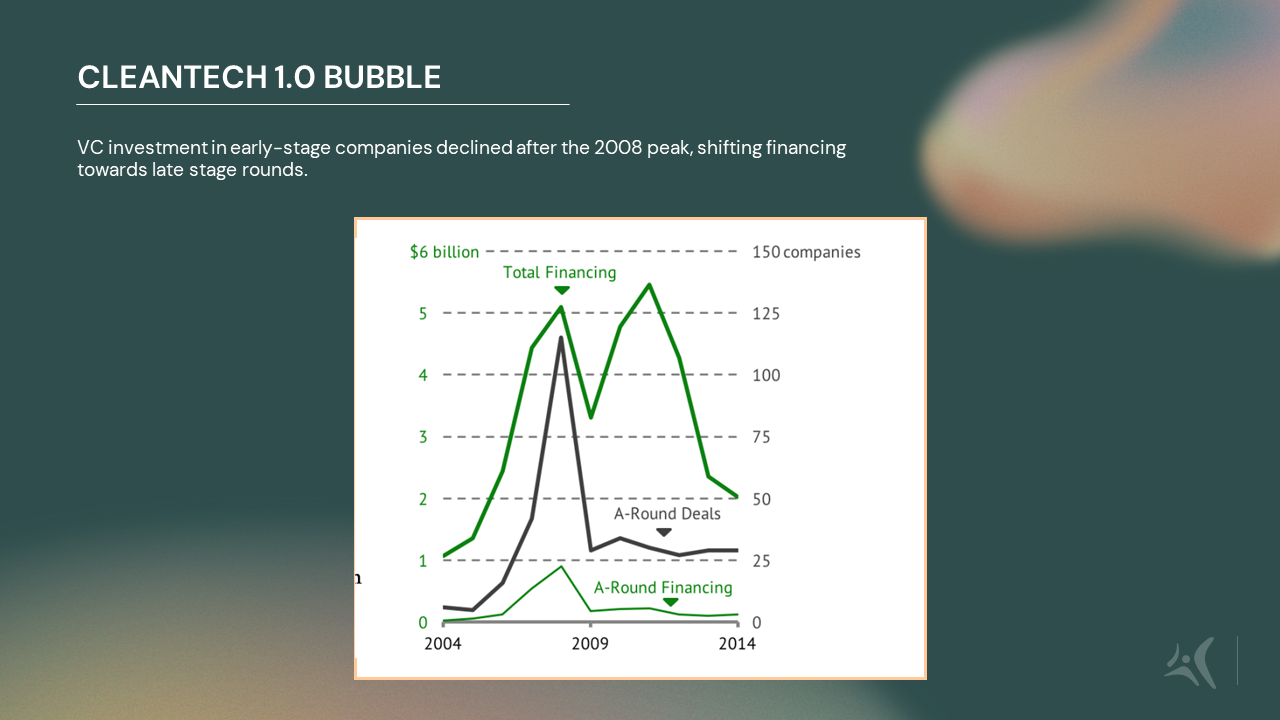

Figure 1 – The burst in the Cleantech bubble

The decline of Cleantech 1.0 stemmed from a combination of factors, including the emergence of fracking, which introduced cheaper alternatives to renewable energy sources, and the reduction of government funding for clean energy initiatives. Additionally, heightened global competition, particularly from countries like China, posed challenges for sectors such as solar panel manufacturing. The venture capital model, though instrumental in the initial stages, revealed its limitations in supporting the prolonged and unpredictable development cycles of clean energy technologies, often leaving startups stranded in what is commonly referred to as the “valley of death” due to lack of “patient capital.” Post-mortem analyses, such as those conducted by the MIT Energy Initiative, advocated for a collaborative approach involving diverse stakeholders, ranging from corporations to hedge funds to affluent individuals. Indeed, Successful Cleantech 1.0 companies like SunRun instead utilized other forms of financing like debt.

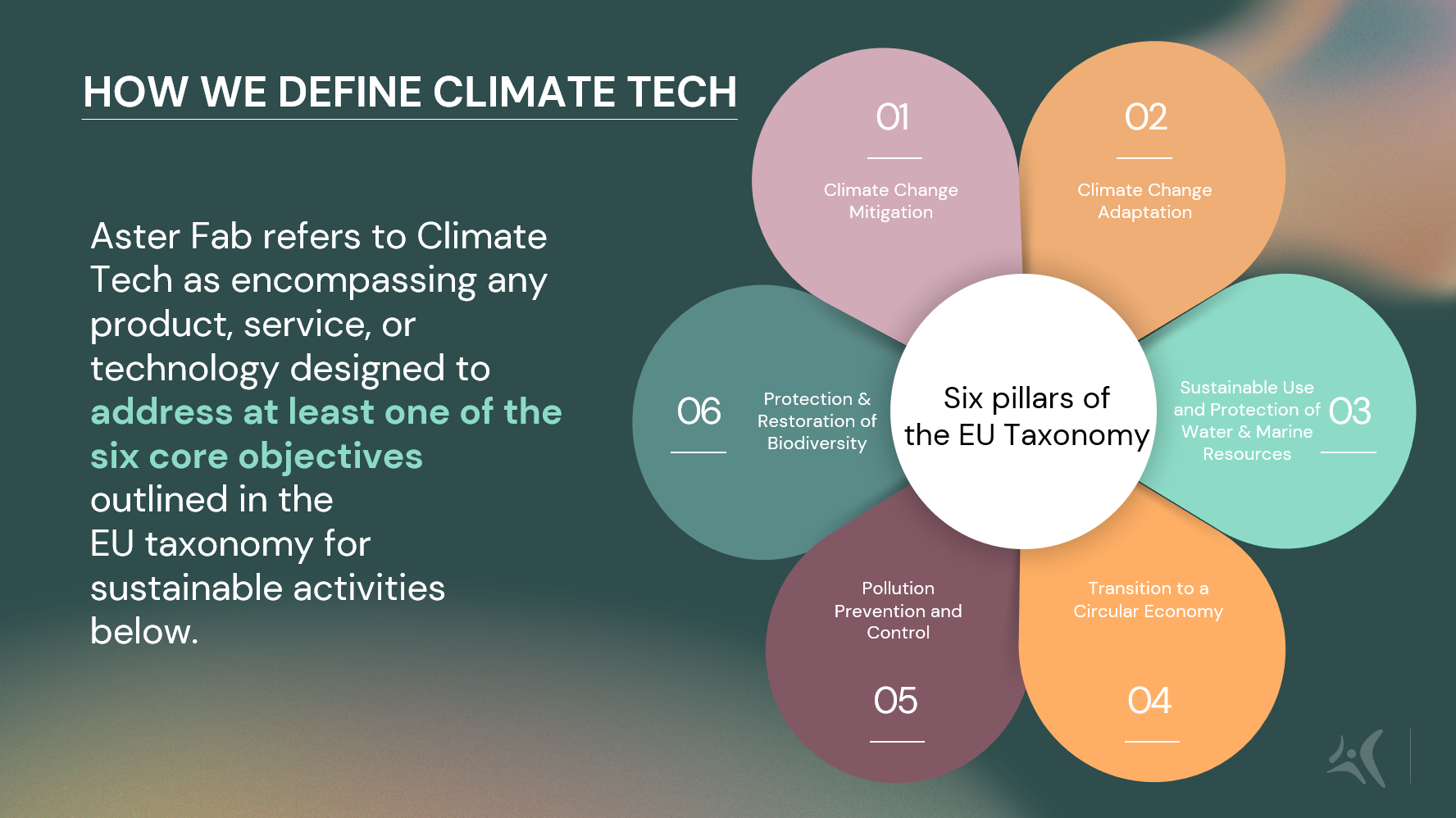

However, the setbacks experienced during Cleantech 1.0 prompted a reevaluation and the birth of Climate Tech 2.0—a more expansive and inclusive approach to addressing climate change. Unlike its predecessor, Climate Tech transcends energy solutions to encompass innovations across multiple industries such as consumer goods, agriculture, manufacturing, and transportation (see our blogpost on the definition of Climate Tech here).

Zooming out, it becomes clear that investing in climate solutions demands an abundance of patient capital and a clear path to exit. The difficulties faced by Cleantech 1.0 companies in securing late-stage equity financing and viable exit strategies underscored the need for a more resilient financial ecosystem. Fortunately, the landscape has evolved, with initiatives like SPACs and dedicated growth capital funds offering new avenues for climate-focused startups.

Additionally, corporate entities are stepping up to assume leadership roles in driving climate innovation forward. Company ArcelorMittal invested $36M in January 2023 in Boston Metal which develops electrochemical units to replace blast furnaces in steel manufacturing. Similarly, HeidelbergCement has partnered with Solidia Technologies, a company specializing in sustainable cement and concrete solutions. This shift signifies a deeper understanding of the interconnected nature of environmental challenges and the necessity for comprehensive, cross-sectoral solutions.

Nevertheless, a notable challenge persists: the funding dilemma known as “FOAK” or “First of a Kind” financing. Climate Tech, with its focus on pioneering solutions across various sectors, often grapples with securing funding for projects deemed too novel or risky by traditional investment standards. FOAK projects, while holding immense potential for transformative impact, face reluctance from investors wary of the uncertainties inherent in untested technologies or business models. For more insights, check out our blogpost Solving the FOAK Equation—CAPEX & Climate Tech here.

In summary, the transition from the Cleantech 1.0 bubble to the Climate Tech era marks a pivotal shift in addressing environmental challenges. While Cleantech 1.0 faced setbacks, it played a crucial role in driving down the prices of solar and wind energy, making them more accessible and essential for advancing climate technology. These advancements laid the foundation for Climate Tech 2.0, which expands the approach beyond energy, signaling a promising future of innovation and cooperation. Challenges like funding for novel projects remain, but with continued dedication, Climate Tech offers a pathway to a sustainable future.

At Aster Fab, our primary mission revolves around supporting hard-to-abate industries in tapping into the potential of climate technology (see our 9 industries of focus here). So, if you are seeking to engage with Climate Tech startups or exploring ways to decarbonize your operations, feel free to reach out to Hélène Maxwell (Climate Tech Expert) hmaxwell@aster.com or Léonard Stéger (Head of Sales) lsteger@aster.com.