123Fab #43

1 topic, 2 key figures, 3 startups to draw inspiration from

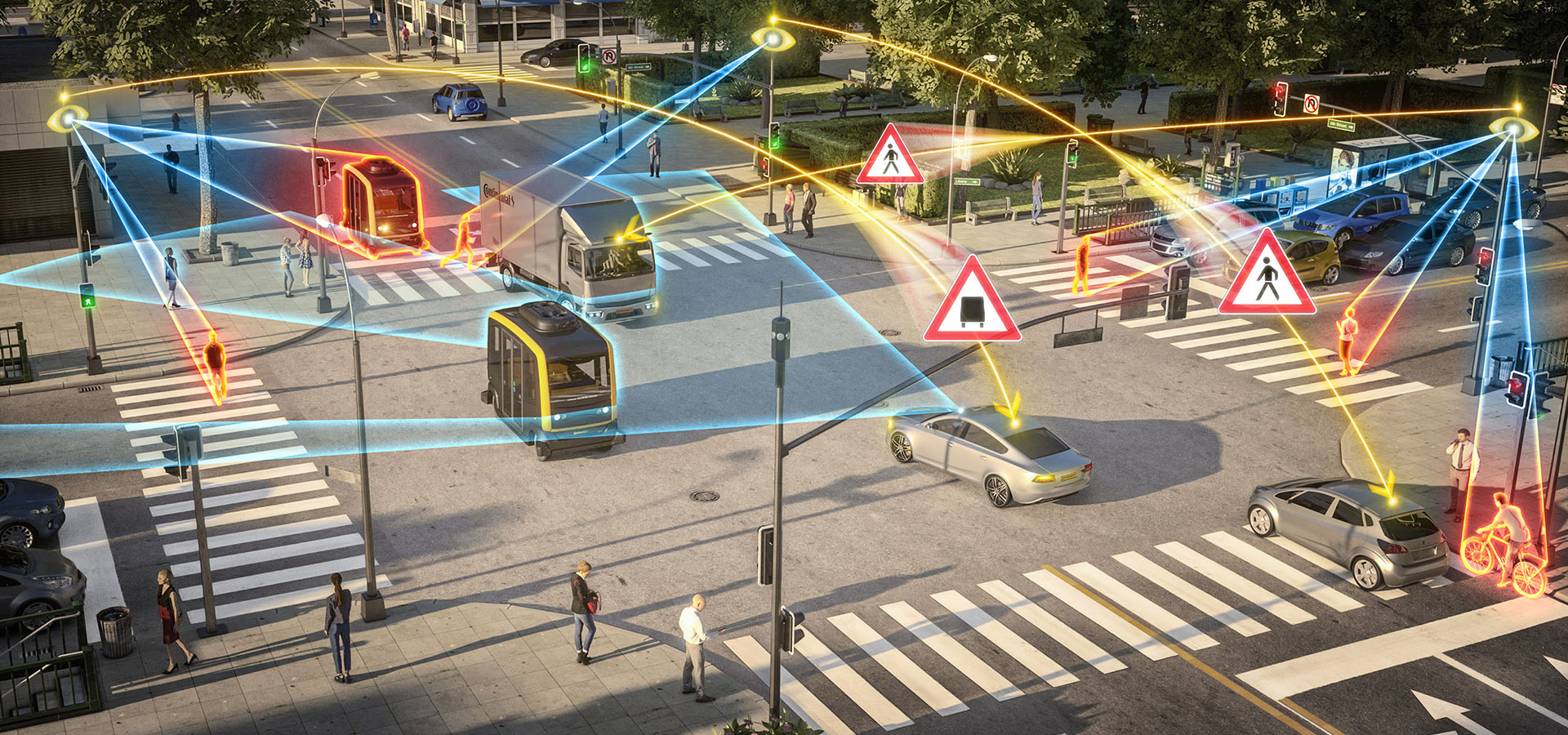

The city of Las Vegas has recently been granted permission to install and test 25 cellular-vehicle-to-everything (C-V2X) roadside units, to transition from Dedicated Short-Range Communications (DSRC) for connected vehicles, to cellular. The objective is to demonstrate the benefits of C-V2X technology, which is said to be as reliable and performant but with twice the range of DSRC. This highlights the growing presence and adoption of Vehicle-to-Everything (V2X) installations within cities. V2X refers to the transmission of information from a vehicle to any entity that may affect the vehicle and vice versa. It includes Vehicle-to-Infrastructure (V2I: data exchange between a car and equipment installed alongside roads, generally a roadside unit), Vehicle-to-Vehicle (V2V: data transfer between vehicles), Vehicle-to-Network (V2N: when a vehicle accesses the network for cloud-based services), Vehicle-to-Pedestrian (V2P), Vehicle-to-Device (V2D) and Vehicle-to-Grid (V2G: information exchange with the power grid). In this newsletter, we will focus on two key components of V2X which are V2V and V2I. The main motivations for V2X are road safety, traffic efficiency, and energy savings. Indeed, according to GSMA forecasts, by 2025, V2X could prevent 260,000 accidents (by detecting road hazards or vulnerable pedestrians and cyclists for example), save 11,000 lives, save 280 million hours of driving each year, and avoid 400,000 tonnes of CO2 emissions (for instance, with platooning, cars or trucks follow each other with short inter-vehicle distance, resulting in reduced fuel consumption and CO2 emissions).

With the advancement of V2X technologies, such as its non-line-of-sight sensing capability that allows vehicles to detect potential hazards, traffic, and road conditions, vehicles are becoming increasingly connected and are being progressively equipped to become fully autonomous. Some legacy V2I technologies are currently in operational use worldwide for relatively simple applications (e.g. for Electronic Toll Collection), while advanced V2X systems are beginning to gain widespread commercial acceptance. They rely on two underlying technologies:

- IEEE 802.11p or DSRC (Dedicated Short Range Communications): this original V2X standard is now mature and mainly used for safety use cases (such as starting to brake before a pedestrian or a hazard is visible to the driver), due to its reliability and low latency (2 ms). However, its range is rather short (less than 1 km). This technology is prevalent in North America, Japan, and Europe.

- Cellular V2X (C-V2X): this relatively new technology offers several operating modes that users can choose from, such as direct communication between vehicles or with the infrastructure and further road users (pedestrians, cyclists). For now, it is mostly used in non-safety-related use cases (vehicle operation management, traffic efficiency, etc.). While this technology has a range of 10km, it requires network support (4G/LTE/5G) and has a higher latency (1s). This technology is very present in China.

Hybrid solutions could be developed by 2030 to achieve interoperability. Startups like AutoTalks are working on such hybrid modules (capable of supporting both DSRC and C-V2X). Indeed, AutoTalks is an Israeli leader that develops fabless semiconductors for the V2X market. They address a variety of issues related to V2X communication, including communication reliability, security, positioning accuracy, and vehicle installation. AutoTalks has developed a chipset capable of supporting dedicated short-range communications (DSRC) and cellular’s C-V2X.

Many OEMs and automotive players are including V2X services into their car models. For instance, Volkswagen has premiered its all-new Golf with V2X capabilities. Car2X-signals from traffic infrastructure and information from other vehicles up to 800 meters away are notified to the driver via a display. The Golf also shares these warnings with other Car2X models. Initially focused on road safety and traffic efficiency applications, Toyota and General Motors were early adopters of IEEE 802.11p-based V2X technologies in Japan and North America. However, the momentum has lately swung in favor of C-V2X and they have expressed their willingness to invest in C-V2X technologies. This is also the path taken by Audi and Qualcomm Technologies, which are deploying a C-V2X technology pilot in Virginia. Workers wear special vests with built-in V2P technology that can alert drivers to their presence.

Besides the challenge of choosing the optimum communication bearer (DSRC, C-V2X, or hybrid), which keeps the industry and the mobile community very active, the security of V2X communication is also a key issue. The regulatory environment is the most important factor influencing the adoption of V2X technology. In China, the government has taken a stand and showcased C-V2X regulations, which should encourage automakers to position themselves quickly. In contrast, in North America and Europe, the governments and transportation ministries are struggling to bring clarity to the industry in terms of V2X, its scope and limitations.

To conclude, there is strong potential for V2X applications, the technologies exist, and it seems that the automotive industry will not wait for regulation to adopt V2X services. However, large-scale adoption will take time, due to the need to equip all infrastructures with adapted devices and the time needed for the automotive players to align on a single (or hybrid) communication technology.

2 Key Figures

433 V2X startups

registered byTracxn

Automotive V2X market expected to reach $12.9 Bn by 2028

The automotive V2X market was estimated at $689 M in 2020 and is expected to reach $12.9 Bn by 2028, at a CAGR of 44.2%.

3 startups to draw inspiration from

This week, we identified three startups that we can draw inspiration from: Valerann, Commsignia, and Connected Signals

Valerann

Valerann is an Israeli start-up that develops sensor systems for installation on roads, and an associated data platform. Their smart studs, installed along the roads, can sense traffic movement, specific weather conditions, road issues and send this data to the central data centre. Combined with intended integrations with Waze, Google Maps, etc., Valerann intends to create a connected real-time traffic notifications and analytics platform.

Commsignia

Commsignia is a Hungarian start-up that develops cooperative intelligent transportation systems designed to increase traffic safety and efficiency on the road. It includes V2V and V2I communication systems that provide actionable insights pertaining to the logistics pipeline through their in-app information services, thus enabling businesses, corporate clients and logistics industry players to connect with other drivers for various road-safety programs.

Connected signals

Connected Signals (originally, Green Driver) is an American high-tech startup, focused on providing traffic signal state and predictions to drivers, automakers, and others. Knowing the current state of traffic lights and how they will change creates opportunities to increase driving safety, increase fuel efficiency, and improve the driving experience. Applications range from EnLighten, which tells drivers when the light they are stopped at will turn green, to vehicle powertrain optimisation based on the state of upcoming lights.