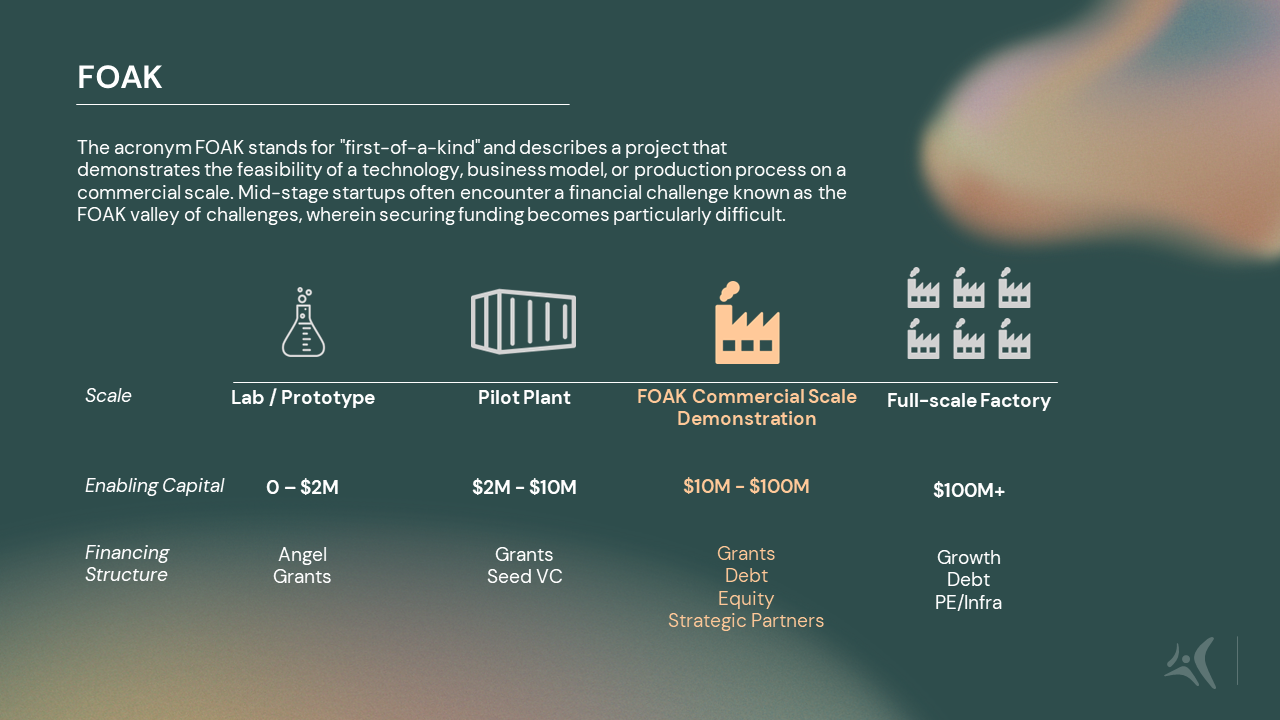

Figure 1 – The financing structure of a FOAK

FOAK projects are those pioneering endeavors that herald the debut of a new technology, business model, or production process at a commercial scale. These ventures hold immense promise for advancing climate change solutions while offering substantial opportunities for exponential growth if successful. However, the novelty and capital intensity of FOAK projects erect significant barriers, creating what is often referred to as the “first-of-a-kind valley of death.”

Indeed, the journey from prototype to full-scale commercial deployment involves traversing various stages, including lab pilots, pilot plants, and commercial-scale demonstrations. At each phase, startups encounter escalating capital requirements, coupled with escalating risks.

The Chicken and Egg Problem

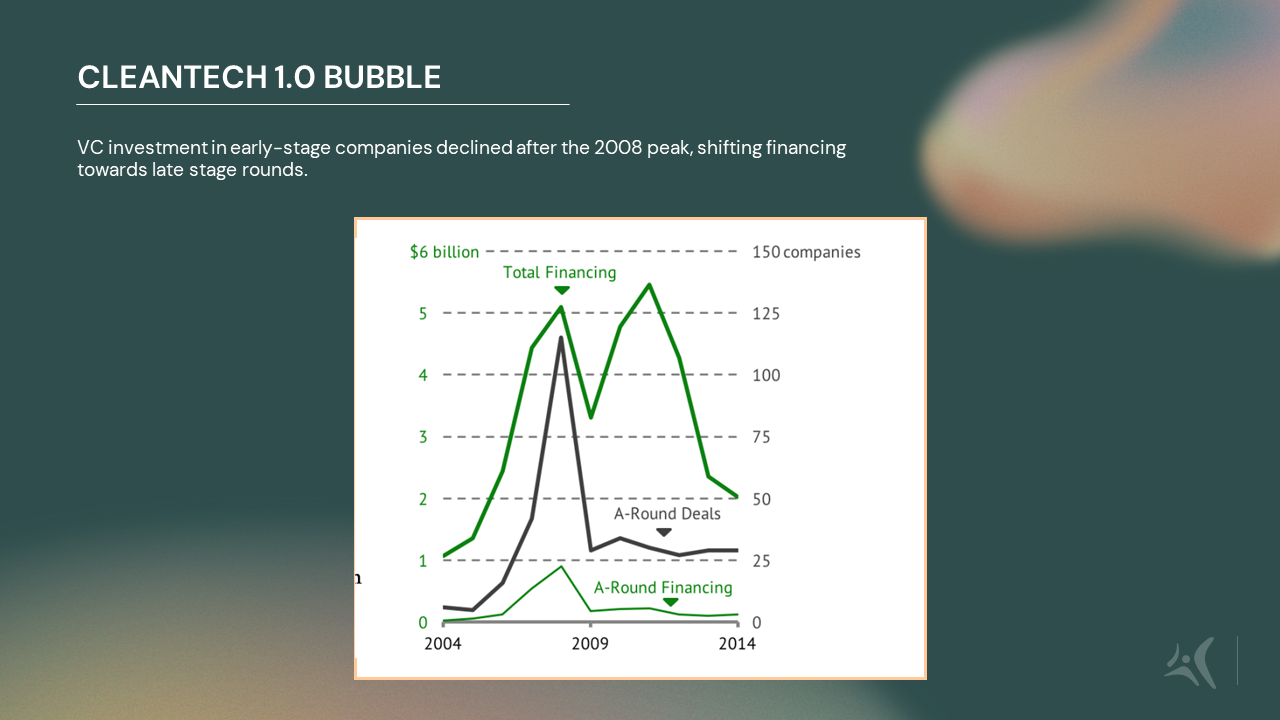

Innovative projects, particularly those considered “First-of-a-Kind” (FOAK), face a significant funding challenge known as the “chicken and egg problem.” This conundrum arises from the reluctance of traditional funding sources such as venture capital (VC), private equity (PE)/infrastructure finance, and debt lenders to invest in FOAK initiatives. The inherent risk and capital-intensive nature of such projects make them unappealing to these investors, who prefer more established ventures with proven track records. Consequently, there exists a pronounced funding gap, especially during the mid-stage of development, where FOAK projects require substantial financial support to progress.

Furthermore, even corporations, which might be proactive in entering offtake agreements with FOAK projects, encounter their own set of challenges. They often lack sufficient risk-bearing capital and are burdened by slow decision-making processes.

While public grants could potentially fill this funding void, they typically come with limitations. These grants are often too small in scale or contingent upon securing additional funding from other sources mentioned above. This creates a circular dependency, exacerbating the chicken and egg situation – FOAK projects need funding to progress, yet traditional investors are hesitant to invest without proof of viability, perpetuating a cycle of financial uncertainty and stagnation.

Solving the Equation

From the founders’ perspective, ensuring successful project and infrastructure financing requires a comprehensive understanding of investor needs. This entails familiarity with various financing methods, including grants, debt, and equity. Such expertise can be cultivated through the guidance of a proficient CFO or by seeking advice from external advisors. Moreover, establishing technical proof-points is paramount. This necessitates demonstrating the technology’s viability with a Technology Readiness Level (TRL) of 6 or 7, often achieved through the operation of fully functional demo plants or through strategic partnerships. Finally, granular planning and meticulous documentation are essential for satisfying project financiers and debt providers. This involves providing comprehensive details of the business model, market projections, patents, regulatory approvals, contracts, and contingency plans.

From a financial players’ perspective, it is imperative to involve more engineers in the investment evaluation process, particularly for technologies that have yet to attain full commercial scale. This ensures a thorough assessment of the technical potential of solutions and helps in making informed investment decisions. Furthermore, fostering strong multi-stakeholder alliances among founders, venture capitalists (VCs), private equity (PE) firms, infrastructure investors, corporates, banks, foundations, government entities, and universities is essential. These alliances facilitate risk mitigation and expedite the development of First-of-a-Kind (FOAK) plants.