123Fab #5

1 topic, 2 key figures, 3 startups to draw inspiration from

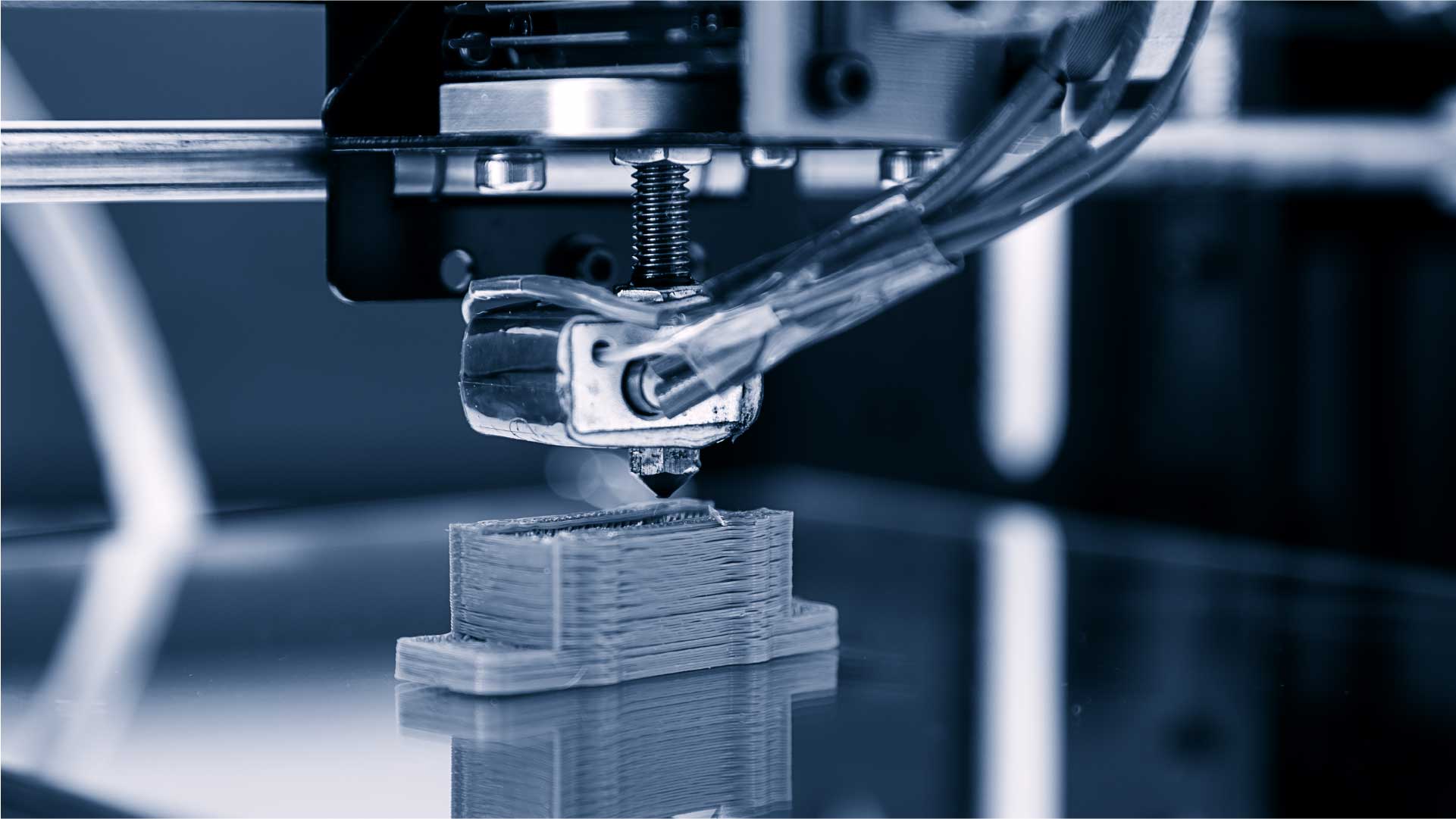

Additive manufacturing (AM) is an alternative approach to industrial manufacturing, which consists of adding layers of materials in precise shapes until the expected product is obtained. Additive manufacturing, often referred to as 3D printing, uses digital technologies to bring agility and efficiency to the manufacturing industry. It requires the combination of a Computer-Aided Design (CAD) software, printing hardware and materials (metals, thermoplastics, ceramics or biochemicals). Use cases today are mainly focused on small batch and high quality units (aerospace, military) and components with complex geometry (automotive, health). While additive manufacturing reached the top of its Hype Curve in 2013, it has seen renewed interest in the light of Covid-19: the general questioning of the supply chain’s dependence on Asian countries is giving new impetus to the idea of shortening supply chains and producing closer to the consumer market. The order established by Western companies — produce in the East, sell in the West — is being questioned.

Based on our current understanding of today’s challenges and opportunities, we wanted to share 3 main beliefs about AM:

- AM must be a lever for a more sustainable economy. AM has a direct impact on the raw materials manufacturing chain: extraction > manufacturing > distribution. By assessing the overall impact of AM on a product’s energy footprint, studies (US DoE, Digital Alloys) show that additive manufacturing greatly reduces the overall energy consumption required to produce a part, in addition to the savings made by reducing the international transportation of goods. It is interesting to note that the energy required to melt and bond materials — despite the wide disparity in energy required between metals such as titanium and polymers — is greater in additive manufacturing than in traditional manufacturing to process a unit. AM requires materials to be in powder or wire form to be processed (thus requiring more pre-treatment than billets used in conventional manufacturing) and processes such as Laser Powder Bed Fusion require nearly 4 times more energy than traditional Command & Control (CNC) machining to produce the same result. However, a 3D printed part represents only about 1/4 of the total energy required by conventional manufacturing. The overall difference comes from the fact that CNC machining traditionally begins with billets. The aerospace buy-to-fly ratio (the ratio of material purchased to material used in the part being manufactured) ranges from 6:1 to 33:1, which means that up to 97% of the raw material is wasted. By adding only the material needed for the part, AM allows massive cuts here. Moving now from this product-centric vision to an international vision implies a massive shift in energy demand from manufacturing countries to Western countries. With the traditional supply chain, the energy used for manufacturing is managed by the country of manufacture (in short: Southeast Asia). With AM, it is now up to Western countries to provide the energy needed for printing and processing. Therefore, if the total energy footprint of the product decreases, this leads to a substantial increase in energy demand from Western countries.

- Mass customisation using AM is difficult. Although there is a technical justification for allowing AM to mass produce unique parts, it raises a series of questions about unit quality assurance, standardization of lifetimes and warranties, and security. Currently, producing the same quantity of a given mass product in its equivalent of custom units raises uncertainties about production time. While printing itself is becoming increasingly efficient, it still requires post-processing, which can be time-consuming and may require a traditional production line — not really suited to a highly decentralized production organization as advocates of AM often fantasize.

- Finally, AM requires a dense community to achieve maximum efficiency. A network of 3D model suppliers, decentralized production units, material suppliers, distribution and logistics providers, and circular economy/recycling experts. Today, this network is not yet fully empowered because the infrastructure — both physical and digital — is in the middle of its development.

In conclusion, the additives industry can address issues of sustainability, society and geostrategy, but if change is made, countries need to prepare the underlying infrastructure necessary to enable optimal efficiency.

2 Key Figures

220 additive manufacturing startups

listed worldwide (created after 2005)

Market size expected to reach $22bn by 2022

According to Formlabs, the 3D printing market, with sales of $6bn in 2017, is projected to grow at a compound annual rate of 30.2% to reach a total market size of $22bn by 2022.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Essentium, AMFG and Xometry.

Esentium

Essentium is a US-based startup providing printers and materials for Aerospace, Automotive, consumer goods and biomedical industries. The company works with the High Speed Extrusion process.

AMFG

AMFG is a UK company offering an end-to-end software that automates human tasks needed in the AM process, thus enabling faster and larger volume manufacturing, at a lesser cost..

Xometry

Xometry is a US company that has raised $118M to become the one-stop shop for all AM-related services. Among others, it provides a vast production-as-a-service platform connecting decentralized manufacturers with companies in need of production capacity.